To avoid tax hikes, Pa. officials push to withhold housing subsidies from delinquent landlords

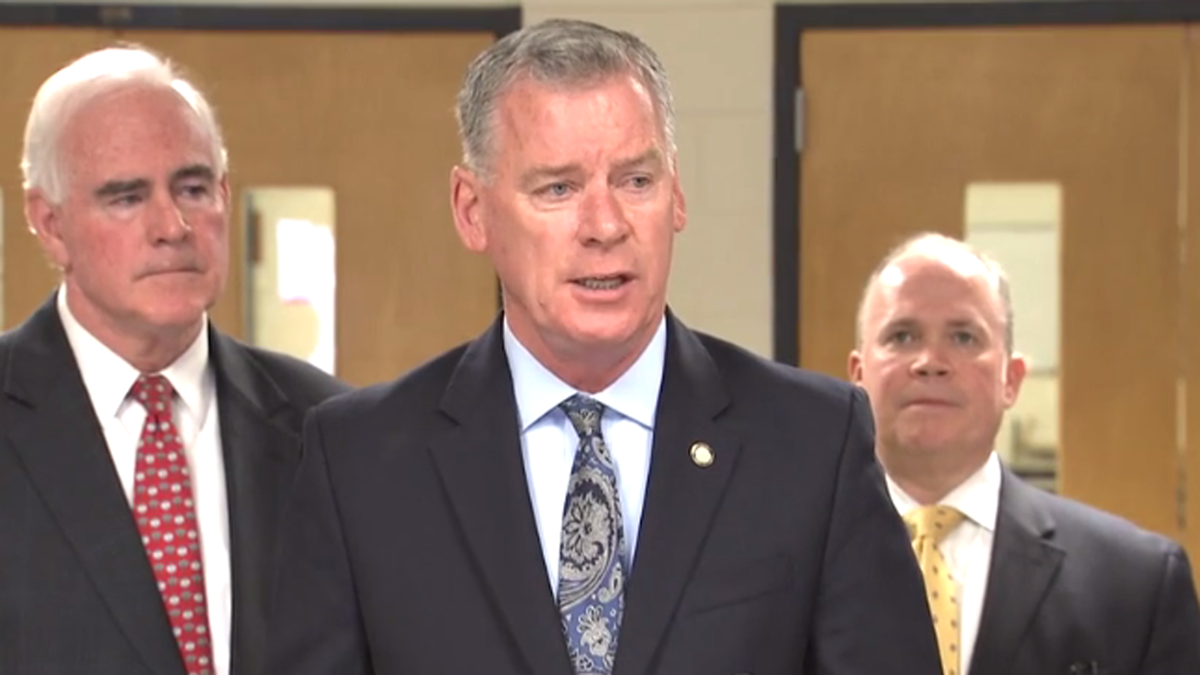

State Senator Tom McGarrigle speaks about his plans to introduce a bill diverting federal housing subsidies from tax delinquent landlords at a news conference in the William Penn School District. (Laura Benshoff/WHYY)

State and federal lawmakers in Pennsylvania want to crack down on landlords who receive federal housing subsidies, but short school districts on their taxes.

They argue delinquency unfairly burdens law-abiding taxpayers, who are tapped to recover the losses.

“The No. 1 problem I hear when I go into the district, especially from seniors, is school property taxes,” said U.S. Rep. Pat Meehan, R-7th, at a recent news conference at Aldan Elementary School in Pennsylvania’s Delaware County.

Property taxes are so unpopular, there is a recurring bill in the Pennsylvania Legislature to abolish them altogether.

This congressional session, Meehan reintroduced his “Protect Our Schools from Tax Delinquents Act,” which would divert Housing Choice Vouchers, also known as Section 8, from delinquent landlords to school districts until their debt is paid. The bill has two co-sponsors from Pennsylvania — U.S. Reps. Lou Barletta, R-11th, and Ryan Costello, R- 6th.

The housing vouchers subsidize rent for qualifying low-income tenants, who pay no more than 40 percent of their monthly income toward remaining rent costs.

Meehan’s bill includes the following language aimed at insulating renters from any negative fallout if their landlords are penalized: “The bill does not authorize or establish any cause or grounds for the termination of the tenancy of any tenant from any dwelling unit assisted under the rental assistance voucher program.”

According to the Pennsylvania Association of School Business Officials, the average property tax delinquency rate by school district ranges from 2 to 3 percent on the low end, up to 12 percent in high-delinquency districts. It’s not clear how many landlords who accept federal vouchers are among the delinquent.

Annually, school districts in Pennsylvania collect $14 billion in property taxes, according to Jay Himes, association executive director.

Broken down to the district level, delinquent landlords who accept the vouchers can cost districts hundreds of thousands of dollars.

“Here in William Penn School District, it’s been calculated that there are more than 550 Section 8 properties, and 10 percent of them are delinquent,” said Meehan at the news conference. That amounts to $300,000 in lost revenues annually for the financially struggling district.

In Pennsylvania, low-income districts sometimes end up with higher property tax rates than wealthy districts, squeezing more money out of poorer residents while still bringing in less than more prosperous counterparts.

When districts weigh what they should get versus what they are likely to collect, they end up passing the difference onto other taxpayers, according to Pennsylvania Association of School Administrators executive director Mark DiRocco.

“Oftentimes you jack that property tax higher,” he said, to eliminate collection uncertainty. Without having seen the bill, DiRocco said he supports any measure to recoup lost taxes for schools.

Only one area housing authority representative responded about the proposal at time of writing.

“I really could not comment other than to say I think everyone should pay their taxes,” said Larry Hartley, executive director of the Delaware County Housing Authority, which distributes the vouchers in the county. In Philadelphia’s suburban counties, voucher use tends to cluster in areas with cheapest rental housing, such as Norristown and Coatesville. Those school districts tend to have fewer resources as well.

A state version of the bill, being developed by state Sen. Tom McGarrigle’s office, is expected to be introduced in about a month, according to Michael Rader, his chief of staff.

Pennsylvania’s chronic education funding woes and rising education costs won’t be eliminated with this tax collection effort. But McGarrigle’s office said it’s leaning in the right direction.

“It’s just another tool in the toolbox, to make sure that projected revenues continue to flow, or do flow, to the school districts,” said Rader.

While not widely implemented, this tool has come in handy in one corner of the Keystone State before.

The city of Erie, in northwest Pennsylvania, has used the threat of withholding housing voucher money to collect delinquent garbage fees from landlords, starting in 2014.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.