Soda tax killing small Philly businesses, Butkovitz contends

City Controller Alan Butkovitz says the city's soda tax is hammering small businesses, and he says he has new numbers that prove it.

Listen 0:00

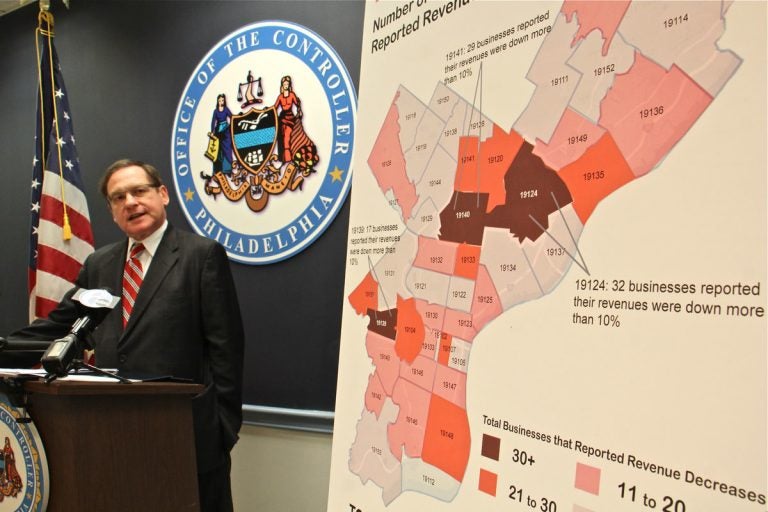

City Controller Alan Butkovitz outlines the impact of Philadelphia's beverage tax on businesses, 88 percent of which reported some level of revenue loss. Losses appeared to be concentrated in some of the city's poorest neighborhoods. (Emma Lee/WHYY)

Philadelphia’s soda tax wars have new ammo.

A survey conducted by City Controller Alan Butkovitz — a longtime tax opponent — found nine in 10 businesses have self-reported revenue loss since the city’s sweetened beverage tax took effect earlier this year. Of those reporting revenue loss, six in 10 blame the tax for their woes.

Butkovitz’s team, with help from various business groups, reached out to “more than 1,600” businesses that sell or sold taxed beverages. Response was purely voluntary, and 741 businesses filled out questionnaires.

Butkovitz said his team tried to fan out across the city and hit every neighborhood. Asked whether those who responded were statistically representative of Philadelphia’s broader business community — rather than simply a self-selecting group of the most aggrieved — he said “a survey of 741 participants provides you a statistically accurate profile.”

Even if the survey wouldn’t pass muster in an academic journal, Butkovitz said he believes it should serve as a bright-red warning sign.

“This is not going to be the comprehensive answer to everything, but I think it does create a serious warning and an attestation of what has been stated by a number of the businesses,” he said during a Monday news conference. “Because I think the administration has minimized and ridiculed the idea that businesses are fighting for survival.”

To that point, 40 percent of responding businesses said “they would have to make significant changes to keep the doors open.”

“The kind of businesses we’re talking about often survive on a 2 percent profit margin,” Butkovitz said. “That’s a big problem.”

And it’s a problem, Butkovitz believes, because grocery and corner stores will flee the poorest communities — leaving behind “food deserts” in their wake.

“It’s not just a question of the popularity of the tax,” he said. “What’s important to us is its impact on providing essential nutrition to people.”

Objectivity questioned

As with just about anything surrounding the 1.5-cent-per-ounce tax, Butkovitz’s survey bubbles over with political implications. The city controller, who recently lost his bid for re-election, has been a relentless opponent of the beverage tax.

When confronted with the survey results, Lauren Hitt, communications director for the city of Philadelphia, questioned Butkovitz’s motivations and methodology.

“The controller has been very upfront about the fact that he intends to use the beverage industry and the soda tax and the opposition to it to advance his own political career,” she said. “We just don’t think it’s an objective analysis.”

She also pointed to the economic benefits of the tax, which weren’t detailed in the controller’s study. With money from the levy, Philadelphia has created 2,000 new pre-K seats. That expansion resulted in an additional 191 teaching positions, according to the city. City officials also believe the broader availability of pre-K has freed parents to get jobs or increase their working hours.

“We know that’s allowed a lot of our parents to go back to work and become more productive employees,” Hitt said.

The administration would welcome an impartial study of the tax’s impact, Hitt said. She noted that researchers from the University of Pennsylvania and Harvard are conducting just such an analysis. That study uses beverage sales in nearby Baltimore as a control, Hitt said.

From January to August, the city collected just over $46 million through the tax. Though revenues have been steady month to month, they’ve come in lower than the city projected.

Of that $46 million, about 40 percent has gone to pre-K and the city’s community schools initiative. Just over 30 percent has been put in reserve.

The city has slowed expansion of the pre-K and community schools projects as it awaits the outcome of a lawsuit challenging the tax. In two lower courts, the city has prevailed over challengers representing the beverage industry and other tax opponents. Both parties are now waiting on the State Supreme Court for a final decision.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.