Delaware seeks to change state health care benefits to fill an unfunded $8.4 billion liability

Delaware’s health care benefits have run deficits for years. The state spends about $2 billion on health care annually.

Listen 1:02

The state Capitol in Dover, Delaware. (benkrut/BigStock)

From Philly and the Pa. suburbs to South Jersey and Delaware, what would you like WHYY News to cover? Let us know!

This story was supported by a statehouse coverage grant from the Corporation for Public Broadcasting.

Delaware is considering sweeping changes to the health benefits for current and retired state employees to counter significant unfunded liabilities.

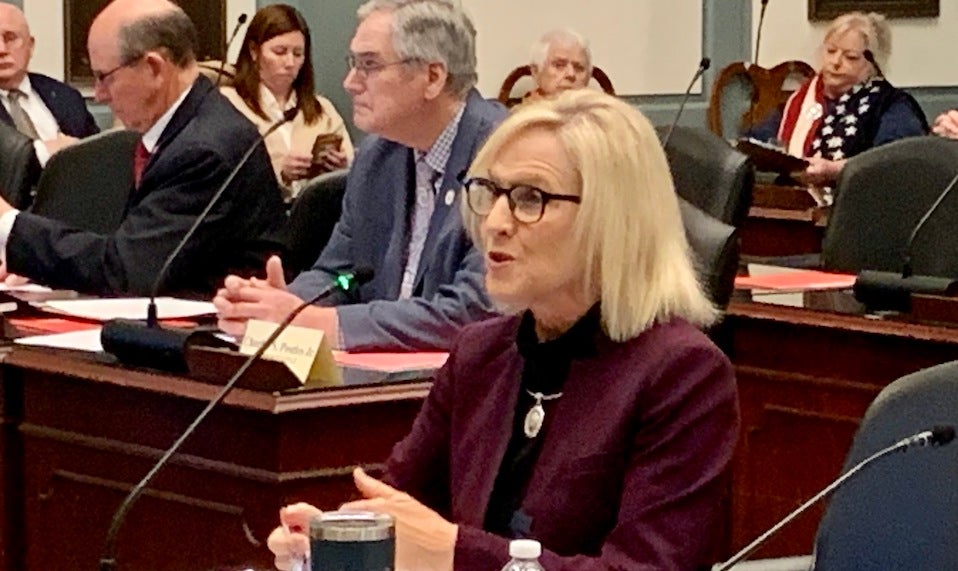

The Retiree Healthcare Benefits Advisory subcommittee, chaired by Lt. Gov. Bethany Hall-Long, presented final recommendations for future hires and including current retirees to the Legislative Joint Health Committee earlier this week. The State Employee Benefits Committee also met to consider options to soften the blow of a 27% premium rate hike for current state employees.

The liability for Other Post-Employment Benefits, which are largely health benefits other than pensions, is $8.9 billion — of which $8.4 billion is unfunded. Officials said the net unfunded liability could grow to as much as $20.7 billion by 2042 if it’s not addressed.

The RHAS subcommittee was created in 2023 after an attempt by the state employee benefits committee to move 25,000 retirees to a Medicare Advantage Plan through Highmark Delaware. Some people who were upset by the planned change formed the advocacy group RiseDelaware and successfully sued the state to block the implementation.

Superior Court Judge Calvin Scott temporarily stayed the state’s decision in October 2022, saying, “This court cannot agree with the sentiment that the need for prior authorization for over 1,000 procedures and the use of only in-network doctors is the same level of benefits retirees obtained with the current policy.”

The subcommittee made several recommendations, including not utilizing a Medicare Advantage plan. It also proposed increasing OPEB pre-funding from 0.36% of payroll to 0.5%, then increasing it by an additional 0.25% of payroll each fiscal year until it reaches 10%. It also urged lawmakers to continue contributing 1% of the general fund from the prior year to the OPEB fund.

It also put forward changes to the length of service and the percentages paid by the state accordingly for Medicare-eligible retirees’ health care premiums hired on or after Jan. 1, 2025.

“I want Delaware to be the place people live, work, raise their families. And we want good state employees … because it’s our roads, it’s our schools. It’s our health system — every facet of daily life,” Hall-Long said. “Business is affected by how efficient our culture of excellence [is] in our status and our culture of excellence is only going to be as good as our employees. We need to make sure that we have the funding in place.”

RiseDelaware Co-founder Elisa Diller and others praised the work and recommendations of the subcommittee.

“One is we can’t stress enough, the need to make sure that there’s the follow through with providing that 1% funding in the future to make sure that we aren’t where we are again,” she said. “I remember back in 2005, reading that report that came out that first flagged the issue of health care costs for Delaware and saying to my husband, ‘You know, by the time we retire, we might need an organization of retirees that are going to fight over this thing for us.’ And so here we are.”

Human Resources Director Claire DeMatteis said without a premium increase for the 2025 fiscal year, lawmakers will have to find $232 million to help cover deficits for the next year.

“The state doesn’t have that money,” she said.

DeMatteis said the state needed to provide context to the 27% rise in healthcare premiums, pointing out how generous the state’s health plans are.

Under the four plans the state offers, a 27% premium increase for an employee only, would see an increase of $9 with the basic plan, $11.54 with the gold plan, $14.94 with the HMO and $33.72 with the PPO plan.

The committee also considered several options for re-aligning rates and the state subsidy. It is also still considering changing its coverage of weight loss medication.

The SEBC is expected to vote on proposed premium changes and the awarding of a contract for a Medicare supplemental plan on March 25, 2024. The Retiree Healthcare Benefits Advisory Subcommittee has recommended taking public comment before the vote on the contract.

Get daily updates from WHYY News!

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.