Winners and losers in Pa.’s $34 billion state budget package

Below is a look at who stands to win and lose from the budget package, if it gets back on track.

Shown is the Pennsylvania Capitol in Harrisburg, Pa. on the Wednesday, April 10, 2019. (Matt Rourke/AP Photo)

This article originally appeared on PA Post.

—

Three days ahead of their June 30 deadline, state lawmakers failed to finalize a roughly $34 billion budget package.

Wolf’s office said the main spending plan, which includes no tax increases, meets his objectives.

But some lawmakers in Wolf’s own party have criticized the plan, and the governor himself strongly opposes parts of related funding bills — in particular, a measure that repeals a small cash assistance program for the poor.

Then at around 9:20 p.m. Thursday, the House failed to pass an education bill — throwing a wrench into the entire process. A spokesperson for the governor said Wolf won’t be signing any budget bills Thursday evening. The House plans to return to session on Friday morning.

Below is a look at who stands to win and lose from the budget package, if it gets back on track.

Loser: Workers who earn less than $12 an hour

In January, Wolf proposed increasing the state’s minimum wage from $7.25 per hour $12 an hour on July 1. Gradual increases would follow, so the wage would reach $15 an hour in 2025.

Earlier this month, Marc Levy of The Associated Press reported that raising “the wage is getting its most serious discussion” in years.

But the effort failed — and House Speaker Mike Turzai, R-Allegheny, told lawmakers they couldn’t discuss the issue during a budget debate in the House.

Winner: Pre-K-12 public schools

Education is the largest part of the general fund budget.

And this year’s spending plan increases education funding in several areas, including:

- $160 million more for basic education funding, the largest state subsidy for K-12 education;

- $50 more million for special education;

- $25 million more for Pre-K Counts, a program that provides early childhood education to income-eligible children.

Wolf’s office has pointed to the education funding increases as one of the main reasons the package meets the governor’s objectives. In a statement, Wolf press secretary J.J. Abbott said the governor has secured nearly $1.2 billion in new education funding since he took office.

Winner: Private schools

The plan also increases the limit for scholarships funded through the Educational Improvement Tax Credit by $25 million.

That is less than the $100 million increase that Wolf vetoed earlier this month, but it’s still a bump up and part of a years-long increase in funding for that program. It also increases the salary limit for families who take advantage of the program by $5,000–also less than Republicans initially wanted.

The program allows businesses to receive tax credits in exchange for the scholarship money.

Loser: Teachers who earn less than $45K a year

In his budget address, Wolf proposed raising the minimum salary from $18,500 a year to $45,000 a year for public school teachers, school nurses and similar professional staff members. The idea gained some bipartisan support, but it wasn’t part of the budget deal.

The Pennsylvania State Education Association, the state’s largest teachers union, was a prominent supporter of the legislation. Chris Lilienthal, a spokesperson for the association, said the group plans to focus on the proposal in the fall.

“I think we have just begun to educate lawmakers about what’s at stake here,” Lilienthal said.

Winner: Communities that rely on state police coverage

For yet another year, Wolf proposed a fee for municipalities that rely on state police coverage.

But the didn’t idea didn’t gain much traction this budget session.

The fees for state police coverage, if passed, would have freed up more money for roads, bridges and other transportation projects.

In April, the state’s auditor general, Democrat Eugene DePasquale, said that more than $4.2 billion has been transferred from the Motor License Fund to state police since the 2012-13 fiscal year. Money for that fund comes from gas tax and transportation-related revenue.

Still, House Appropriations Chairman Stan Saylor, R-York, has defended using the fund to help pay for state police. He has said that the practice goes back to the 1960s and that the General Assembly has passed legislation to reduce its reliance on the Motor License Fund.

“This is a multi-year effort,” Saylor said.

In the 2019-20 budget plan, that shift continues — with $97 million being added to the general fund for state police, according to budget documents from Saylor’s committee.

Winner: Spending in general

The overall general fund is increasing by more than $1.2 billion compared to what lawmakers approved last year.

A lot of agencies and programs benefit from that increase.

It includes 2 percent increases for the four-state related universities, the Pennsylvania State System of Higher Education, and community colleges.

There is also increased funding for libraries, agriculture, career and technical centers, domestic violence victims, child welfare programs and people with intellectual disabilities.

The Commonwealth Foundation, which describes itself as a free-market think tank, criticized the level of spending increase in the budget.

But lawmakers on both sides of the aisle pointed to several funding increases as a reason to support the plan.

“I think there’s a lot to like,” Senate Majority Leader Jake Corman, R-Centre, said during a floor debate Thursday, “because I think what we tried to do … is fund what worked.”

Meanwhile, state Sen. Vincent Hughes, D-Philadelphia, said the budget reflects “the political realities that we’re in: a GOP-controlled Senate, a GOP-controlled House. In that political reality, however, there are movements forward.”

Winner: The rainy day fund

The plan includes a deposit of $250 million into the state’s primary savings account.

Loser: Progressive causes

Keystone Progress, which describes itself as the state’s largest and most effective progressive organization, called the budget unacceptable.

“Republicans have railroaded this process,” the group said in a Facebook post addressed to Wolf, “and only you can stop them, now. Stand with the people.”

In the state House, more than half of the Democrats voted against the main spending plan. And on Thursday, some Democratic House members criticized provisions in a code bill, saying they hurt environment protections.

Winner: 2018-era Tom Wolf

In 2015, Wolf proposed major changes to the tax system in Pennsylvania: higher sales and personal income taxes, lower corporate net income taxes, and major school property tax cuts. He ended up in a 9-month budget impasse with the Republican controlled-General Assembly.

In more recent years, he proposed smaller changes. And last year, he signed his first budget and he signed it on time.

This year’s budget passed with a 140-62 vote in the House and a 42-8 vote in the Senate.

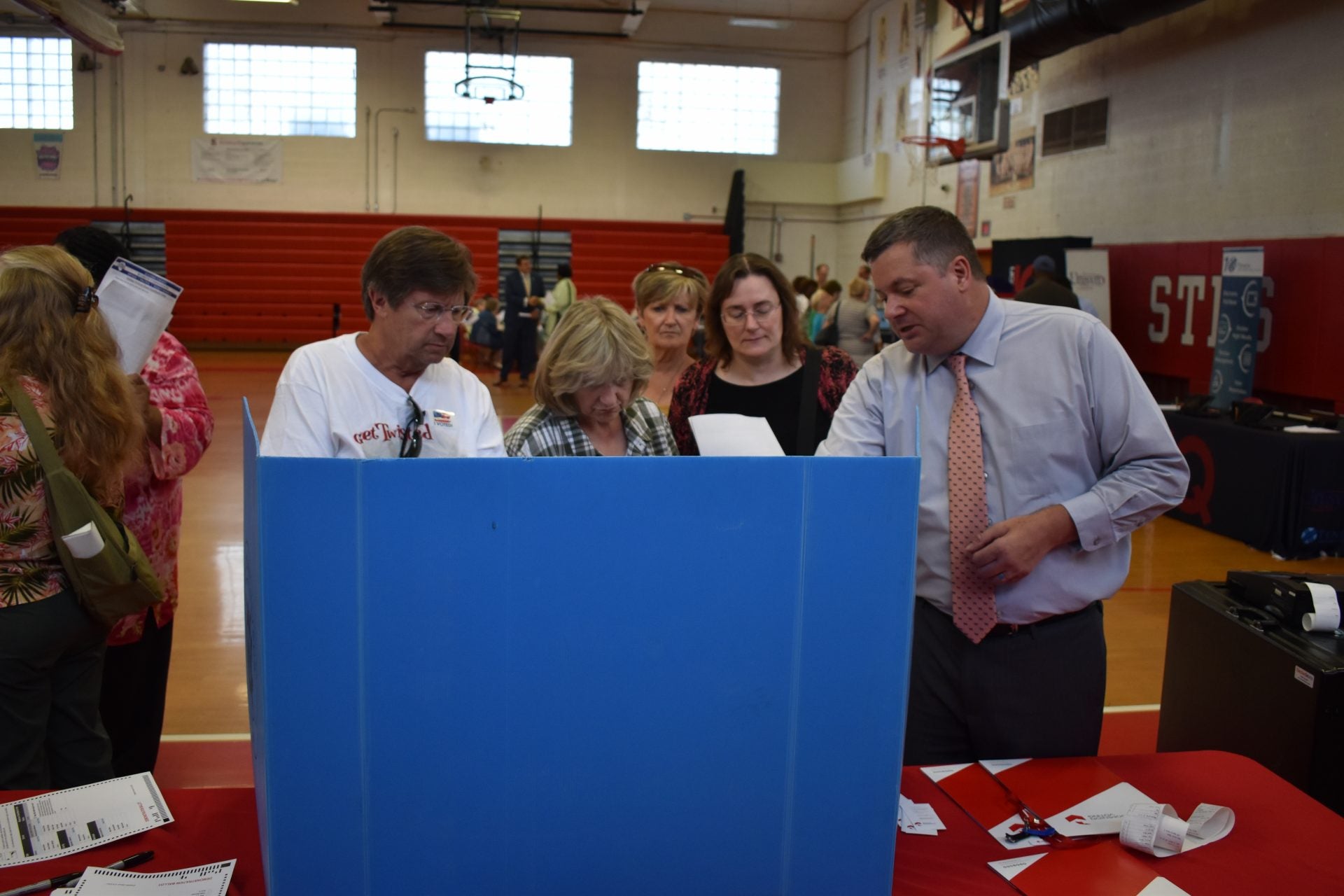

Winner: Voting-machine replacement efforts

In his budget proposal, Wolf asked for $15 million to help counties pay for new voting machines — part of a $75 million proposal over five years.

Republican lawmakers appeared reluctant to provide that money, but they ended up approving voting machine money in a code bill attached to the main spending bill. In fact, they approved more money than Wolf asked for: Up to $90 million, funded by borrowing money.

That code bill includes other election changes, such as legislation that will prevent people from voting a straight-party ticket. That raised a lot of objections from Democrats.

Loser: Cities and towns that want to ban or tax plastic bags this year

State lawmakers and local municipalities can’t pass any laws to ban or tax single-use plastic bags or similar products until a study is completed by the state Independent Fiscal Office and a report is completed by the Legislative Budget and Finance Committee.

Those reports have to be completed before July 1, 2020.

That proposal was added to one of the code bills.

Winner: Natural gas drillers

Pennsylvania remains the only major gas-producing state without a severance tax on natural gas drilling. The state does have a high corporate net income tax, as well as an impact fee that brought in about $1.7 billion from 2011 through 2018. Severance tax supporters, however, say it would bring in significantly more money.

This year, Wolf separated a severance tax proposal from the budget, and he said he’s hopeful lawmakers will return to his $4.5 billion infrastructure proposal in the fall.

Loser: Poor people who receive about $200 a month

The debate over General Assistance, a relatively small program in the state budget, led to a loud and chaotic argument on the Senate floor Wednesday.

Wolf supports the program that provides money to certain poor people, including victims of domestic violence and people in drug or alcohol treatment. But General Assistance repeal is included in a bill that would also provide increased funding for Philly hospitals, among other things.

Wolf has said he’s not sure whether he would veto the bill. The Wolf administration has estimated the cost for General Assistance next year would be $24.5 million.

PA Post is a digital-first, citizen-focused news organization that connects Pennsylvanians with accountability and deep-dive reporting.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.