In Philly budget proposal, Kenney calls for tax hikes to cover school deficits

As promised, Kenney's proposal would cover the school district's budget gap. The question now is how City Council members and taxpayers will react.

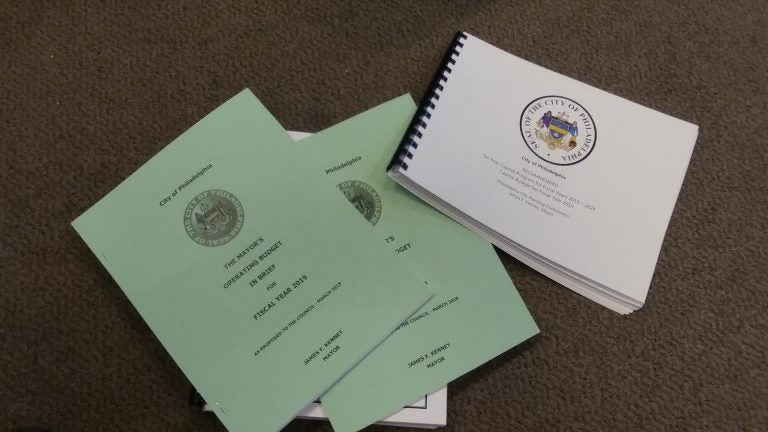

Philadelphia Mayor Jim Kenney's Fiscal Year 2019 budget proposal. (Tom MacDonald/WHYY)

Philadelphia Mayor Jim Kenney promised local investment when he advocated local control of the city’s school system.

His latest budget proposal delivers just that, hiking property taxes and reducing scheduled business tax reductions to cover the district’s looming deficit.

The mayor’s plan, released Thursday, would send a projected $980 million to the School District of Philadelphia over the next five years. That money would ward off any potential cuts and give the district long-term financial stability it hasn’t enjoyed in years.

To make the math work, the mayor is proposing four major revenue streams:

- a 6 percent property tax increase that would generate $475 million;

- an increase in the real estate transfer tax to add $66 million;

- an increase in the city’s annual contribution to the school district that would add $20 million a year and $100 million over the next five;

- a slowdown in planned wage tax reductions that would save $340 million. That $340 million would then be diverted to the school district.

The mayor will present his plan to City Council Thursday.

His finance director, Rob Dubow, said the proposal was designed to “share the pain” among homeowners and city businesses.

By far the most substantial revenue proposal — and the one destined to inspire the most chatter — is the 6 percent property tax hike. A median Philadelphia home, valued at $113,000, would see an annual tax bill jump of about $95, according to Dubow. Those properties with a homestead exemption — in other words, properties that are used as the taxpayer’s primary residence — would see a median tax hike of $70 a year.

All new revenue generated from the property tax hike would go toward the district. Right now, the district receives about 55 percent of local property tax. Under Kenney’s proposal, the district’s share would increase to about 58 percent, Dubow said.

The proposal does not include an increase in the use and occupancy tax or a plan to negotiate payments in lieu of taxes from nonprofits, which are exempt from property taxes.

The district’s four-year deficit is projected at roughly $700 million. This spring, the district will refresh its five-year estimate, but Dubow anticipates it will land somewhere around $900 million.

The administration’s plan, he said, is calibrated to leave the district with a roughly $70 million fund balance each year for the next five years.

This summer, the state-controlled School Reform Commission will cede control of the district to a locally-appointed school board. Kenney is currently mulling a list of candidates who could serve on the new, nine-member body.

When Kenney publicly pushed for local control at the end of last year, he said the city should be prepared to step up and plug the district’s budget deficit. He said to expect no extra help from Harrisburg, and his budget proposal covers the district’s five-year needs without any extra cash from the Legislature.

The question now is whether Council members and taxpayers will endorse Kenney’s vision or flinch at his call for tax hikes.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.