Carney unveils nearly $5 billion Delaware budget plan

Gov. John Carney’s latest spending plan increases state spending by 4.6% over the current year and is reflective of strong revenue numbers.

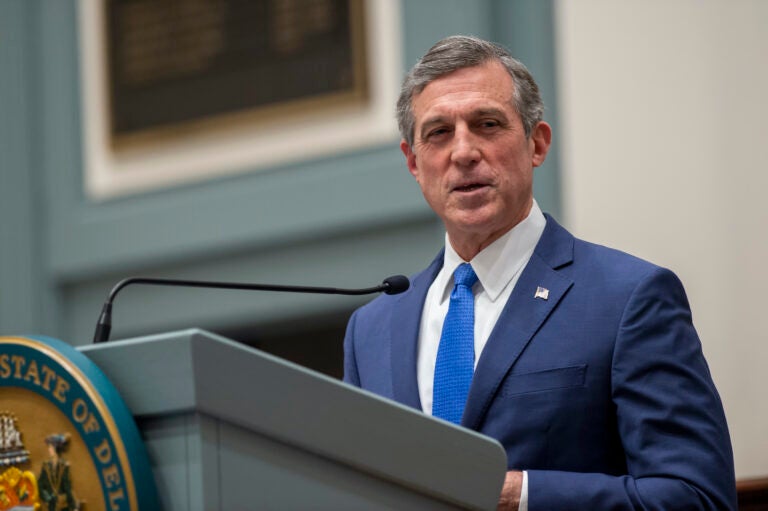

Delaware Gov. John Carney gives the State of State Address in the Senate Chambers at Legislative Hall in Dover in January 2021. (Jason Minto/State of Delaware)

Delaware would spend $4.9 billion under Gov. John Carney’s budget plan unveiled in Dover Thursday morning. The budget grows spending by 4.6% compared to the current year’s plan. Two years into the pandemic, the budget growth comes as the state is swimming in revenue.

After severe cuts were required in Carney’s first year in office, his budget has historically taken a cautious approach to expanded spending.

The budget plan uses one-time sources of income like stimulus money from the federal government on one-time expenses like COVID-19 testing and overdue upgrades for the University of Delaware, Delaware State, and Delaware Technical Community College.

“This fully funds our budget stabilization account and allocates one-time cash and revenue to the bond bill,” Carney said. The bond bill pays for construction projects and other capital improvements. Last year’s $1.35 billion bond bill was the largest in state history. This year’s proposal falls just short of that record at $1.18 billion.

“We’ve got a supercharged capital program with the federal money and our own capital spending,” Carney said. “It’s an expanded opportunity for workers in this new economy and supporting families in the workforce.”

Carney’s also proposing an increase in pay for state workers.

“Our approach to pay policy over the last several budgets has been to try to lift up those at the bottom, number one by raising the salary for pay grade one and then, number two, by giving a flat dollar amount increase instead of a percentage increase to again try to lift up and move our lower paid employees to towards a $15 minimum wage,” Carney said.

Office of Management and Budget Director Cerron Cade said they’re on track to lift all state workers’ minimum wage to $15 an hour by 2025 as required by state law.

Workers collecting unemployment benefits will not have to pay personal income taxes on those checks, a cut in revenue that will cost the state $25 million over two years.

The budget does not include tax breaks called for by Republican lawmakers. State Rep. Rich Collins (R-Millsboro) has filed legislation that would tie Delaware’s personal income tax brackets to the rate of inflation to lower rates for residents with low and medium income.

“The value of cost-of-living raises earned by low- and moderate-income Delawareans is being eroded by our state’s rigid tax system,” the Millsboro Republican said. “Wages growing in recognition of inflation are being taxed at higher rates as those earnings are pushed over static tax bracket thresholds. It amounts to state theft by inefficiency.”

Even though Delaware is expected to bring in $400 million more in revenue than originally forecasted last June, a bulk of that extra cash comes from the realty transfer tax.

“If you think about the real estate market right now, it is on fire and the state gets 3% real estate transfer tax, actually 4% now,” Carney said. “This real estate market has just meant millions, tens of millions of dollars extra into our state revenue forecast.”

Secretary of Finance Rick Geisenberger says because the real estate market is so volatile, it would hurt the state’s financial stability if they cut taxes only to raise them in a few years when the real estate market drops.

“The real estate transfer tax has grown 30% a year for each of the last two years. Normally, it grows about 7.5% a year during good times over the last 10 years,” Geisenberg said. “Obviously, the downside risk is that it’s not unusual and has happened at least twice in the last 25 years where that revenue has dropped 45% in a single year. So it’s something we ought to be very careful about.”

Revenue from the corporate franchise tax paid by thousands of businesses incorporated in Delaware has also seen major gains.

“We’re outpacing the normal,” Geisenberg said. “Last year we grew 13%. The last time we grew 13% in the corporate franchise tax was during the dot com bubble in 1999. So, that’s another area we should be cautious about.”

Over the next two months, the Joint Finance Committee and Bond Bill Committee will hold hearings to discuss Carney’s plans for specific agencies. They must approve a budget that’s signed by the governor by June 30.

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.