Cargo is piling up everywhere and it’s making inflation worse

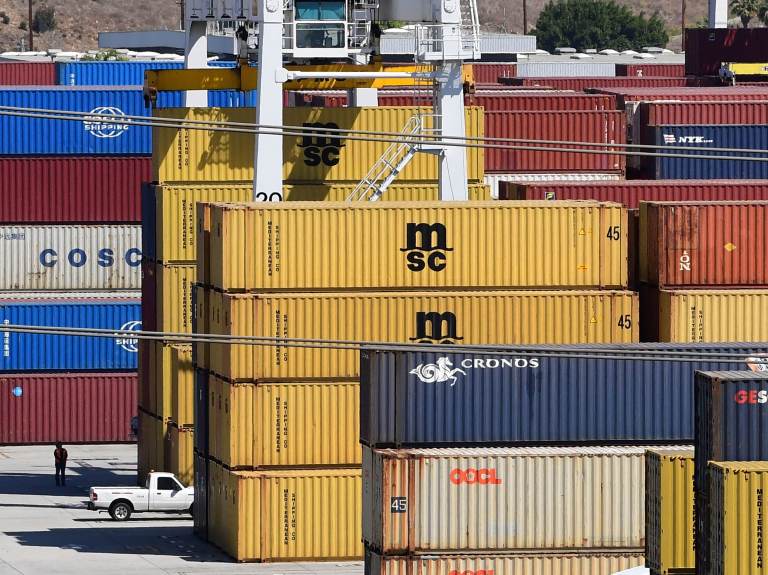

Shipping containers stacked high at the Port of Los Angeles, California on April 19. Supply chain disruptions are hitting small business owners across the U.S. (Frederic J. Brown/AFP via Getty Images)

John Nephew thought he had a winner with a new, tabletop game called “Dice Miner.” Importing the games from China turned out to be its own roll of the dice.

Nephew, founder of Atlas Games in Duluth, Minn., ordered a 40-foot cargo container full of games from Shanghai last December, anticipating delivery in about six weeks.

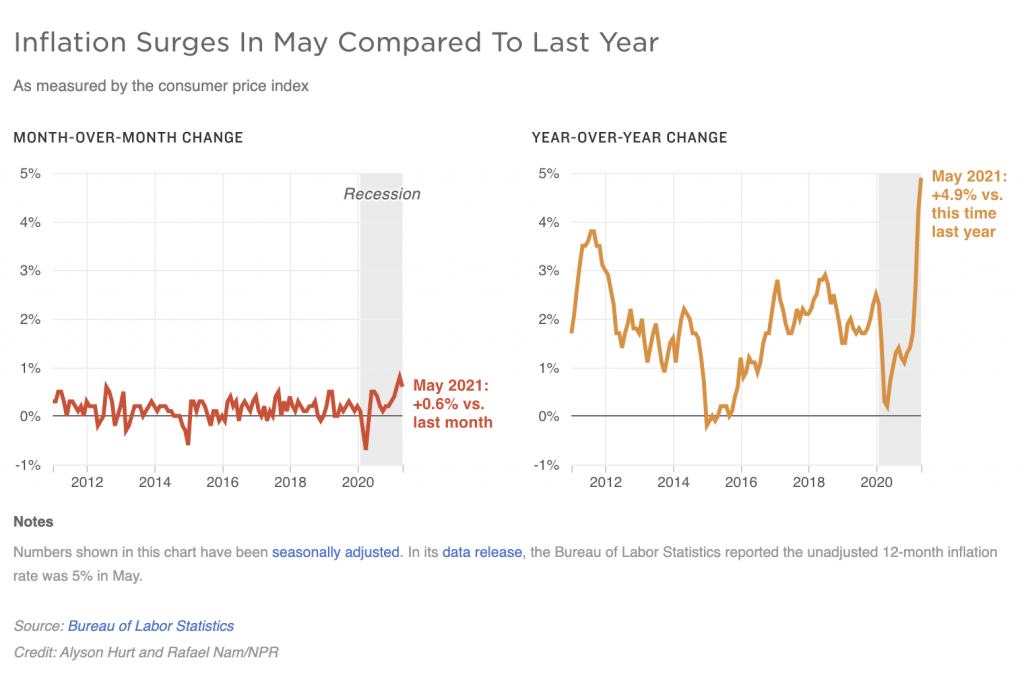

Instead, the games took nearly six months to arrive — an increasingly common example of the supply chain bottlenecks pushing inflation to its highest level in more than a dozen years.

“We were booked on something like eight different shipping voyages in a row, and had them canceled from under us,” Nephew says.

Soaring demand from Americans for everything from iPads to cars is leading to a surge in freight crossing the Pacific, hitting business owners like Nephew.

When the cargo with his games finally arrived on the West Coast, the container was immediately emptied so it could be sent back to China for another load.

The games then continued on to Minnesota by truck, rather than rail, which would have been more economical. The final shipping cost was about $12,000, at least 50% more than the game maker had budgeted.

Businesses around the country are wrestling with similar challenges in getting their goods.

The Port of Los Angeles just logged its busiest month in history, handling more than a million shipping containers in May, more than half of them loaded with imports from Asia.

“We feel the importer and exporter pain,” says Gene Seroka, executive director of the country’s busiest cargo port. “The impacts that all of this has had is noticeably hurtful to these men and women who are trying to do their jobs in the supply chain.”

“This just continues to show the strength of the American consumer during this pandemic-induced buying surge,” Seroka adds.

The record volume of cargo has overwhelmed longshoremen, truck drivers, warehouses and railroads. Vessels are waiting up to five days just to get into port, and it can take 10 more days for a container to be loaded on a train.

Things aren’t quite so busy on the East Coast. But the cost of bringing a refrigerated container from Italy to New Jersey has soared to $10,000, more than twice the going rate before the pandemic.

“They say there’s not enough containers in Europe, lack of space on the boats,” says Philip Marfuggi, CEO of the Ambriola company and a board member of the Cheese Importers Association of America.

It not only takes up to twice as long for shipments to arrive, he says, but deliveries have become less predictable.

“Like the other day, I had eight containers show up,” Marfuggi said. “They should have been like two a week. And then all of a sudden, they all showed up at once.”

All of this create costs and headaches for businesses that had grown accustomed to reliable, just-in-time delivery.

Federal Reserve Chairman Jerome Powell said these “bottleneck effects” have been larger than he and his colleagues anticipated, prompting the central bank to raise its forecast for inflation this year to 3.4%. But Powell expressed confidence that the cargo constraints won’t last indefinitely.

“Prices like that, that have moved up really quickly, because of the shortages and bottlenecks and the like — they should stop going up and at some point they in some cases should actually go down,” Powell told reporters last week.

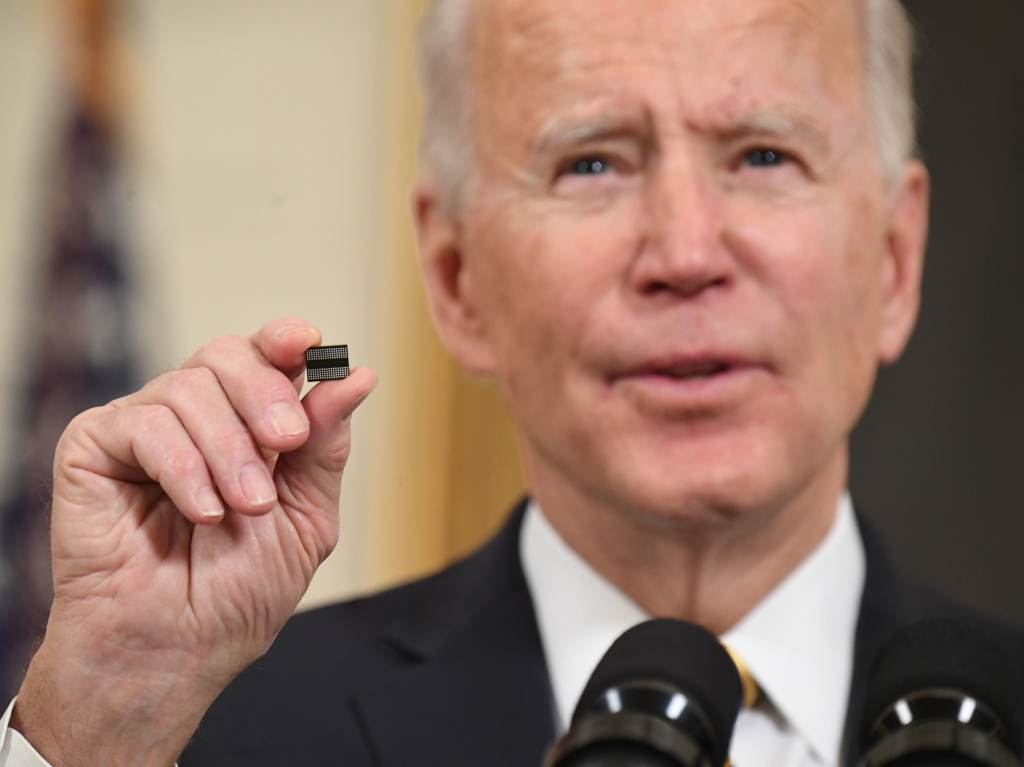

The Biden administration has created a task force to address the most urgent shortages – like computer chips – while also looking for ways to build more resilient delivery networks for the future.

“One of the thing the pandemic exposed is just the degree of vulnerability we have across our supply chain,” said Brian Deese, director of the president’s National Economic Council.

As pandemic fears recede and people are able to spend more of their money on travel and entertainment, demand for goods is expected to decline.

But it could take months to untangle the traffic jam. With back-to-school and holiday shopping seasons still to come, the Port of Los Angeles is likely to remain extremely busy through the fall. Seroka thinks it will be early next year before cargo volumes shrink back to more normal levels.

That’s bad news for business owners like Nephew, who is already bracing for even higher shipping costs after he already had to pay 50% more to ship his “Dice Miner” games.

“It’s just a mess,” says Nephew. “That shipping price is going to look like a bargain within the next couple of weeks.”

9(MDAzMzI1ODY3MDEyMzkzOTE3NjIxNDg3MQ001))