Suburban Pennsylvania leaders against combining local pensions

Listen

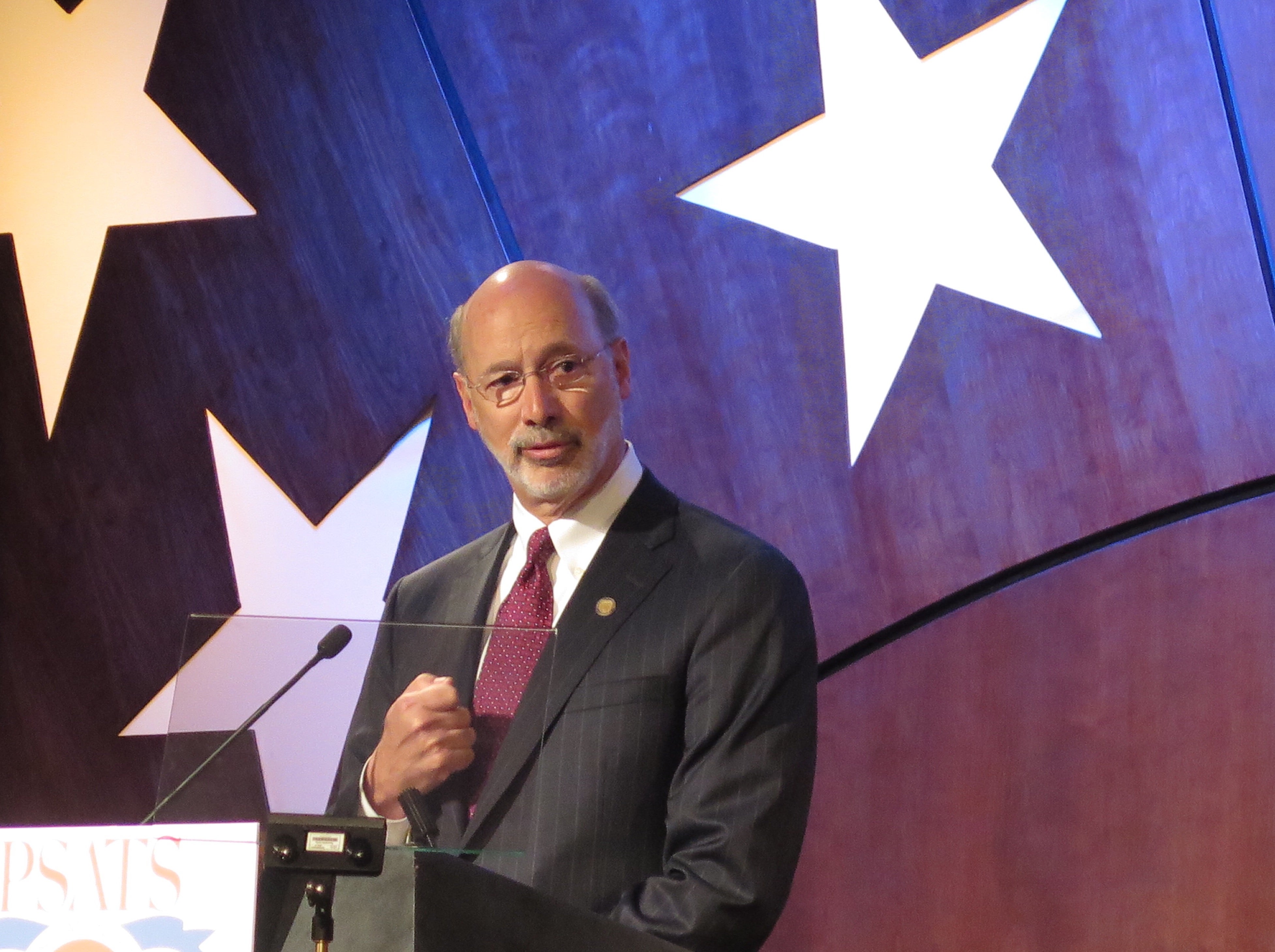

Gov. Tom Wolf speaks to the Pennsylvania State Association of Township Supervisors at their 2015 meeting in Hershey. (Emily Previti/WITF)

Hundreds of township supervisors are in Hershey this week for their annual meeting.

Day two opened with remarks from Gov. Tom Wolf. Before the governor began, association staffers said they hoped he’d talk about pensions, ideally calming their fears about being worse off from any major changes enacted at the state level.

But Wolf did not mention pensions.

Asked about it after his speech, Wolf said he intends to weigh in at some point. He just doesn’t know when, exactly, he’ll be ready to fully detail his proposal.

“I want to come up [with] a proposal that I think is actually helpful. Not ideological. Practical. And do it in a way that actually translates into a reduction of expenses in cities, which translates into lower taxes for people who are living in cities,” Wolf said.

Notice he’s saying “cities.” That is significant: The Commonwealth’s collective municipal pension shortfall is concentrated in its urban population centers. Wolf didn’t get into specifics beyond that, aside from a seeming rejection of possibly throwing cash at the problem with straight-up bailouts, or giving more state aid to the least solvent pension funds.

“I guess anything’s possible, but I can’t see how you’d want to relieve certain municipalities for things they’ve done in the past at the expense of other Pennsylvanians who have not,” Wolf said.

That last part is the fear in places where pension funds are healthy, according to Elam Herr, assistant executive director of the Pennsylvania State Association of Township Supervisors.

“What their concern is, is that the state will say, we’re all in one system, put all the money in. So those who have excess money will bail out those who are underfunded,” Herr said.

Nothing’s been formally advanced in the legislature that would force or encourage the consolidation of municipal pension funds.

But two separate measures soon will be, according to Rick Schuettler, Herr’s counterpart at the Pennsylvania League of Municipalities. Schuettler says his organization is not in favor of consolidation.

Herr’s not either, but he sees the point:

“Pennsylvania has too many pension systems,” Herr says. National experts would argue that’s an understatement.

The Commonwealth leads the country with more than 2,200 defined benefit retirement plans for local governments. Minnesota’s next next with more than 700 (mainly for firefighters), followed by Illinois with more than 600.

Stephen Eide is a research fellow at conservative-leaning think tank The Manhattan Institute. Eide says that with so many municipal pension funds, taxpayers often lose money covering separate management fees, and he says combining resources would mean more investment options.

Eide notes the political difficulty entailed in a mass merger, though.

“The question that’s been raised is: should we consolidate pension systems? And the tension in that question is between effective government and also self-government,” he says.

He says it might make more sense to add restrictions, or increase regulation—even though that also means less local autonomy.

It remains to be seen how far the consolidation proposals will go in the legislature.

House Speaker Mike Turzai addressed the crowd after Wolf, and did address municipal pensions. Specifically, he touched on the consequences for the distressed funds, which township leaders prefer to think of as a city issue. Turzai, R-Allegheny, also wants to empower more municipalities to offer defined contribution plans, which don’t promise to pay out set amounts during retirement.

“I do think distressed funds, in the end, need to be required to go to defined contribution plan for new hires,” Turzai says. That’s also not included in bills introduced, but Turzai says there are more plans in the works.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.