One Philly teacher saw $185K in student loan debt forgiven. But hundreds more are still struggling

Black educators in Philadelphia are among those most impacted by student loan debt.

Listen 2:13

Michelle Gibbs is a 5th grade reading and writing teacher at Elwood Elementary in Philadelphia. (Kimberly Paynter/WHYY)

From Philly and the Pa. suburbs to South Jersey and Delaware, what would you like WHYY News to cover? Let us know!

Michelle Gibbs has dedicated the last 17 years of her life to educating the youth in the School District of Philadelphia. But little did she know her devotion and sacrifice for her career as a teacher would be made even more difficult by a financial nightmare, “It has to be one of the most mentally unhealthiest positions to be in, to worry about where is your next paycheck going to go and knowing it’s going to go to your student loans,” Gibbs said.

Gibbs is not alone, as college costs have continued to soar over the past two decades having a negative impact on millions of college graduates like her.

According to EducationData.Org data from 1963 to 2020, the cost of tuition has increased by 2.5% per year after adjusting for inflation.

The average cost of attendance for a student at a public 4-year in-state institution averages $104,108 over 4 years with student borrowers paying an average of $2,186 in interest each year. The average student borrower spends roughly 20 years paying off their loans.

The report reveals the cost of fees and interest make the ultimate price of a bachelor’s degree to be as high as $509,434.

For many teachers in Philadelphia, the cost of higher education has made it hard for them to balance repayment of student loan debt while enjoying life.

“I had a car note, I had a mortgage, I had parents, I was doing a lot and I was single,” said Gibbs, who graduated with $80,000 in student loan debt after earning her bachelor’s degree in 2005.

Gibbs said her teacher’s salary wasn’t enough to make the monthly payments and found herself constantly struggling over the years.

When Gibbs re-enrolled in two graduate programs to earn her master’s degrees she hoped to help raise her salary and temporarily pause her repayments, but she unknowingly caused damage she didn’t expect.

“When I say it out of my mouth, I hear how crazy it sounds, but I was desperate; the only thing I could think to do was to get them to hold off on charging me payments by going back to school,” Gibbs said.

By 2023, after returning to school to pursue her graduate degrees, Gibbs owed $185,000 in student loan debt.

Gibbs joins a long list of educators across the city who have found themselves trying to balance their passion for teaching and the financial woes that come from low salaries and high student loan demands.

“A lot of people enter these student loans without any kind of knowledge about how they work. Nobody really prepares you for what that means, all you know is that you’re getting money,” said Gibbs.

And the data shows that Black teachers are being impacted by student loan debt the most.

Earlier this school year, Elevate 215, a nonprofit organization that serves as the organizational convener of the Philadelphia Citywide Talent Coalition, surveyed 734 public school teachers from both the district and charter schools to find out how to help create a more diverse and effective teaching workforce.

“When we talk about advocating for ways to make Philadelphia more attractive for teachers, let’s get some feedback on what attracts them to the city,” said David Saenz, Director of Communications for Elevate 215.

The survey revealed that 89% of all teachers had or currently have student loan debt.

Of that 89%, the survey also revealed that more than a quarter of all respondents (28%) currently had more than $50,000 in student loan debt.

But teachers of color had more debt than their white counterparts, “for newer teachers, especially teachers of color, the highest racial group impacted by student loan debt were Black teachers and all Black, Indigenous, and People of Color (BIPOC) teachers were more likely to have over $50,000 in student loan debt compared to White teachers,” said Saenz.

Results from the survey revealed 46% of Black teachers, 37% of all BIPOC teachers and 23% of White teachers currently have more than $50,000 in debt.

“For somebody new into the field and trying to sustain quality of life while paying back the work they put in to get into the (teaching) profession … it is a barrier for them to continue in (education); what we are trying to make sure is that we do create pipelines to have a more diverse teacher workforce (and) how do we ensure these barriers are alleviated,” said Saenz.

The survey asked teachers to prioritize the financial incentives they think would motivate them to remain teaching in Philadelphia. Saez said higher pay was the top motivating factor across the board. However, when looking at responses by respondent demographics and years of experience, student loan forgiveness incentives were more likely to be the top motivating factor among teachers of color and newer teachers.

BIPOC teachers ranked student loan forgiveness as the second motivating factor, compared to all teachers and white teachers who ranked it fourth.

Saenz said the survey helps provide a blueprint for how to address the teacher shortages and retention issues, “The teacher survey data indicates a student loan forgiveness program would not only be a powerful retention tool for current teachers but it can also be utilized as a recruitment incentive to attract future candidates to teaching.”

For Gibbs, the ideology behind teachers who leave the profession due to student loan debt is no surprise, “I have at least two (teachers) that I can think of that left because there wasn’t enough money. The sad reality… they’re leaving from the district to get a little more money because (they think) at least I might be able to pay my loans off, I have a better shot of paying my loans off and living the American dream,” said Gibbs.

The Biden administration has made it their top priority to erase student loan debt and educate longtime borrowers about the existing and updated four student loan repayment programs.

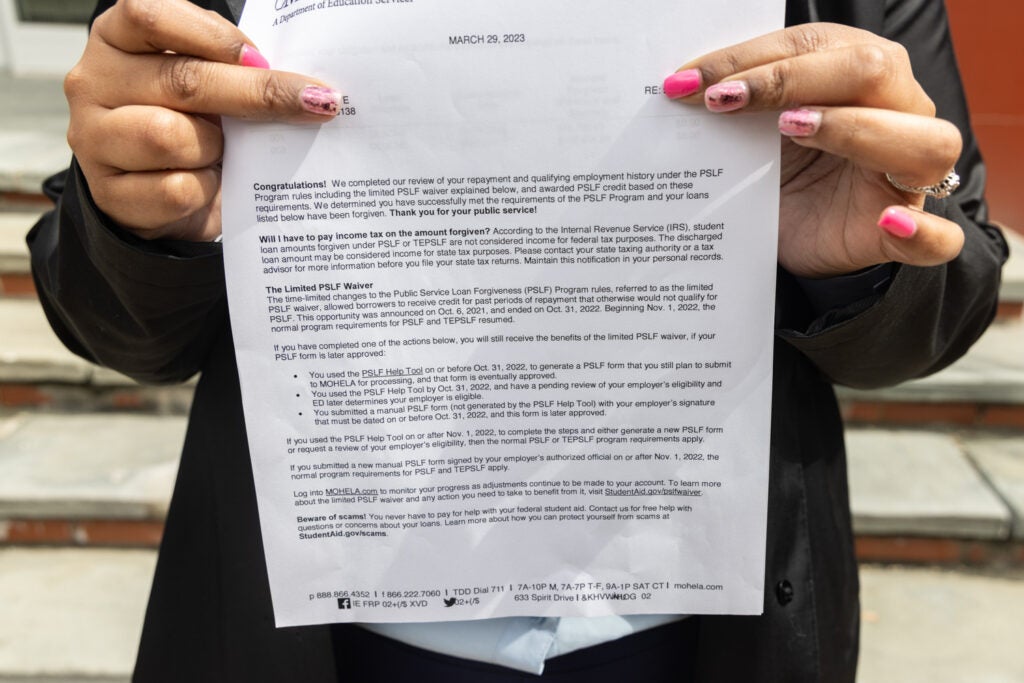

For Gibbs it was almost too little too late, after nearly two decades of feeling her life was on student loan hold, finally she received some good news. In March of 2023 she was one of more than 38,000 Pennsylvania teachers, firefighters, nurses and government workers who had their student loans forgiven under President Joe Biden’s Public Service Loan Forgiveness program.

President Biden sent her a letter that left her speechless and emotional, “I opened my email and it is a letter saying your loans have been forgiven. I fell to the floor and started hysterically crying. I got emotional. I’m sorry, up until this point I remember thinking I’m never going to pay this back,” said Gibbs.

Gibbs satisfied her 120 payments and had her remaining $185,000 in student loans forgiven under the PSLF plan. She was told by her loan servicer that despite her payments over the last 19 years, she would’ve still owed $365,000 due to interest if the loan had not been forgiven.

“We lose sleep thinking about our students, we lose sleep thinking about what we need to teach students. We are working from sun up to sun down and a lot of teachers work off the clock and for free there is no salary boost for coming in early and staying late,” said Gibbs as she hopes more teachers will get the help they need and the relief to continue to thrive as teachers in our city.

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.