How is the rise of co-working spaces shaping Philly’s real estate market?

One of the big recent commercial real estate storylines has been the steady growth in the number of coworking offices opening in greater Center City.

Though the momentum seems to have slowed a bit with news that two of these spaces have fallen on hard times, a new report by Center City District, Philadelphia’s Independent Economy: Implications for Office Space, lays out the facts about Philly’s growing coworking environment. At the report’s release event last week experts expressed confidence that more, mostly national coworking companies are on the way, like the forthcoming WeWork office in Northern Liberties.

The report sets the table for this discussion by pointing to the recent spate of papers and articles arguing that the future of work will be much different, which requires our collective thinking about office space to evolve.

In this future, independent contracting and project-based employment would continue to reshape the relationship between employers and employees, further enabled by advances in telecommunications technology that make it less important for co-workers to occupy the same physical space all the time, creating a much more atomized workforce.

If this story were to pan out on any significant scale, it could create some significant reverberations across the economy, and one of the more interesting areas to watch would be the commercial real estate market.

The report walks through the logic of why coworking spaces would stand to benefit from this scenario:

“If we are experiencing a paradigm shift, then many existing business structures will have to adapt, including the commercial real estate office market. Most commercial office buildings are owned by institutional investors and real estate investment trusts that need to deliver a return to investors. Leasing is built around stable and growing firms that can make long-term contractual commitments for space. But neither independent workers nor small start-ups are likely to contract for large blocks of traditional office space, nor do many have the financial credit or track record to secure a long-term lease. But, independent proprietor activity can be aggregated by intermediaries.

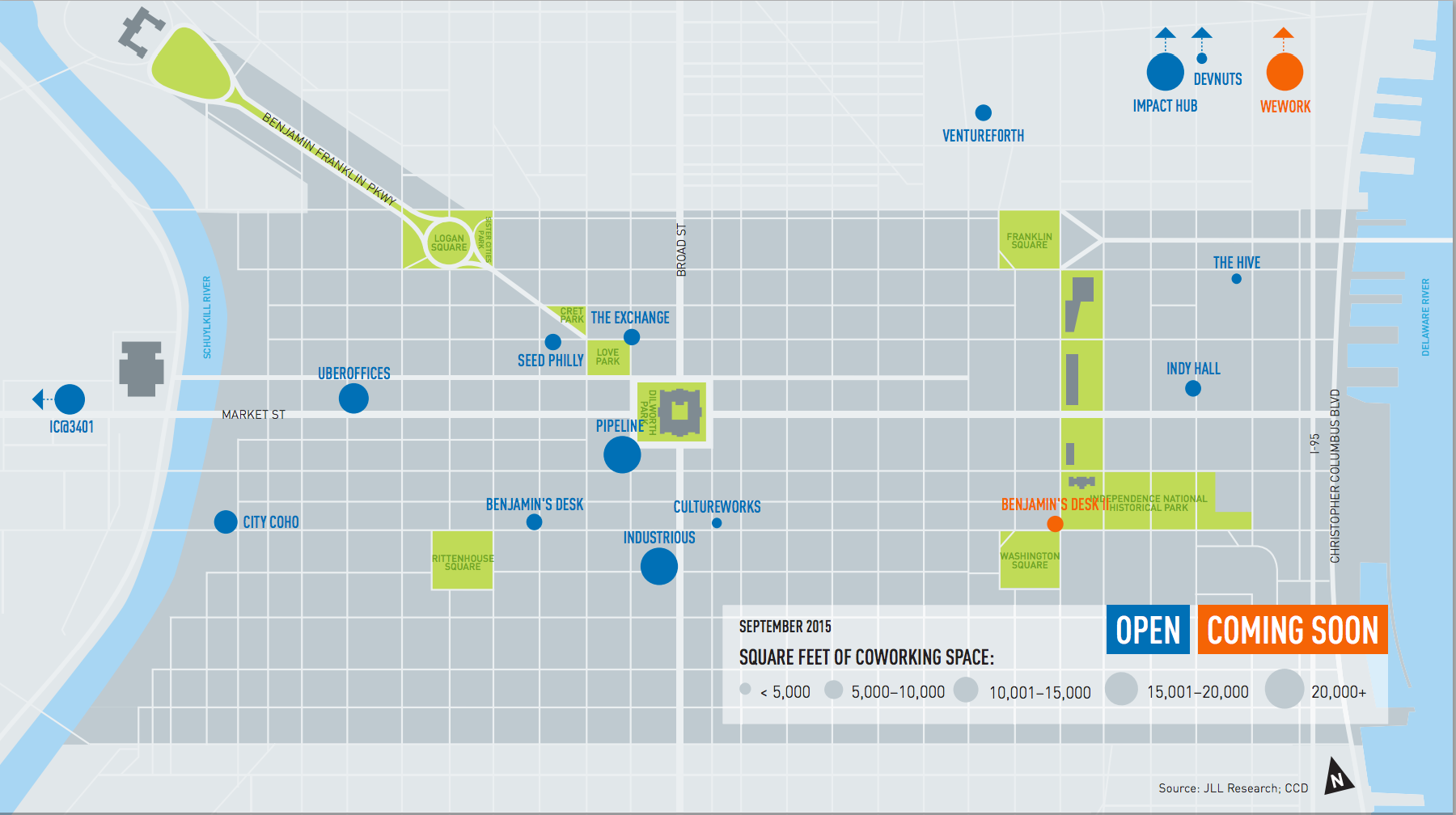

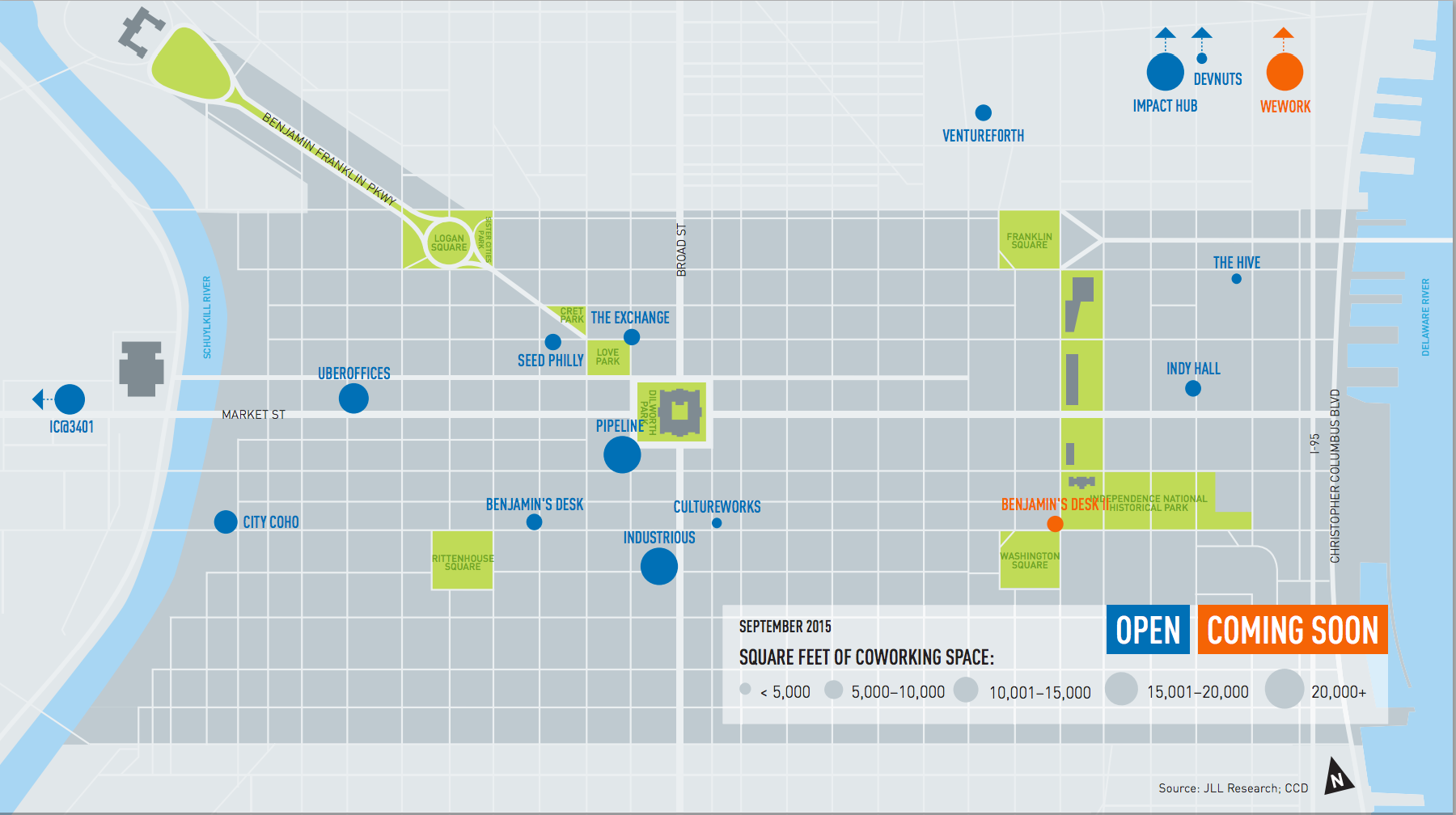

Within the last decade, locally grown coworking spaces have emerged in Philadelphia to meet the space needs of mobile and untethered workers, largely in older buildings, often owned locally, and not usually counted in the inventory of commercial office space. Recently, a series of multi-city national groups have opened spaces in more traditional office buildings, joining local coworking operators in a market that currently occupies approximately 200,000 square feet in 16 different locations throughout Greater Center City and University City. Several major players are about to announce new locations. But at the same time, the recent closure of some coworking establishments suggests that ambitious predictions of workplace transformation might be overstated.”

The report attempts to measure the shape of the coworking market using national and local public data, supplemented by information provided by managers at four major coworking spaces in Center City and an online survey of independent workers conducted over this past summer by CCD and the Central Philadelphia Development Corporation (CPDC).

The report demonstrates that while growth in the coworking sector is real and it’s a trend worth paying attention to, these offices still make up a very small share of the total square footage of commercial real estate in Philly.

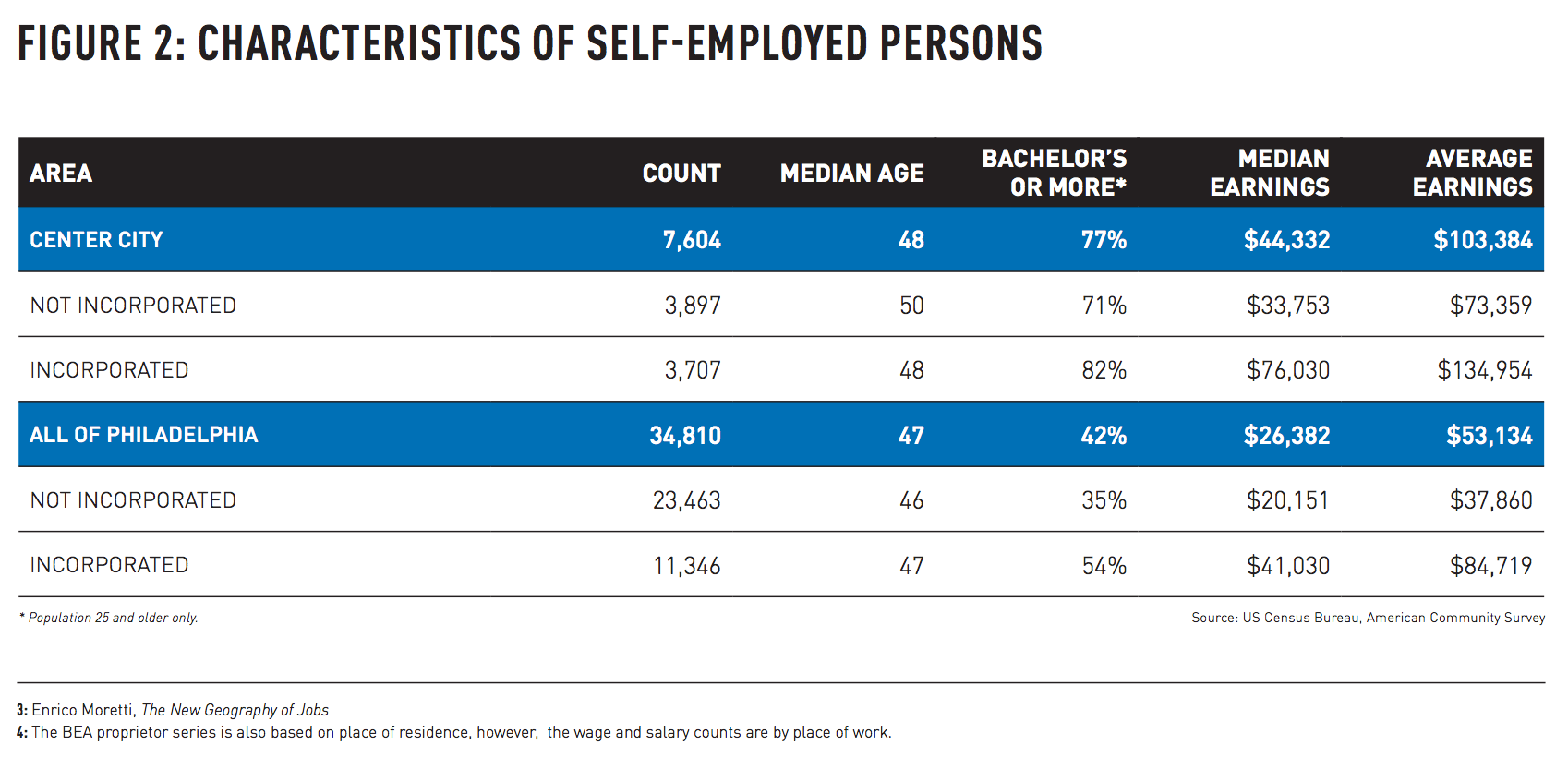

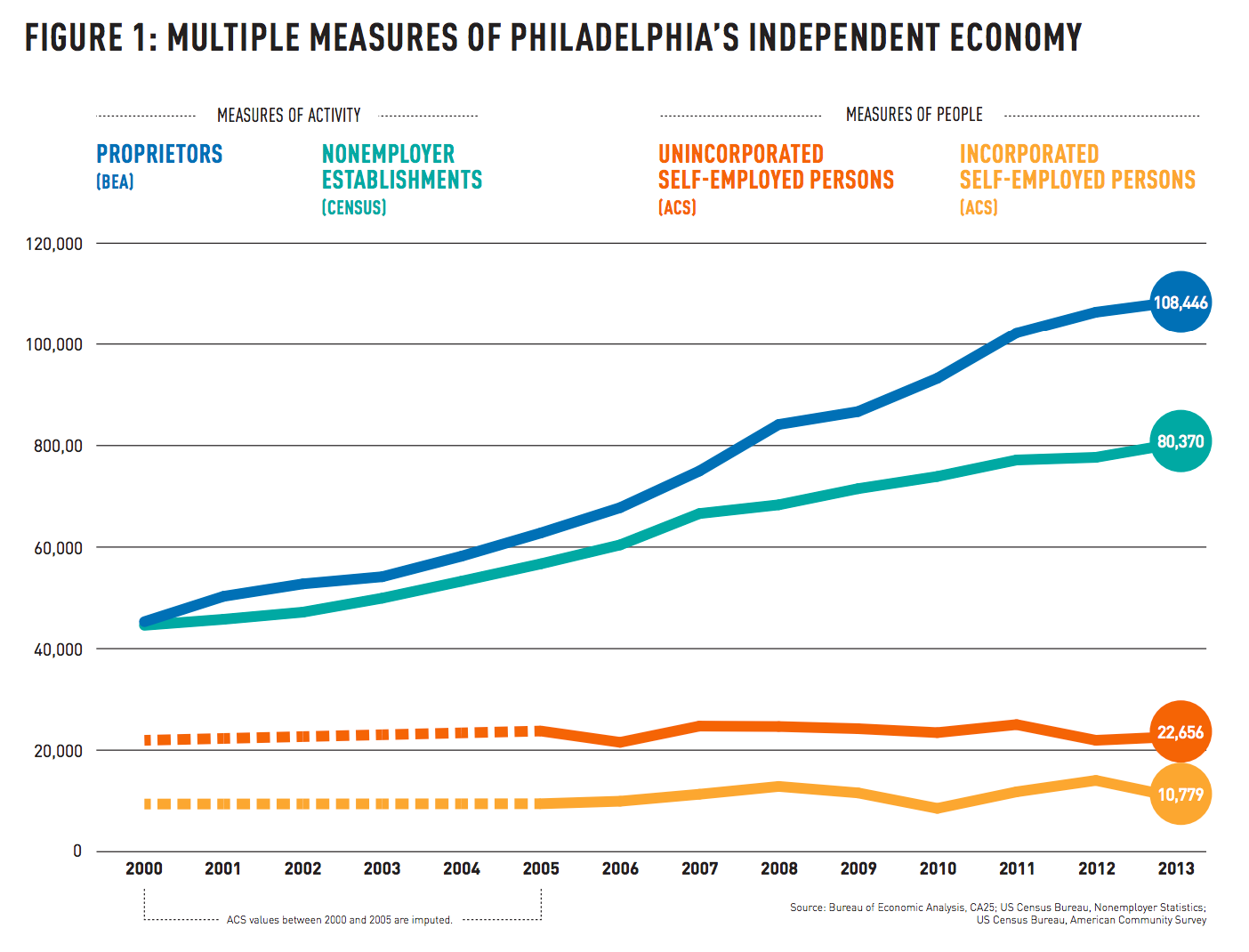

Key to understanding how coworking will influence the commercial real estate market are characteristics of the self-employed workforce. The CCD report’s authors looked at four different ways of measuring the independent workforce, which turns out to be pretty tricky because most of the local indicators measure jobs, not people.

Data from the American Community Survey, which measures people, suggest the percentage of independent workers has remained relatively flat since 2000 at around 30,000-35,000.

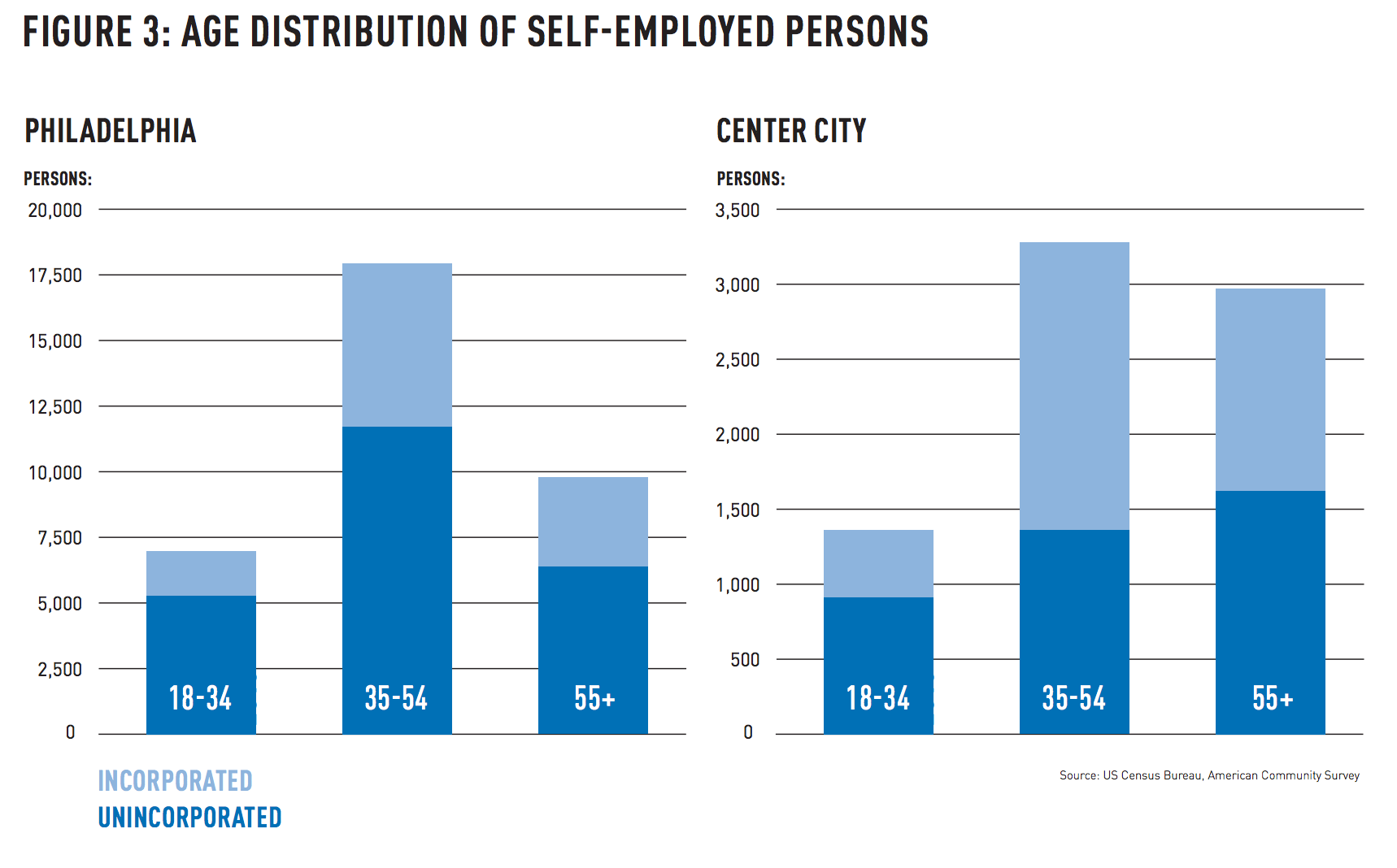

One surprising finding about who Philly freelancers are is the thirty-somethings tapping away on their laptops at Elixir aren’t representative of Philly freelancers at all. The more standard profile is a 46-50-year-old mid-career professional, who CCD suggests may be “ventur[ing] out on their own by building upon networks and relationships they established within the world of ‘traditional’ work.” The freelancer population in Center City actually skews even older than in Philadelphia as a whole. For reference, the median working age for the whole working population in Philadelphia is 33 in Center City and 38 citywide.

The educational profile of self-employed workers in Center City is much different from the self-employed population citywide though, with 48% of the Center City group holding an advanced degree, compared with 22% citywide. The most common educational attainment level for self-employed workers citywide was a high school diploma, coming in at 38%.

The city’s self-employed workforce works across sectors, from high-paid professionals like lawyers to lower-wage professions like daycare providers. And this is where the demographics conversation starts to bleed into the real estate issues, because, as the report’s authors write, “taken together, office-using industries (Financial Activities, Real Estate, and Information and Professional and Business Services) account for nearly half of the self-employed in Center City (approximately 3,600 people) and about one-third citywide (approximately 10,000 people).”

The report notes that the market for co-working is even smaller than this segment of people because “many office-using independent workers are very comfortable in home offices; others may be working as contract employees at work stations within traditional firms.”

If 100% of these workers were to get coworking memberships, the report’s authors estimate that would require around 500,000 square feet of office space–certainly nothing to sniff at, but still destined to be a pretty minor player in the commercial real estate market.

One potential source of growth the report’s authors see is regional, national, and international companies who don’t have branch offices in Philly, but employ a few people here. Those types of workers were actually a majority at one of the four coworking spaces who provided the data for this report.

This trend that could have some interesting implications for the regional geography of job growth and commuting patterns. CCD explicitly touts coworking spaces as a good option “for suburban firms seeking to attract urban residents, or retain downtown dwellers tiring of their reverse commutes.”

They also suggest suburban firms looking to gradually move into Philly, or national firms looking to test the Philly market without committing to leasing a traditional office, would find some utility in the coworking option.

These trends also have some interesting implications for redevelopment of old buildings. The coworking business models rely on redevelopment of Class B and C office space, so this is driving redevelopment of the upper floors of previously neglected older buildings into shared office space. Case in point: the Hale Building at 1326 Chestnut was just purchased by Brickstone Cos. for $5 million, with the intention of turning the upper floors into “creative” office space.

For more, check out the full report.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.