New Jersey’s mega-mall: Will it ever open?

-

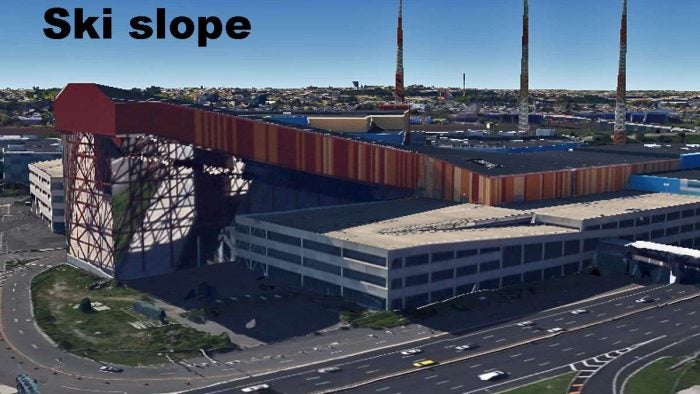

The mega-mall would include this indoor ski slope. (Image courtesy of Triple Five)

-

-

-

-

-

-

This is the first installment of Mall Madness, a five-part series on the American Dream retail and entertainment complex under construction in the Meadowlands. The series was produced through a reporting collaboration between WNYC, NJ Spotlight, and Bloomberg Businessweek. The mall is schedule to open in the fall of 2018

Bloomberg Video

“It makes me angry every time I drive by it,” said Matt Reagan, expressing a sentiment likely shared by many New Jerseyans about the multicolored behemoth of a building in the Meadowlands now known as American Dream.

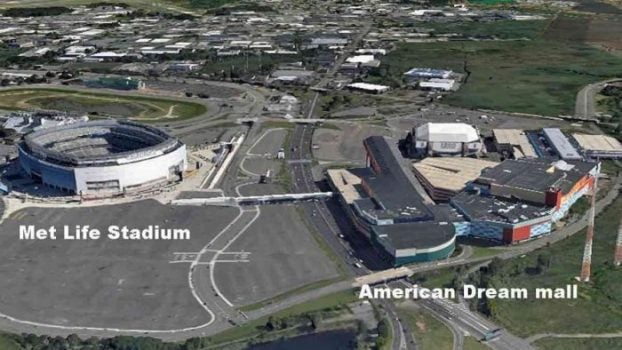

Reagan, a Rutgers Law student who was flipping hamburgers while tailgating at nearby MetLife Stadium before a Bruce Springsteen concert this summer, sees the huge, empty structure as a symbol of New Jersey’s waste and failure — and the inability of the government to get anything done.

“They’ve already had more than enough money to build what they wanted to build, and they haven’t done it,” he said.

Construction on the project that drew his strong criticism began in 2003, and two separate developers have tried and failed to finish a mixed retail and entertainment center once called Xanadu. They hoped it would revitalize a Meadowlands sports complex that had suffered through the decline of horseracing and its once-popular sports arena. Now, a third developer, Canada-based Triple Five, has taken over the project. The company is trying to emulate what’s made its Mall of America a big success in Minnesota, intending to transform the sprawling complex into more than just a mall, but a destination that will attract international tourists as well as millions of visitors from New York and New Jersey.

But even as Triple Five says it’s moving ahead with an ambitious $2.65 billion finance plan to pay for the major construction that’s still needed to bring the developer’s vision to life, questions remain about whether a megamall that was first dreamed up more than a 13 years ago remains relevant in a new era in which online shopping is becoming a dominant force. To bring Triple Five onto the project, Gov. Chris Christie also had to pledge government tax incentives to the private developer, and the size of the incentive package has now grown to over $1 billion, although none of those tax breaks can be redeemed unless the project eventually opens its doors and turns a profit.

Even if all does go right and the project becomes a success, public records indicate the annual net benefit for New Jersey will be an estimated $36 million. Most of the permanent jobs that will be created by American Dream will also pay less than $20,000 a year, according to the public records, a small sum for East Rutherford, the town in which the project is located, where median household income runs close to $80,000.

Meanwhile, public records also indicate that as the project has moved forward over the past several years, there is one group that has made money on it — those with political ties to Christie. Campaign contributions have also flowed back to the governor over the same period.

Putting together the financing

Christie unveiled Canada-based Triple Five as the project’s new developer in 2011, saying it had the wherewithal to finally complete a project that had already left two prior developers, Mills Corp. and Colony Capital, in shambles. The difference, Christie said, was that for Triple Five, which is run by Canada’s Ghermezian family, the project would represent more than just a place to make some cash.

“That’s what we needed all along,” Christie said at the time. “Someone who didn’t want to use this as a way to make money, but as a showpiece, a centerpiece for their development. And that’s what the Triple Five group will do.”

But right now, American Dream is facing what will almost certainly prove to be a make-or-break moment as Triple Five is trying to close on its $2.65 billion construction-finance plan. After holding back from making public comments for weeks, company officials are now saying the deal will close soon, possibly before the Christmas holiday.

In all, Triple Five is trying to generate $2.65 billion from investors, some through a complicated $1.15 billion bond sale, but public confidence has not been running high after the company missed its own early November deadline to complete the financing deal. And that delay comes after another planned bond sale was postponed last year. So it remains unclear whether the financial market has any interest in a three-million-square-foot retail and entertainment center that’s located less than nine miles from Times Square.

Christopher Leinberger, an experienced developer who chairs George Washington University’s Center for Real Estate and Urban Analysis, said typically the financing for successful commercial-development projects comes together like “a magnet gathering up little pieces of metal.”

“My experience with financing real-estate projects is that either it comes together quickly or it doesn’t come together,” he said.

But company president Don Ghermezian said Triple Five’s financing plan remains very much alive. In fact, he is now predicting the entire financing package will close later this month.

“The financing is 100 percent committed,” Ghermezian said during a recent interview held at company’s American Dream leasing office and showroom across overlooking the site in East Rutherford. “The financing will be announced very, very shortly.”

A major expansion of the Xanadu project’s original design concept is already underway in an effort to bring American Dream more in line with Triple Five’s other malls, which feature massive entertainment attractions like indoor theme parks and full-size ice-skating rinks in addition to a retail component.

Ghermezian said he’s just hoping that New Jersey residents can give the company “a little bit more patience,” promising they will definitely be impressed by the final product.

“People that live in New Jersey that want that feel like we are a world-class state with a world-class project on par with any project in the world, I think that this project will be a tremendous (source) of pride for New Jersey,” Ghermezian said. “There’s no doubt in my mind.”

“We’re putting everything we have into it” he said.

A key component of Triple Five’s finance plan is the sale of tax-exempt bonds backed by the pledged government tax incentives, which total $1.15 billion. A New Jersey Transit rail line also already serves the sports complex, which helps the project by providing it with a crucial rail link to Penn Station in New York — at no cost to the developer. Last year officials at the New Jersey Sports & Exposition Authority also unexpectedly shut down the Izod Arena, which is also located in the sports complex, ensuring its operations would not interfere with any of the construction work at the adjacent American Dream site.

Jobs, wages, and taxes

Christie and Triple Five officials have defended the government’s involvement in the project by saying the state will benefit in the long run from the jobs and tax revenue that the project will create. And the tax incentives are structured in a way that forces Triple Five to first open its doors to the public and turn a profit before any of the incentives are paid out.

But the net benefit for New Jersey, as calculated by the New Jersey Economic Development Authority, an agency that has approved a $390 million portion of the tax-incentive package, is $730 million spread out over two decades. That breaks down to roughly $36 million a year, which is about one tenth of 1 percent of the state’s overall $34.5 billion spending plan for the current fiscal year.

The EDA’s long-term projections also indicate that most of the roughly 10,000 permanent jobs that will be generated by American Dream – if it proves to be a success – will pay less than $20,000 a year.

That’s not enough income to afford even a one-bedroom apartment in most of the communities that surround the sports complex in Bergen and Hudson counties, according to rent totals tracked annually by affordable-housing activists. Such compensation would also likely mean many of the American Dream employees could qualify for state public-assistance programs and the Earned Income Tax Credit.

Senate Majority Leader Loretta Weinberg, a Democrat from Bergen County who has been raising questions about the development effort for years, said she remains unconvinced that the state’s investment will be worth the financial commitment.

“I don’t know what kind of economic engine that is,” Weinberg said.

“You need to pay people enough that they in turn can go shopping and pay for a roof over their head, buy food and take care of their kids,” Weinberg said. “If you don’t do that, then you’re undermining the whole underpinning of our economy here.”

But officials from Triple Five say their economic estimates are much higher than those the EDA used to calculate the size of the tax incentive. The company has roughly 500 people working at the site now, and is spending $28 million to $30 million each month. They eventually expect there to be 23,000 construction jobs and another 23,000 jobs created or supported once American Dream opens, with $50 million in annual tax revenues from construction and another $133 million from the permanent jobs.

“We’re creating tens of thousands of jobs, we’re creating an incredible tax base and revenue for the state of New Jersey,” Ghermezian said. “These are taxes that we’re creating that otherwise would not exist in the state of New Jersey.”

Ghermezian also suggested that New Jersey residents, who have long complained about the existing buildings’ multicolored exterior, will be happy with the exterior of the project once its completed. “We’re getting rid of all these colored Lego blocks, whatever it is,” he said.

John Reitmeyer is the budget and public finance writer for NJ Spotlight. Ilya Marritz is a reporter/producer for WNYC. Susan Berfield is a reporter for Bloomberg Businessweek.

The Mall Madness series continues tomorrow with a closer look at the retail industry’s shift from “bricks to clicks” and how that trend could impact American Dream’s long-term business plan. The series was produced through a reporting collaboration between WNYC, NJ Spotlight, and Bloomberg Businessweek.

___________________________________________

NJ Spotlight, an independent online news service on issues critical to New Jersey, makes its in-depth reporting available to NewsWorks.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.