Delaware, New Jersey and Pennsylvania score high for identity theft, says Wallethub report

WalletHub reported Delaware, New Jersey and Pennsylvania are vulnerable for identity theft and fraud in 2025, due to the rising number of data breaches.

Listen 0:57

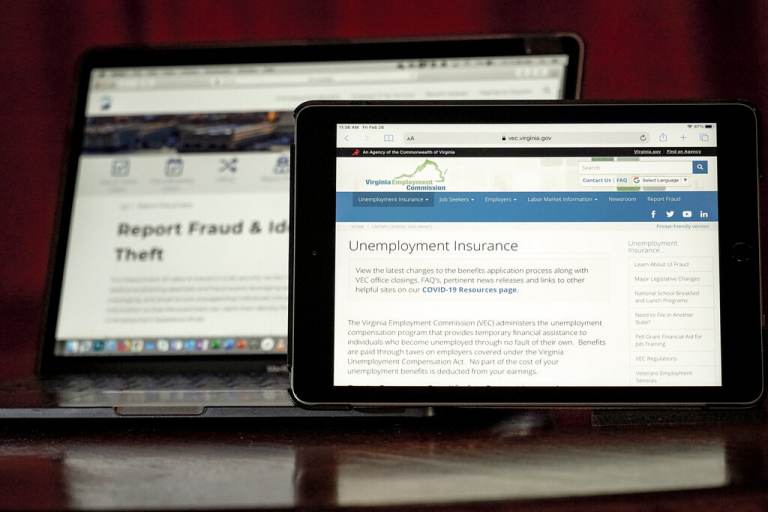

Web pages used to show information for collecting unemployment insurance in Virginia, right, and reporting fraud and identity theft in Pennsylvania, are displayed on the respective state web pages, Friday, Feb. 26, 2021, in Zelienople, Pa. (AP Photo/Keith Srakocic)

From Philly and the Pa. suburbs to South Jersey and Delaware, what would you like WHYY News to cover? Let us know!

Delaware ranks among the nation’s most vulnerable states for identity theft and consumer fraud, with New Jersey and Pennsylvania following at 14th and 18th, respectively, in WalletHub’s latest report.

In 2023, U.S. consumers faced an estimated $10 billion in fraud-related losses, the report claims, up $1 billion from 2022, with identity theft playing a leading role.

Data breaches involving major companies like Microsoft, AT&T and Ticketmaster have significantly increased risks, jeopardizing personal information.

WalletHub’s recent study analyzed 14 metrics across identity theft and fraud and uncovered vulnerabilities for 2025. High complaint rates, financial losses and gaps in state-level protections placed Delaware as the second-most vulnerable state due to frequent fraud complaints and substantial financial losses.

Pennsylvania ranked 18th overall, with more than 314 theft complaints per 100 residents and an average financial loss of $8,228 per case. In 2024, the state’s Bureau of Consumer Protection handled over 34,000 consumer complaints and initiated 71 legal actions, including civil complaints, subpoena enforcement and bankruptcy actions.

John Abel, chief deputy attorney general for Pennsylvania’s attorney general, explained that demographic factors play a significant role in the state’s susceptibility to fraud. Pennsylvania has a substantial population of older adults, with an estimated 2.6 million people aged 65 or older according to the U.S. Census data, who are often more likely to engage with scammers.

Abel noted that seniors’ increased availability makes them more susceptible to fraud schemes. He recommended that families speak with their elder relatives to help reduce risks.

“Historically, our state has tended to have a high proportion of senior consumers.” Abel said. “They are more likely to pick up the phone or engage with a would-be scammer. They tend to be at home more.”

Pennsylvania has made efforts to address identity theft by focusing on individual complaint management, enforcement actions and public education initiatives. The Attorney General’s Office helps victims of fraud by connecting them with law enforcement and other resources.

The state has also pursued legal actions, such as a $1 million settlement with Rutter’s and a $52 million settlement with Marriott following data breaches that impacted Pennsylvania residents. Public education programs further aim to raise awareness about fraud prevention, emphasizing phishing scams and data security best practices.

Lastly, addressing this situation includes a strong emphasis on public education by implementing a robust public education outreach program.

The state has bolstered its legal framework with the Breach of Personal Information Notification Act (BOPINA), which requires companies to report data breaches under specific circumstances. Abel stressed that the law allows the state to step in and investigate breaches and take legal action when necessary.

Abel added that addressing this issue relies significantly on common sense measures. These can include using strong, regularly updated passwords, verifying the legitimacy of websites and exercising caution with unsolicited telephone pitches or offers.

During the holiday season, he advised vigilance against phishing scams, which often arrive as text messages or emails about delayed packages or other fraudulent alerts.

Abel emphasized that consulting with trusted individuals about any unusual emails or phone calls before acting on suspicious communications can significantly reduce the chances of falling victim to scams.

As identity theft and fraud continue to rise, consumers are encouraged to stay informed and take steps to safeguard their personal information.

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.