DRWC’s annual audit

The Delaware River Waterfront Corporation earlier this month adopted its annual financial statements and audit report.

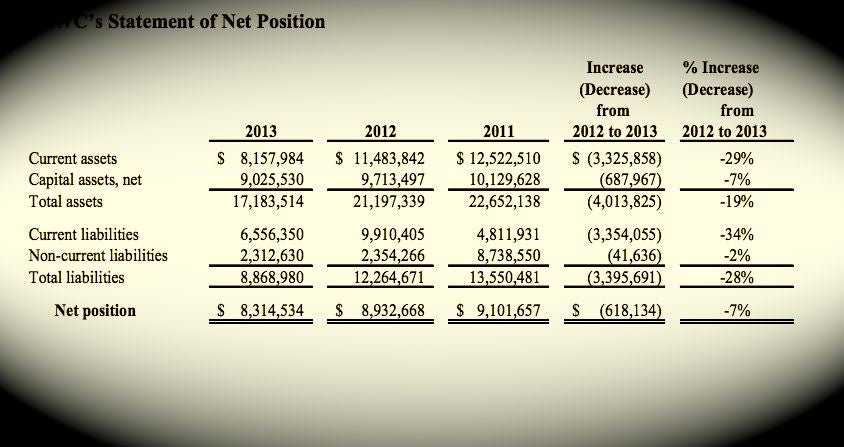

The documents included information about the past three fiscal years, 2011, 2012 and 2013, but the numbers for the year ending June 30, 2013, represent the newest info.

“Revenues were consistent with budget projections. At the same time, expenses were higher than anticipated mainly due to construction and capital projects,” auditors Mitchell & Titus wrote in the report.

“The assets of the Corporation exceeded its liabilities at June 30, 2013 by $8,314,534, representing the Corporation’s total net assets. All the Corporation’s net assets may be used to support continuing operations. ”

Board Vice Chairman Jay Goldstein, founder and president of Valley Green Bank, led the board’s review of the report.

The board of directors had no questions at the meeting, said DRWC Director of Finance Rinku Modi. “It was a clean audit,” she said.

According to the report, DRWC’s assets at the end of fiscal 2013 decreased by 29% from the previous year and liabilities decreased by 34 percent.

This is mostly attributable to the fact that duringt the past year year, DRWC teed up many capital projects, and paying for them decreased both the organization’s cash on hand and its financial commitments.

The DRWC’s net position – its assets, including cash and property, minus liabilities – has decreased over the past several years, from $9.1 million in fiscal 2011 to $8.9 million in 2012 and $8.3 million in 2013.

“It’s normal, because a few years back, we had not as many projects, so we had a stronger cash balance,” she said. Using up that money – much of it from grants – to build projects makes the number smaller, she said, but the fund balance remains strong.

The full report is attached to this article. Other highlights in changes from 2012 to 2013, pulled from the report:

-“Rentals, concessions, and events” decreased 6% in fiscal year 2013 mainly due to a decrease in parking revenue as compared to fiscal year 2012.

-“Miscellaneous revenues” is lower by 98% as the previous year’s revenue included a onetime settlement of pending litigation.

-“Interest Income” is higher by 23% because of strategic investment of available funds to earn maximum interest.

-“Personnel services” decreased by 8% because there was a gap in hiring new employees to replace outgoing employees.

-“Purchase of services” is higher by 42% due to more professional fees paid out to consultants for the capital projects undertaken during fiscal year 2013 as compared to 2012.

-“Materials and supplies” decreased 33% mainly due to DRWC’s efforts to reduce expenses and cut costs due to limited revenue sources.

-“Employee benefits” is lower by 14% due to decrease in premiums as a result of changing carriers and decrease in OPEB contributions paid due to the Plan is currently over-funded.

-“Indemnities and taxes” decreased by 9% due to lower parking lot taxes due to lower parking revenue.

-“Engineering and construction” is lower by 12% due to less capital projects undertaken during fiscal year 2012.

-“Fundraising expenses” is lower by 36% mainly due to major cost incurred for a rain back up plan in 2012. No such expenses were incurred in fiscal year 2013.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.