Republican mendacity metaphor: The Corker kickback

Sen. Bob Corker has changed his mind and now signals support of the GOP tax bill. The fiscal particulars haven't changed. Except for a tax break for wealthy property owners.

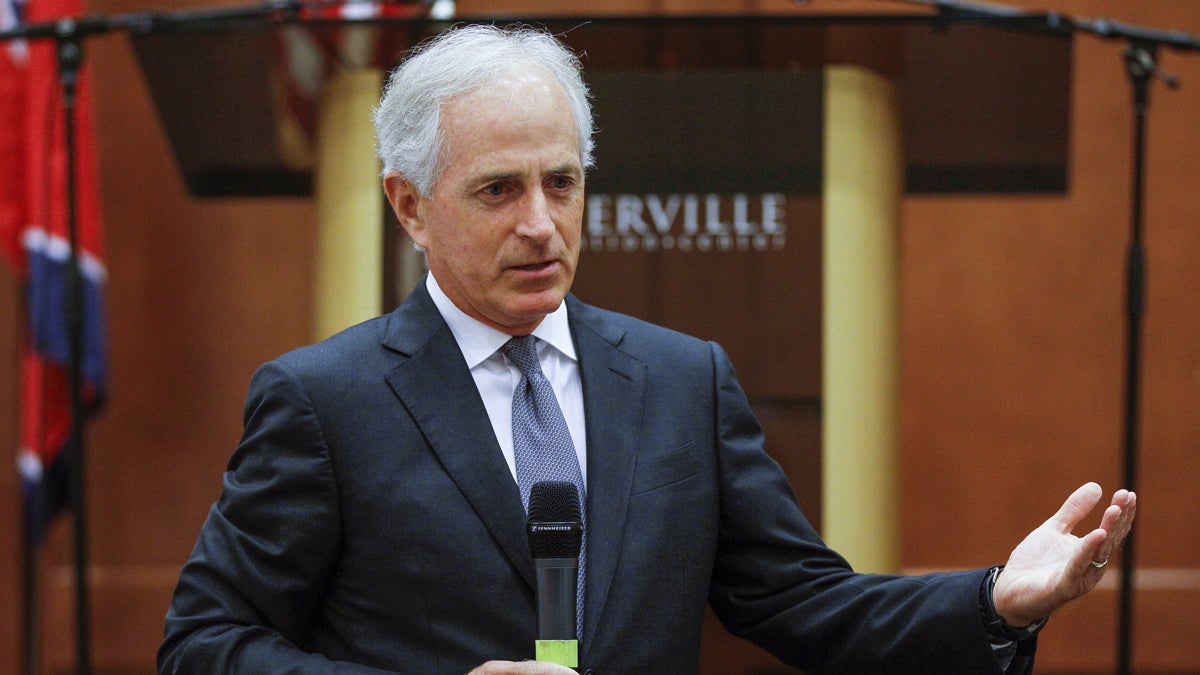

U.S. Sen. Bob Corker, R-Tenn., is shown speaking to the Sevier County Chamber of Commerce in Sevierville, Tenn., on Wednesday, Aug. 16, 2017. (AP Photo/Erik Schelzig, file)

Amidst all the GOP’s current herculean efforts to slash the taxes of big corporations, the richest Americans, and fat-cat party donors — at the expense of the average working stiff — one little episode serves as the perfect metaphor for Republican mendacity.

The star of this shameless show is Bob Corker. Seventeen days ago, the lame-duck Republican senator said he opposed his party’s big tax bill; as a fiscal conservative and avowed foe of budget deficits, he pointed out that the bill under negotiation would add more than $1 trillion of new red ink to the federal ledger. For Corker, that alone was a deal-breaker; in a statement on Dec. 1, he said that his concern about red ink has been “a guiding principle throughout my time in public service.” His statement made waves, because Senate Republicans need virtually every vote in their ranks in order to pass the phony-populist measure that predictably services the upper brackets.

But then, last Friday, Corker suddenly signaled thumbs-up for the tax bill. Which was weird, because the fiscal particulars haven’t changed at all. It will still blow a trillion-dollar hole in the budget (make that $1.7 trillion, or worse). Corker basically said the red ink is fine with him, lamely explaining that “every bill we consider is imperfect.”

So what gives? Why did he switch to Yes? What happened to his “guiding principle”?

Two hours after his Friday announcement, the final text of the bill was released and … well well well … what do we have here: It magically contains a provision, apparently inserted on the fly at the 11th hour, that reduces the taxes paid by people who own large amounts of commercial real estate. Bob Corker owns large amounts of commercial real estate.

What a coincidence.

Corker reportedly made as much as $7 million last year from commercial real estate; now he stands to make a lot more, thanks to that new provision. No wonder #CorkerKickback is trending on Twitter.

Now comes the funny part: When Corker was asked yesterday about his magical windfall, he said he had no idea that the new provision had been slipped into the final bill because he hadn’t actually read the final bill. That was a very awkward answer, because it meant that either he’d dropped his fiscally conservative “guiding principle” for no reason at all, that he’d decided to vote for the biggest tax bill in 31 years without bothering to read it; or that he knew darn well that he (and other real estate operators, like Trump) would be getting an 11th-hour windfall, and he’s pretending not to know.

His solution to this embarrassing episode is basically this: All this extra money wound up in my pocket, and I’m determined to get to the bottom of this!

Over the weekend, he wrote a letter to the chairman of the Senate Finance Committee. “Since this issue has never been discussed with us by committee or Senate leadership, I went back through the bill in detail today” — and lo and behold, he discovered his goodies “on page 25, line 3.” Therefore, “I would ask that you provide an explanation of the evolution of this provision and how it made it into the final conference report. I think that because of many sensitivities, clarity on this issue is very important.”

Many sensitivities … I’d say so. A Republican tax bill that primarily benefits the well off and breaks Trump’s fake promise of giving major relief to “forgotten” Americans, a tax bill that’s loaded with special-interest perks and, now, a provision rigged to line Corker’s pockets, does seem a tad politically sensitive — especially at a time when public approval of the tax bill sits at a teeny 26 percent. (Not that Republican lawmakers care.)

But regarding the “clarity” that Corker seeks, we got some yesterday from John Cornyn, the No. 2 Senate Republican. To get the clarity, all you need to do is pierce his fog of obfuscation.

When asked on ABC News how the Corker provision wound up in the bill, Cornyn replied: “Well, we were working very hard. It was a very intense process … What we’ve tried to do is cobble together the votes we needed to get this bill passed.” Translation: To get the votes they needed, they crafted a legal bribe. When asked by ABC News whether the provision was indeed added to financially benefit Corker, Cornyn tried the standard bob and weave: “Picking out one piece in a 1,000-page bill and saying, ‘Well, this is going to benefit somebody,’ I just think that takes the whole bill out of context.”

Which was the Washington version of a confirmation.

Meanwhile, Donald Trump, the commercial real estate beneficiary, is still lying about the Republican tax bill. He tweeted yesterday: “As a candidate, I promised we would pass a massive TAX CUT for the everyday working American families who are the backbone and the heartbeat of our country. Now, we are just days away.” Indeed we are. But Bob Corker — if joined by just one other Senate Republican dissenter — has the power to wreck that timetable. Assuming, of course, that he cares enough to salvage his “guiding principle” and personal integrity.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.