What Mitt Romney’s tax return tells us about the U.S. tax system

Listen

Hour 1

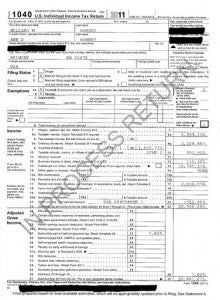

While Mitt Romney’s federal income tax return may have been shocking in terms of the sheer volume of his wealth, everything about it was perfectly legal. He reported income in 2010 of over $21.6 million, nearly all of it from interest, dividends and capital gains, which are taxed at lower rates than what he earned in wages ($528,871 from speaking fees). His effective tax rate was 13.9 percent, which resulted in a tax bill of $3 million. Mitt Romney’s tax return has reignited the contentious debate over the fairness of our tax system, tax loopholes and the way we tax investment income. In this hour of Radio Times, we turn to Temple University Beasley School of Law professor ALICE ABREU to help us understand what the Romney income tax return tells us about the American tax system and how it benefits to the wealthy. Then, Pulitzer-prize winning journalist DAVID CAY JOHNSTON joins us to talk about why he calls our tax system “separate but unequal.”

Listen:

[audio: 012612_100630.mp3]

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.