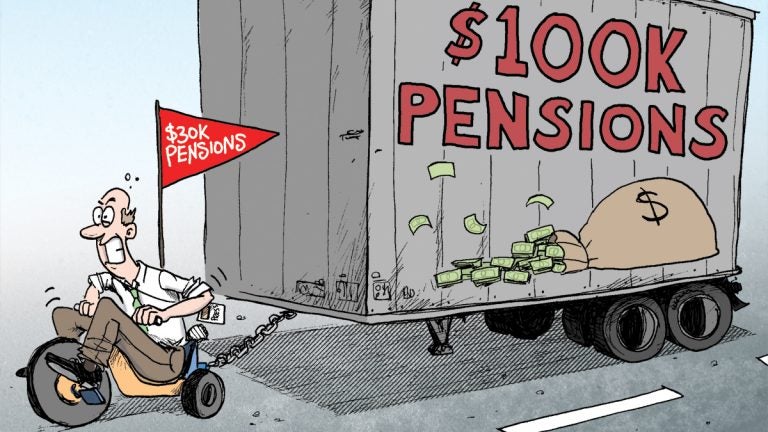

Commentary: NJ’s $100K pension club hurts union credibility

The Grand Canyon is an apt metaphor for the pension mess that faces New Jersey taxpayers. After all, an unfunded liability of $83 billion is one of those numbers that’s hard to envision. Maybe if I type it out – $83,000,000,000. No, still doesn’t quite cover it.

Okay, how about this. If you stacked $100 bills lengthwise up into the sky, $83 billion would tower nearly 1,430 Mount Everests high.

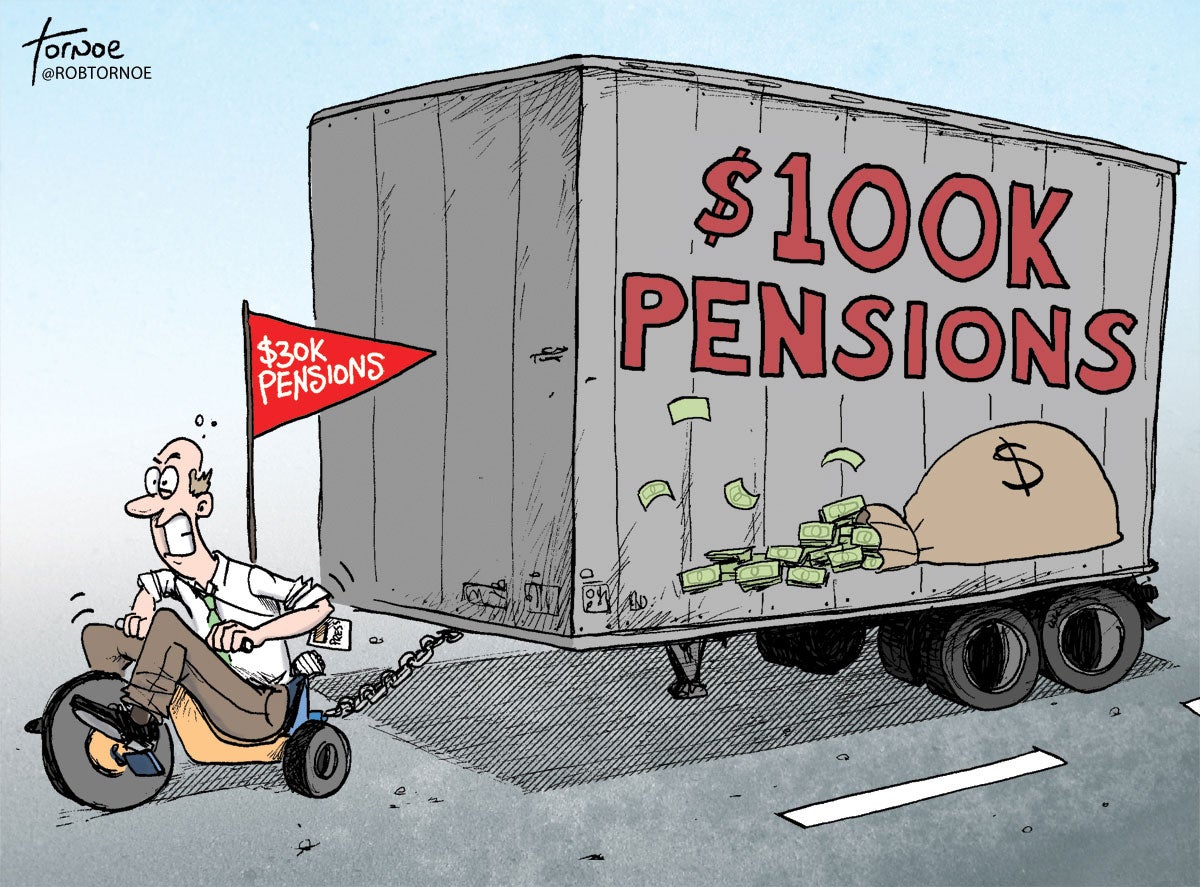

The point is the problem is big. But that was supposed to change with Chris Christie, the loud-mouth fiscal conservative who made a name for himself busting corrupt politicians fattening their pockets by milking the system. It was a little over four years ago that Christie boasted he “fixed” New Jersey’s $83 billion pension problem by signing a bipartisan fix that had public employees giving up benefits with the promise the state would begin to make full payments.

But Christie didn’t hold up his end of the bargain.

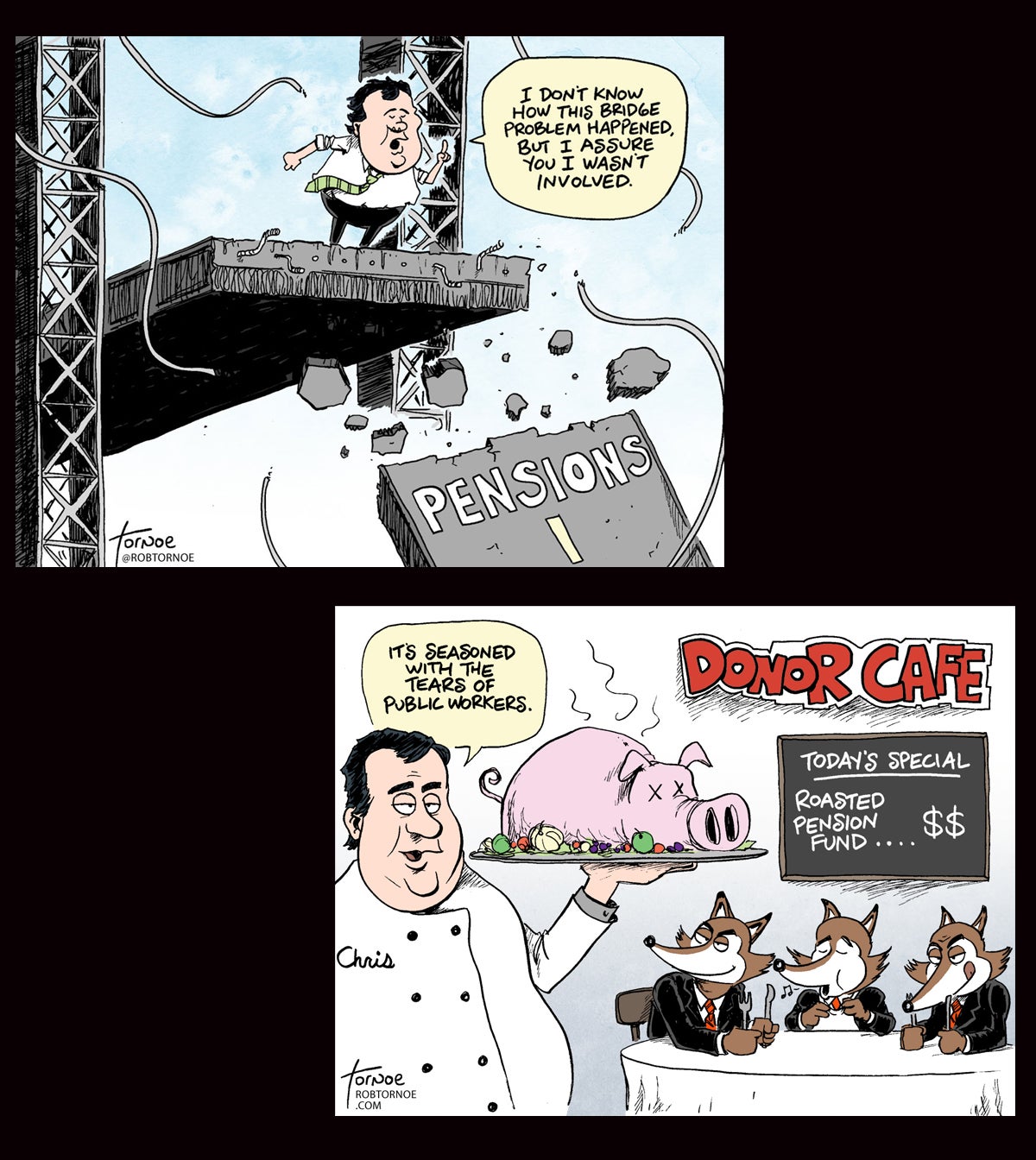

Christie instead decided to follow the footsteps laid by previous governors over the last 20 years by shortchanging the system, shifting $2.4 billion that should’ve gone towards pensions towards to fill budget holes.

Christie’s unquestioned pension duplicity is not at question here. In fact, I’ve covered Christie’s irresponsible stewardship in many, many cartoons. He is, very clearly, to blame for much of the fiscal problem New Jersey faces today:

But you can’t blame Christie for everything.

What’d I’d like to talk about here is the other side of that coin, a problem that Christie foes and labor leaders seem to want to keep hidden under the rug is the obscenely high pension payments reaped by few.

The “One Percent” of New Jersey Pensioners

As watchdog Mark Lagerkvist noted recently, the amount of retired public officials enjoying pension payments over $100,000 a year has doubled in just the last four years, to the tune of 1,988 (In 2010, the number was just 971). Consider these the “one percent” among New Jersey’s 285,000 retirees.

That’s in stark contrast to the $31,145 the average state retiree earns for a lifetime of devotion to public service. I imagine most hard-working state employees would cringe when they hear some of the individual tales of the $100-K club.

Take for instance the man at the top of the list, former Jersey City school superintendent Charles Epps. Not only does he enjoy a rather cushy $195,000 pension (that’s over $16,000 a month, for life, for being retired), but Epps was handed a $268,000 settlement (plus $85,000 in unused sick time) when he stepped down amid controversy. That’s a nice chunk of change for a guy who led a school district that the state designated as “failing.”

In fact, looking at the $100-K list, 23 retired school administrators earn a pension over $150,000. As someone who supports public education and has criticized the move in some places to charters, I’m all for paying teachers and rewarding successful school leaders. But paying them that much in retirement when school districts across the state are underfunded strikes me as idiotic.

At least the New Jersey Education Association (NJEA) made attempts to reform pensions (although recently they seem to be backtracking a bit). Police and firemen unions have been steadfastly opposed to any changes in the pension system that don’t benefit them, and they’re among the worst at taking advantage of overtime rules that plump up a lifetime of payouts.

Would you believe the largest number of members of the $100K Club are our men and women in uniform? Retired local law enforcement and firefighters make up nearly 50 percent of all pensioners making over $100,000 a year. And nearly 93 percent of them took advantage of an exclusive “special retirement” provision that allows them to cash out after 20 years of service.

Take former Union City deputy police chief Joseph Blaettler. I’ve never met Joe – he’s probably a great guy – but he was able to step down at 46 with a $135,000 pension. So on Joe’s 80th birthday, New Jersey taxpayers will have made him a millionaire in retirement nearly five times over.

I can already envision the response I’m going to hear from state workers. “Politicians created the system!” “I was just playing by the rules!” “I’ve been promised these benefits!”

All those statements are true, and yet, it’s hard to be sympathetic to so-called public servants who know these obscene pensions are unsustainable. I also understand that most state workers have been positioned as human shields, protecting the affluent (and in many cases, obscene) retirement benefits reaped to those who have gamed the system.

In any case, it’s time for union leaders to accept the fact we have to do something now. Today. Right away. By just 2016, taxpayers will be forced to cough up $4.3 billion in annual payments in order to secure full funding for retirees, and another $3.7 billion a year to cover health care premiums. That’s $8 billion total which would comprise nearly 24 percent of Christie’s proposed 2015 budget of $33.8 billion.

There are ways to move forward. Unions and the state should agree to place a cap on the amount a retired state worker can earn in retirement. California was able to achieve significant savings by capping pensionable income at $110,000 a year. In effect, if state workers there earn a 50 percent pension, they would receive a $55,000 a year pension when they retire.

Unions should also get out in front and call for rules against “pension padding” and “double dippers” who artificially increase their salaries over their last three years of service to inflate their pensions. Not even the plan drafted by Christie’s Pension and Health Benefit Study Commission touches these sacred cows, which I image every taxpayer can agree are obscene (the commission thinks the issue “may not be financially material”.

I would also try to force through a reduction in benefits on the $100K club. For the sake of keeping it broad and simple, imagine if state and unions were somehow able to agree on a $40,000 pension reduction per person across the board for this group. The state would save nearly $400 million over the next 10 years, and the LOWEST pension would still top $60,000 a year.

Making the cut in a progressive way would be ideal (maybe a $40,000 cut for anyone above $150,000, and pro-rate the rest as you go down the scale), but my point is there are significant savings to be made adjusting pensions for those that, frankly, are getting rich off gaming the system.

I know I’m going to get some blowback from my progressive friends about this, and I welcome the discussion. For New Jersey to fix this mess, Christie has to stop raiding pension funds like a cookie jar, and unions need to realize there simply isn’t enough money (thanks in large part of previous cookie jar raiders) to cover all the promises that have been made.

I’d just rather see those changes made for those than can afford it rather than being forced upon those that can’t.

______________________________________________________

Rob Tornoe is a columnist and WHYY contributor. Follow Rob on Twitter @RobTornoe.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.