Philadelphia renters highly involved in their neighborhoods, planning survey finds

Many Philadelphia renters are highly committed to their neighborhoods, concludes a new city planning commission survey. Outside Center City, “many” becomes the majority.

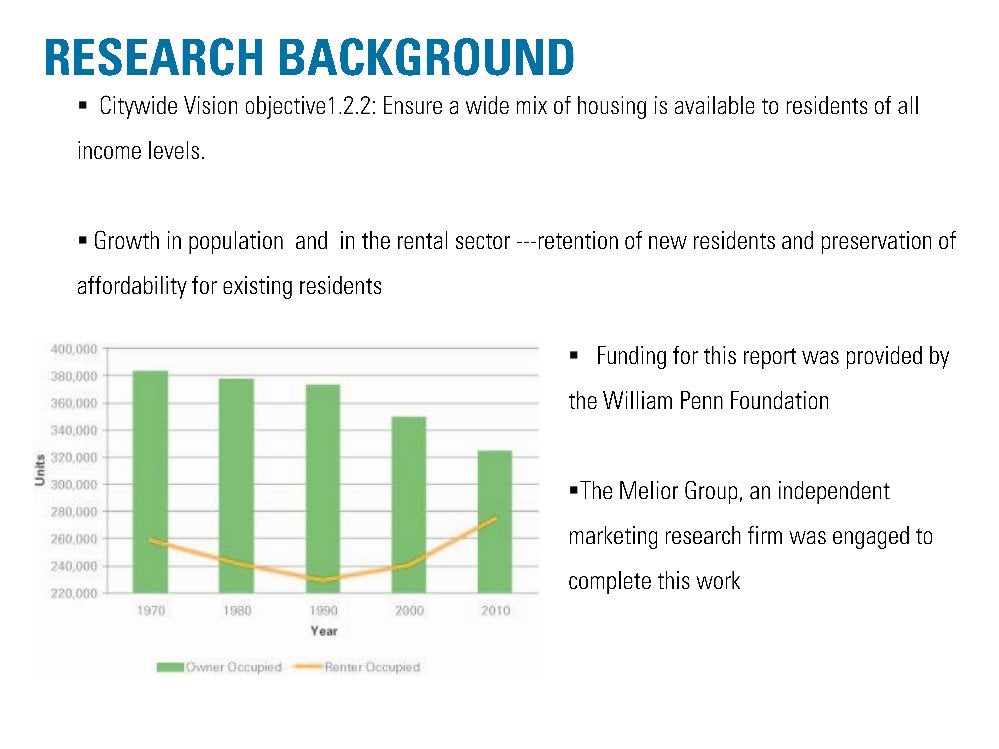

This and the other facts found in the $20,000 renters and landlords survey come on the heels of a Pew study showing a decline in home ownership and increase in renters in Philadelphia. “This is a really valuable report,” said Deputy Mayor for Economic Development and Philadelphia City Planning Commission Chairman Alan Greenberger.

Historically, the perception has been that homeowners are more committed, less transient, and better for neighborhoods than renters. Especially outside of Center City, “when we talk about development projects, at least before the recession, community groups often act negatively to rentals,” he noted.

Home ownership rates remain high in Philadelphia, Greenberger said. But getting more renters into the mix can be an indicator that a city is dynamic, vibrant, and attracting new people.

“People are coming from outside to see what’s going on here,” he said. Around the world, the most desirable cities, including New York, London and Tokyo, all have high rental rates, he added. “Renters are a marker, and not a bad thing for Philadelphia, as we become a more outwardly known city.”

Funded by the William Penn Foundation and executed for the planning commission by The Melior Group, a market research firm, the survey gauged commitment to neighborhood by whether renters know their neighbors, participate in social activities such as block parties, and help maintain the neighborhood through clean-ups and street cleaning, said city planner Octavia Howell, the PCPC lead staffer on the project. The survey results will help guide the planning commission through neighborhood and district plans, she said.

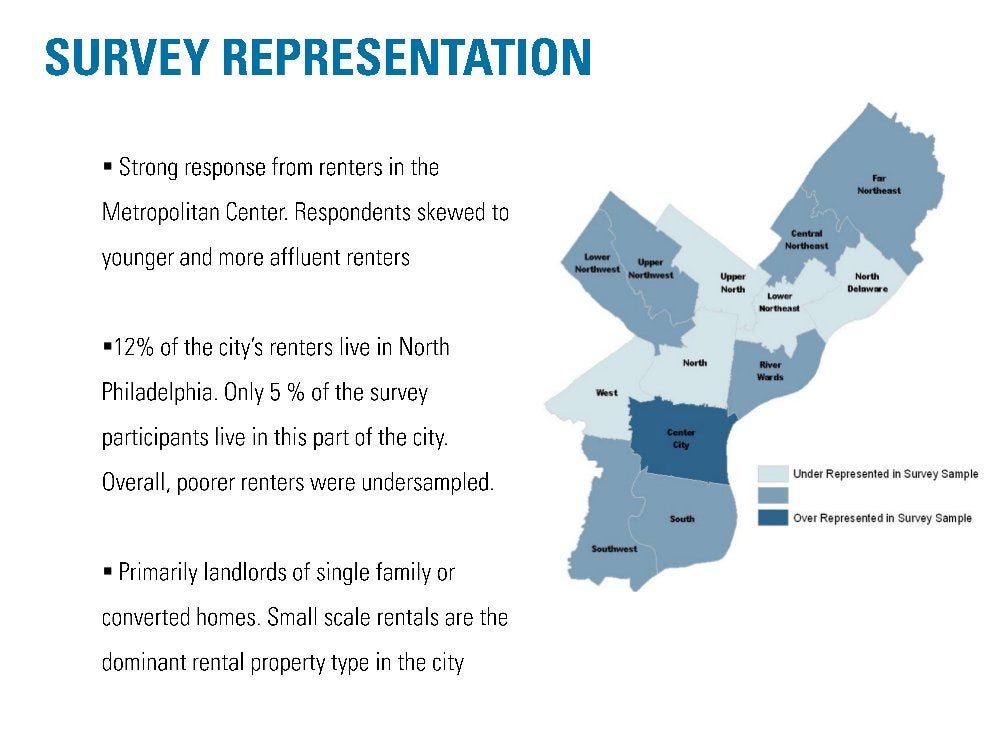

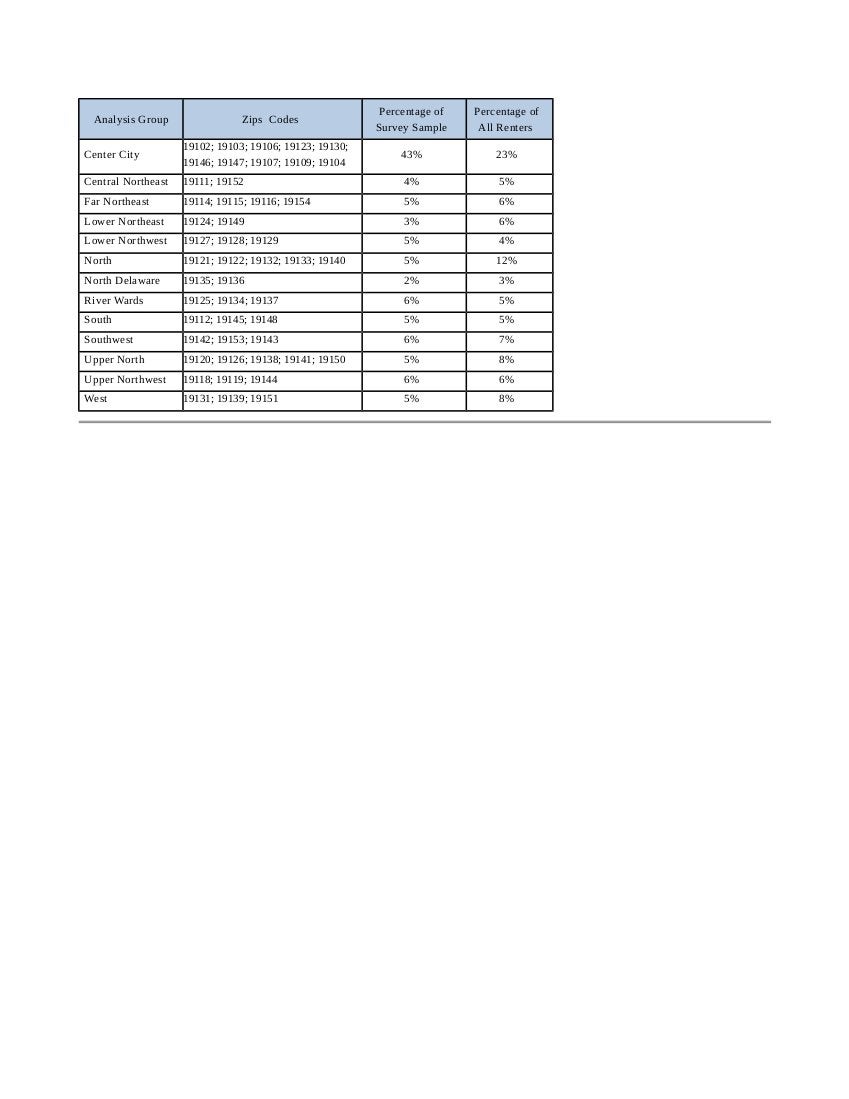

The goal was to poll 1,000 renters, and the survey reached 1,500, Howell said. The responses were skewed toward University City and Center City, though – that’s where 43 percent came from, while only 22 percent of renters live there, Howell said. In contrast, while 12 percent of the city’s renters live in north and west Philadelphia neighborhoods, just 5 percent of survey respondents do. “Those are important areas not to be heard from, since there is more poverty and different things going on there,” Howell said.

To try to adjust, responses were separated into two groups for analysis: One from Center City neighborhoods and one from all others.

The highest commitment scores came from renters outside Center City, Howell told planning commissioners at their recent August meeting. In Center City, 43 percent of surveyed renters said they knew their neighbors and 29 percent were involved in neighborhood maintenance or upkeep activities, Howell said. Outside the city center, 56 percent knew their neighbors and 51 percent were involved with efforts to keep the community looking good. (See the slides below to learn which neighborhoods are considered part of Center City for this study.)

Howell said that she and some other city planners had a hunch that renters are more active in their communities than they generally get credit for, but even so, “the percentages were surprising.”

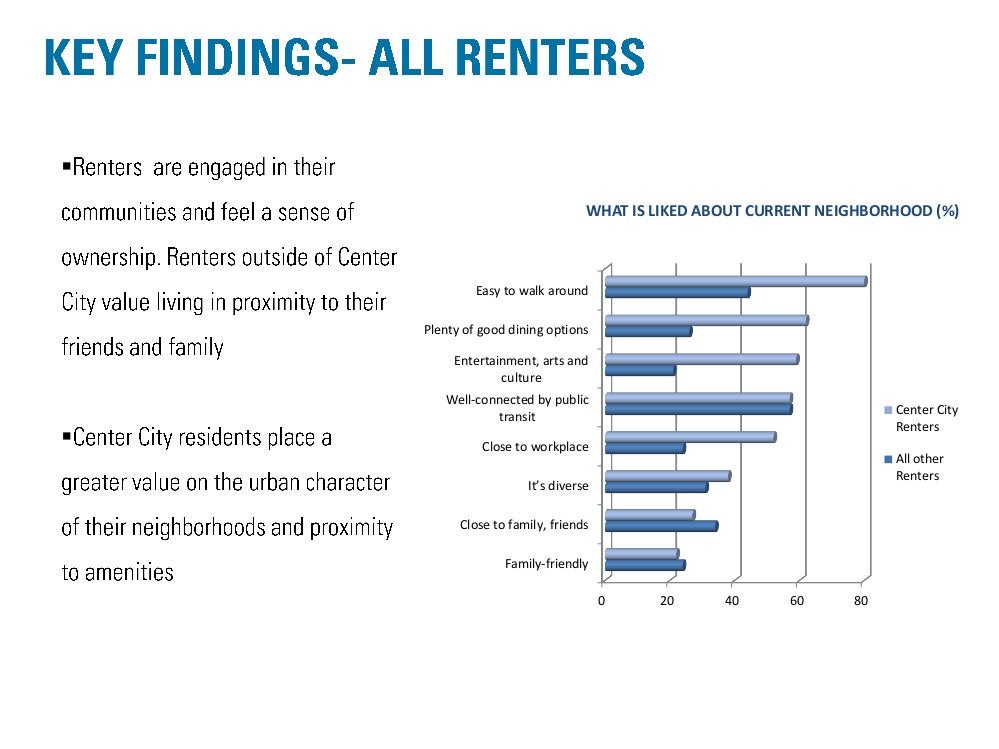

More Center City residents chose to live in their neighborhoods for their “urban character” and “proximity to amenities.” Center City residents really love their neighborhoods’ walkability and assortment of restaurants and entertainment options, for example.

A higher percentage of renters who live outside the city core chose their neighborhoods to be close to friends or family, she said.

Here’s what everybody loves: Transit access. More than half of all renters in both Center City and outside those neighborhoods said access to transportation was one of the things they found desirable about their neighborhood.

Another key survey goal was assessing whether people rent because they want to, or have to, and how hard it is for city renters to afford their apartments.

Center City renters are younger, wealthier and more likely to be white than those from other parts of the city, Howell said. Their rents are higher, but they can more easily afford them. What they can’t afford: Purchasing a home in their neighborhood. Seventy-five percent said they would have to move to another neighborhood or settle for poorer quality housing in order to buy.

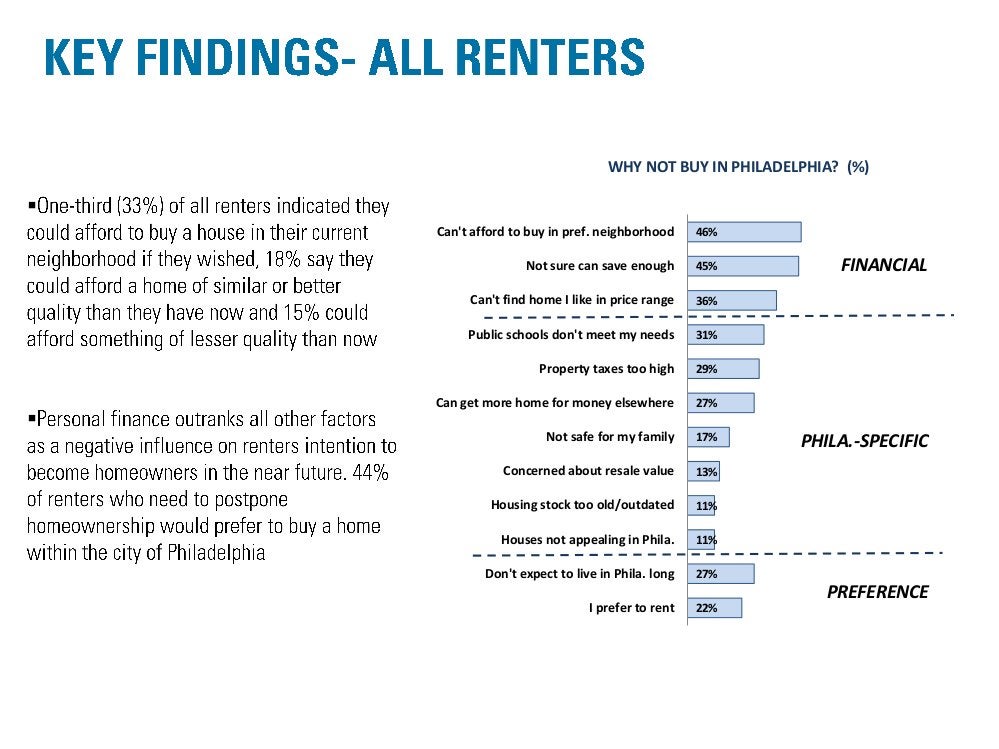

While the recent recession and housing bubble have changed societal attitudes about renting vs. owning, at least somewhat, personal finance still outranks other factors that keep renters from buying a home, Howell said.

About a third of all renters said they could afford to buy a home in their current neighborhood if they wanted to, but 15 percent said it couldn’t be as nice as their current apartment.

Other factors that respondents said kept them from buying included some Philadelphia-specific criticisms: School quality (31 percent), taxes (29 percent), the feeling they could get more house for less money outside the city (27 percent).

Twenty-seven percent of responding renters said they wouldn’t be in Philadelphia long enough to buy, and 22 percent said they just prefer to rent.

Commissioner Nilda Ruiz, who is President and Chief Executive Officer of Asociación Puertorriqueños en Marcha, Inc., said in the North Philadelphia neighborhoods she’s worked in, many people simply don’t have enough money to buy. But a good number could own homes if they wished, with some guidance. Her organization offers pre-purchase classes, and none of the 500 people who have gone through the program have been foreclosed on. “Sometimes it’s not that they have bad credit, they have no credit,” she said.

The city survey also sought feedback from those on the supply side of the rental market: Landlords. The survey team sent surveys to 250 of them whose contact information they got from L&I records. Results came from 21 landlords and property managers, mostly from single-family and converted rental homes as opposed to large rental family units, Howell said, noting that in Philadelphia, much of the rental housing stock is of the single-family and converted home type.

The great majority of them are landlords by choice, Howells aid. “Only a small fraction of renters own homes elsewhere and decided to rent because they couldn’t sell” their previous home, she said.

Landlords reported that profitable renting is becoming more difficult in some parts of the city, that it is difficult to provide the demanded improvements while offering competitive rents, Howell said. Generally, the property owners are happy when neighborhood rents are going up, “when what is perceived as gentrification is happening,” she said.

Not many prioritize renting to people with low incomes, and even those who do target “the highest income of the low income groups.” All but one landlord expressed “a real avoidance of Section 8” tenants, citing the difficulty of evicting problem tenants who are also Section 8 recipients. “That was one of the major things they wanted help with (from the city) – evictions when a tenant is not a good tenant,” Howell said.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.