The child tax credit was a lifeline. Now some families are falling back into poverty

In January, the first month without the deposits, 3.7 million children fell into poverty. (Sean Gallup/Getty Images via NPR)

When Sarah Anderson lost both her jobs during the pandemic, the money dried up and the stress kicked in.

So the extra income from the expanded child tax credit was a lifesaver.

“The money wasn’t a replacement for that income, but it just helped keep everything afloat,” she said.

The mother of four from Durham, NC used it to pay for the basics like food, gas and bills. But that safety net disappeared in December after Congress failed to renew the program as part of the Build Back Better plan.

“To lose that money, especially when the price of everything has skyrocketed … I just feel really abandoned by this country,” Anderson said.

“I go to bed at night just wondering how are we going to pay all of these bills this month. And I just don’t want my kids to feel that stress.”

Anderson is not alone. The payments from the child tax credit were closing the gaps on child hunger and poverty across America. And in the months since they ended, there’s evidence that the families who needed the money the most have already slipped back into financial trouble.

The end of payments collide with rising costs

The impact of stopping the monthly payments was devastatingly swift, according to an assessment from the Columbia Center on Poverty and Social Policy’s monthly tracker.

It estimated that 3.7 million children were kept out of poverty in December when the last child tax credit payment was made. In January, the first month without the deposits, 3.7 million children fell into poverty.

“We have about $34 left in our bank account,” says Amy Jean Tyler from Crestwood, KY.

Her husband was laid off last year and she said the child tax credit had been their only reliable source of income for months. Now, she said they’re living week to week, “sometimes waiting on unemployment checks that don’t always arrive on time.”

One of the program’s biggest impacts was seen in food security. According to an analysis of Census Bureau data, after the first payment went out the number of adults reporting that their household didn’t have enough to eat dropped from 10.7 million to 7.4 million.

And the loss of the monthly payments has collided with rising prices in housing, food and gas.

A.J. Wilbur manages eight rental units in a small town in Bradford County, PA, and said during the six months when the tax credits were paid, no one was late on rent or utilities. But the month after the program expired, everyone fell behind again.

“Three of the rentals have small children, two of which are single working mothers,” he said. “I just received notices this week that these two still have past-due water and sewer bills. One is over $200 and the other over $170. Very high for this area.”

He said his tenants were having to choose which bills to pay right now, and with housing hard to find in the area, they were prioritizing rent over utilities like power and water.

The child care dilemma and the ‘high cost of being poor’

Elizabeth Ananat is an economist at Barnard College who has been tracking the effects of the expanded child tax credit since the first payment went out in July. One of the things she focused on was on the notion that the payments would convince people to leave the workforce.

“We pushed and pulled on the data every which way trying to see if we could find some parents dropping out of the labor force because now, you know, they have this money,” she said. “And we just saw no evidence of that at all.”

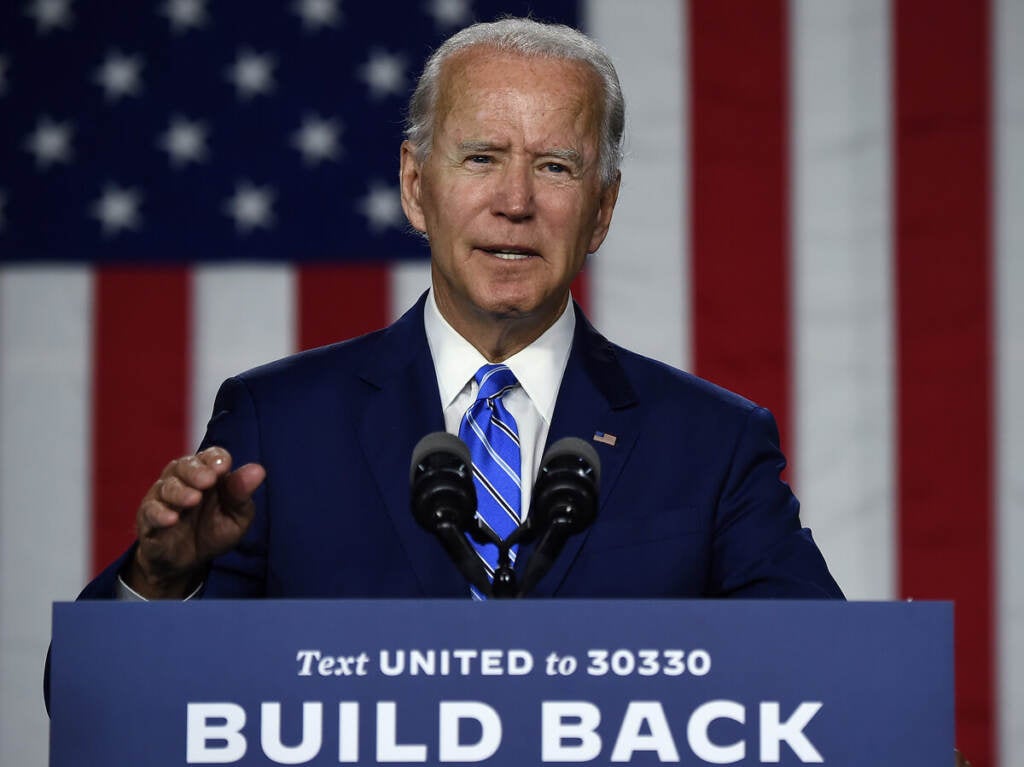

J(oe Raedle/Getty Images via NPR)

And considering that child care was one of the most common ways that families spent the money, losing the child tax credit payments might actually be costing people their jobs.

One woman who went by the name “Fallon” for privacy reasons said she worried her boss would fire her if she kept missing work due to not being able to afford a sitter. And Caitlyn Overacker in Fairbanks, AK said that without the tax credit to help offset the cost of daycare for her five kids, she was considering leaving her job at the local library.

“I really like my job,” she said. “It would be a real shame.”

Ananat said there was also a key difference between spreading the payments monthly versus one lump sum at tax time: low-income families don’t always have the same amount of money coming in every month.

Having that reliable deposit can make a big difference, especially in the event of an emergency, a job loss or even just unstable scheduling. Families without savings might need to turn to credit cards or loans, or miss payments altogether, facing interest and late fees.

“This is sort of the high cost of being poor,” Ananat said. “Getting money at tax time is helpful, but it’s hard to smooth that over the year when you don’t know what’s going to happen and you can’t predict when you’re going to be in trouble.”

She is hoping the program will come back, with a combination of the monthly payments along with a lump sum at tax time, since many low-income families did end up getting more money overall last year.

Taxes are due on April 18th, so many families still have the remainder of the child tax credit coming as part of their annual refund. Some cities have or are planning to implement their own versions of guaranteed income, and President Biden also called for the original payments to be restored in his State of the Union address.

But for now, there are no signs of the program’s return.