How Actual Value Initiative will affect Northeast Philadelphia

To help balance its budget, the City of Philadelphia is looking to AVI, or, Actual Value Initiative.

The move would base property tax assessments on perceived market values, which means taxes for just about all residents are going to change.

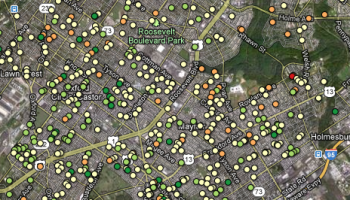

To help determine how AVI will affect neighborhoods around the city, the Philadelphia Public Interest Information Network has compiled data to break down who is expected to pay more and less in property taxes.

City Council reached a deal last night that gives $40 million to the School District of Philadelphia and delays the implementation of AVI for one year. But the Nutter Administration has not yet weighed in on the plan, which is more than $50 million short of what the district had asked for.

Use this map to enter your address and see what your expected property tax will be with AVI.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.