On ‘Radio Times’: Clinton-era cut in the tax code contributes to Puerto Rico’s financial problems

How did Puerto Rico end up with more than $70 billion dollars of debt?

Listen 0:00

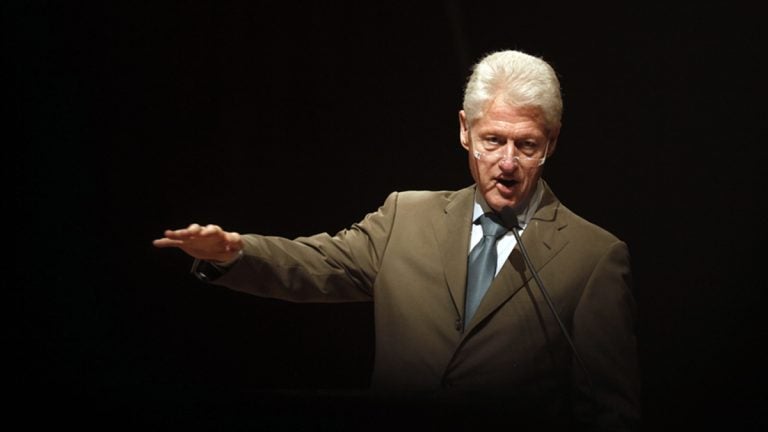

Former U.S. President Bill Clinton speaks during a forum on renewable energy in San Juan, Puerto Rico, Tuesday, July 16, 2013. (Ricardo Arduengo/AP Photo)

How did Puerto Rico end up with more than $70 billion dollars of debt? The answer is complicated and some of it is rooted in the island’s relationship to the mainland and its history with the federal government.

Amilcar Antonio Barreto, who has family in Puerto Rico and teaches at Northeastern University, says the elimination of Section 935 in the US tax code is a partial explanation.

Never heard of it?

“Section 935 of the U.S. tax code, which is now gone, gave U.S. corporations tax breaks for opening up plants in Puerto Rico,” Barreto explained on Thursday’s edition of Radio Times with Marty Moss-Coane. “This worked for decades, until 1996 when President Clinton along with Newt Gingrich negotiated it away.

“It was phased out over ten years and by 2006 the last of the 935 benefits were gone. That’s when factories began pulling out and Puerto Rico began its economic decline.”

Listen to the clip above.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.