Penn State, insurer scuffle over paying Sandusky victims

Listen

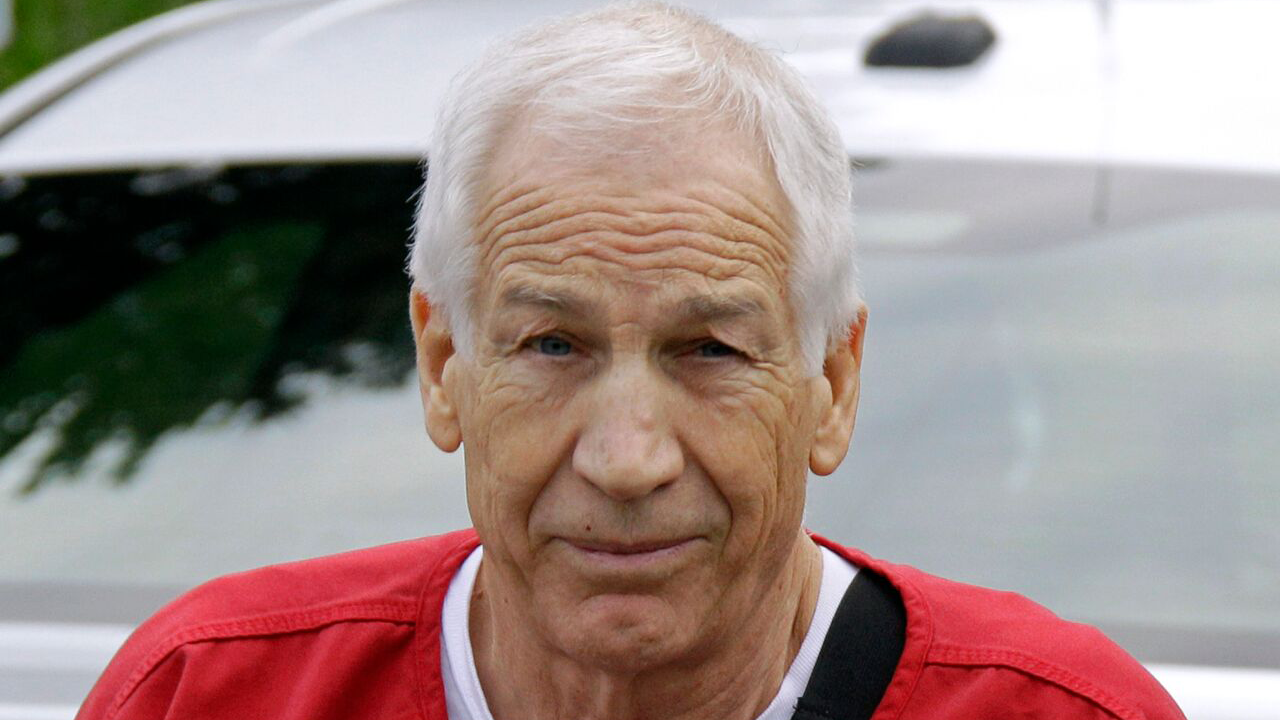

Penn State University is continuing to pay millions to victims in the Jerry Sandusky child sexual abuse scandal, with the total payout now approaching $100 million. The school and its insurer are suing each other over who is ultimately responsible for those payments.(AP file photo)

Penn State University is continuing to pay millions to victims in the Jerry Sandusky child sexual abuse scandal, with the total payout now approaching $100 million.

But who is footing the bill for the high-price settlements? Not the university’s longtime insurance provider. In fact, the university and its insurance company are suing each other in state court over the question of who should be responsible for the former assistant football coach’s decades of child molestation.

As of this summer, Penn State had paid $92.8 million to settle 32 claims, according to a recently published financial audit, and university officials may have to settle more in the future.

The legal battle in Philadelphia Court of Common Pleas over who should pay has a trial date scheduled for March. In the meantime, university officials say the millions already distributed came from an emergency fund generated from interest on loans the school issued to itself.

“These costs are not funded by student tuition, taxpayer funds, or donations,” said Penn State spokesman L. Reidar Jensen, noting that the university bears the risk of paying for the settlements out of its emergency fund.

School officials are optimistic that a jury will award Penn State some of what it spent from its reserves after a trial.

The whole tussle began when the school’s insurance provider, Pennsylvania Manufacturers Association Insurance Company, refused to continuously represent Penn State when the first civil lawsuit was filed in November 2011 by one of Sandusky’s victims.

Penn State called that a breach of contract. The insurance company pointed to a “abuse and molestation” policy exclusion, saying that absolved it of responsibility.

It’s unclear how much Penn State has paid to defend itself in court over Sandusky charges, but school officials say that, without long-term insurance-supported legal help, the university is in an “untenable” position.

A question of occurrence

In court filings, Penn State trots out the liability insurance policy that began in 1992 and highlights how coverage is supposed to begin when “bodily injury” is caused by an “occurrence” in the “coverage area,” terms sure to be scrutinized at trial.

“The terms tend to be fairly general,” said Temple law professor Mark Rahdert, who studies insurance disputes. “Because you can’t anticipate exactly, precisely, how liability will occur, but you can anticipate a general category of how liability will occur.”

But the assaults committed by Sandusky were Penn State’s fault, since it happened under the “care, custody or control of PSU,” according to the insurance company’s filings.

In 2012, a jury convicted Sandusky of 45 counts of sexual abuse. He’s now serving a minimum 30-year prison term

If anything, the insurer argues, PSU’s negligence may constitute one “occurrence” each policy year, and the policy’s “occurrence” payout cap is $2 million per incident.

“Both parties would rather meet in the middle,” Rahdert said. “Penn State would much prefer to get $40 million than get stuck with all $90 million to cover. And the insurance would much rather get $40 million, than have to pay all $90 million. And you don’t know how it’s going to come out when it gets to, say, the Pennsylvania Supreme Court.”

Whatever happens on the question of who should pay and how much, it will have major ramifications for this case going forward. For instance, the now-defunct kids’ charity The Second Mile has also been named as a defendant in civil lawsuits filed by victims. Prosecutors said Sandusky targeted many of his victims through training camps and other programs. How much Second Mile’s insurance will have to contribute toward settling cases could be informed by the Penn State court battles.

Attorney Steven Engelmyer, who is representing Penn State’s insurer, wouldn’t comment on the dispute. But in court filings, he’s argued that compensating victims of Sandusky’s sexual abuse is not the insurance company’s problem because the university never told it of information the university had about Sandusky being a potential liability.

“We disagree with PMA’s position,” said Penn State’s Jensen. “Penn State has other insurance, and, as we said, we can cover expenses not paid by insurance from interest that has been and will be earned in the future on internal loans.”

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.