Pa.’s return on pension investments lower than national averages

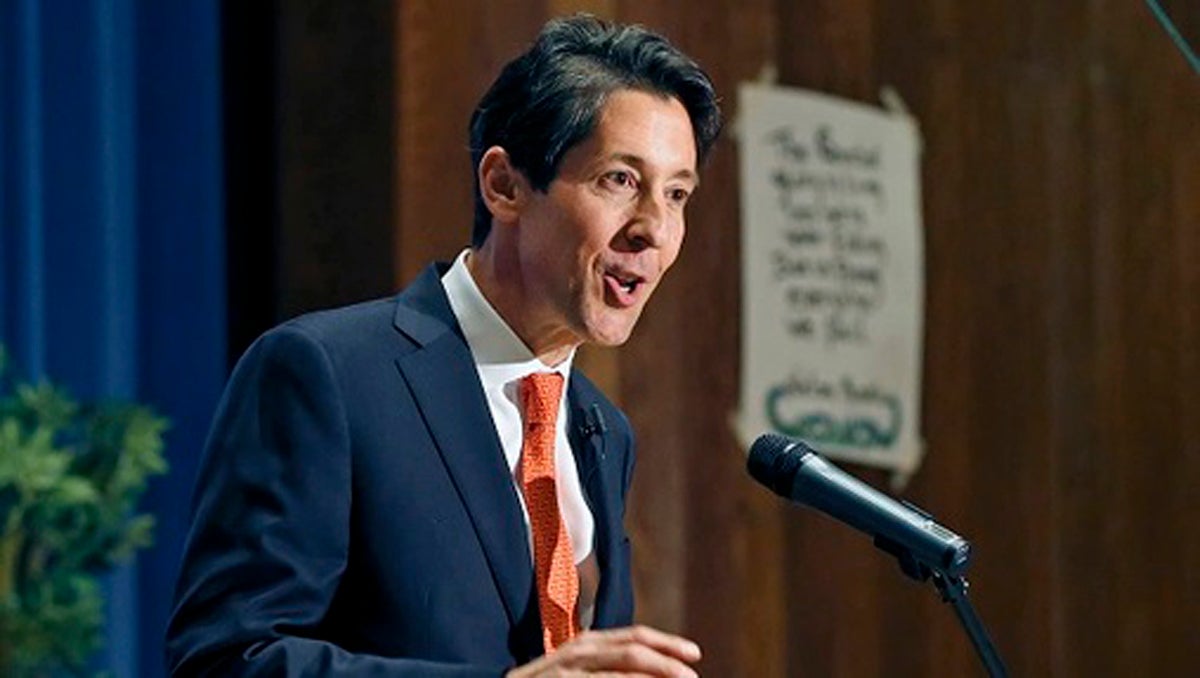

First-term Treasurer Joe Torsella has advocated shifting state funds to lower-risk investments. (AP Photo)

A new Pew Research Center report shows state investors across the country are increasingly making more expensive, more volatile investments with pension funds in an effort to beat market rates.

It’s a trend some in Pennsylvania have already recognized as a potential problem — and there is a growing movement looking to reverse it.

Traditionally, states have invested the billions of dollars that flow through their public pension funds in safe places, such as corporate and government bonds.

Around the 1980s, however, they began investing more in stocks, which can make more money, but are also more volatile. And, over the last decade, there has been even more investment in hedge funds and newer alternatives, like hedge funds.

The result? Greg Mennis, director of Pew’s Public Sector Retirement Systems Project, said states are paying way more money for high returns they might never see.

“The increase to the alternative asset classes has more than doubled over the past decade, and along with that there’s been about a 30 percent increase to the investment managers that help with public pension funds,” he said.

Mennis said Pennsylvania ranks low in terms of getting bang for its invested buck.

“From a performance perspective the state has been a little bit below average, he said, referencing returns on investment that are consistently below projections. “On a fee perspective, fees have averaged about $600 million a year, and that would put Pennsylvania in about the top five of the states.”

Recently, state Treasurer Joe Torsella announced he’s shifting a billion state dollars that he controls to cheaper, more stable investments.

However, he’s limited in that he doesn’t have control of the state’s biggest pots of money — its two public pension funds.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.