Can Philadelphia be the next big biotech hub?

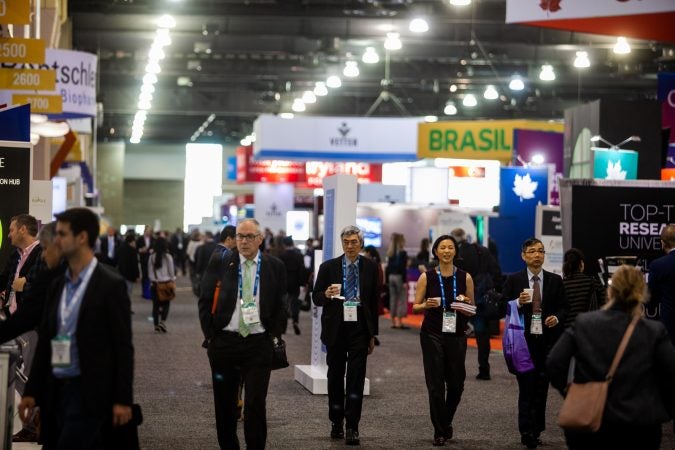

Tens of thousands of industry leaders came to the city this week for BIO, an international convention. Local boosters pitched Philly’s advantages.

-

The BIO International Convention drew thousands in the biotech industry from around the globe this week to the Pennsylvania Convention Center. (Brad Larrison for WHYY)

-

The BIO International Convention drew thousands in the biotech industry from around the globe this week to the Pennsylvania Convention Center. (Brad Larrison for WHYY)

-

The BIO International Convention drew thousands in the biotech industry from around the globe this week to the Pennsylvania Convention Center. (Brad Larrison for WHYY)

-

The BIO International Convention drew thousands in the biotech industry from around the globe this week to the Pennsylvania Convention Center. (Brad Larrison for WHYY)

-

Attendees of the BIO International Convention listen to a panel discussion on the biotech industry in France Thursday on the last day of the conference. (Brad Larrison for WHYY)

-

The BIO International Convention drew thousands in the biotech industry from around the globe this week to the Pennsylvania Convention Center. (Brad Larrison for WHYY)

-

Neal Koller, Chairman and CEO of Alphyn Biologics, makes a presentation on his companies work in providing therapy for infectious diseases Thursday at the BIO International Conference. (Brad Larrison for WHYY)

-

The BIO International Convention drew thousands in the biotech industry from around the globe this week to the Pennsylvania Convention Center. (Brad Larrison for WHYY)

-

The BIO International Convention drew thousands in the biotech industry from around the globe this week to the Pennsylvania Convention Center. (Brad Larrison for WHYY)

When Kathy High was setting up her company, a number of potential investors told her this: “A biotech company should be in Boston or San Francisco or maybe San Diego, but not Philadelphia.”

High and her team said no, all their expertise and researchers were here, so they were not going to move.

Earlier this year, their gene-therapy company, Spark Therapeutics, was sold for billions of dollars to the Swiss health-care company Roche. That’s the success story local industry leaders cite in arguing for Philadelphia and the Delaware Valley as a potential biotech hub.

This week, when tens of thousands of people in the biotech industry gathered here for the international BIO convention, local companies got the chance to, once again, pitch Philadelphia as an up-and-coming center of innovation.

CSL Behring, which has its headquarters in King of Prussia, even sponsored a mural in the heart of the city called the Promise of Biotechnology.

“Every politician and every government representative in any region will say, ‘We want this, we want to create a biotech sector to drive jobs and all of the good things that come with a knowledge-based economy,’” said Andrew Marshall, chief editor of the journal Nature Biotechnology. “But it’s very, very difficult to recreate that.”

He said Philadelphia certainly has a lot going for it — world-class research universities, a cluster of biotech companies — but it still has a way to go before the region can become the hub that local boosters want it to be.

For one thing, Marshall said, most of the venture-capital firms that know enough about biotech to invest in it are based in Boston and the Bay Area, which is why those will, for now, remain the go-to places for new companies.

He said many companies fail not because of their ideas or science: “They’re insufficiently capitalized, or they can’t take the assets or the technology forward. They’re like the walking dead, zombie companies, and they don’t really go anywhere or they gradually die out.”

The critical difference is a lack of money or intellectual-property lawyers or accountants for companies to fully capitalize on their ideas.

But, Marshall said, Philadelphia is definitely a place people around the world are watching. For one thing, he said, Spark Therapeutics is a creative exception to the venture-capital funding model.

Children’s Hospital of Philadelphia put $50 million behind its own researchers to help launch Spark in 2013, with a payoff of more than $450 million this year when Roche bought the company.

Editor’s note: Spark Therapeutics CEO Jeffrey Marrazzo is the son of WHYY president and chief executive officer Bill Marrazzo. Both Spark and Jeffrey Marrazzo donate to WHYY.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.