Thousands of filings expected as N.J. foreclosures resume

Groups that help New Jersey residents deal with foreclosure cases say they’re concerned about a judge’s ruling that allows four of the biggest banks to resume uncontested foreclosure proceedings.

Bank of America, Citibank, JP Morgan and Wells Fargo now can proceed with foreclosure actions in the state under court monitoring.

New Jersey Citizen Action executive director Phyllis Salowe Kaye expects a sharp increase in foreclosures as a result of the decision allowing banks to proceed with cases that were on hold since December.

“The floodgates have been opened,” she said. “Foreclosures are going to move forward, and they’re going to come in bulk form now. We think thousands will be filed in the next few days. A lot of people are going to lose their homes. “

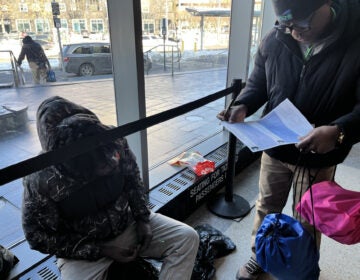

Salowe Kaye says foreclosure help centers don’t have enough counselors to deal with the anticipated increase in requests from distressed homeowners.

Robert Levy of the New Jersey Mortgage Bankers Association says an increase in foreclosed properties will have a negative impact on home values. But, he says, the money banks recoup can be used for other loans for consumers.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.