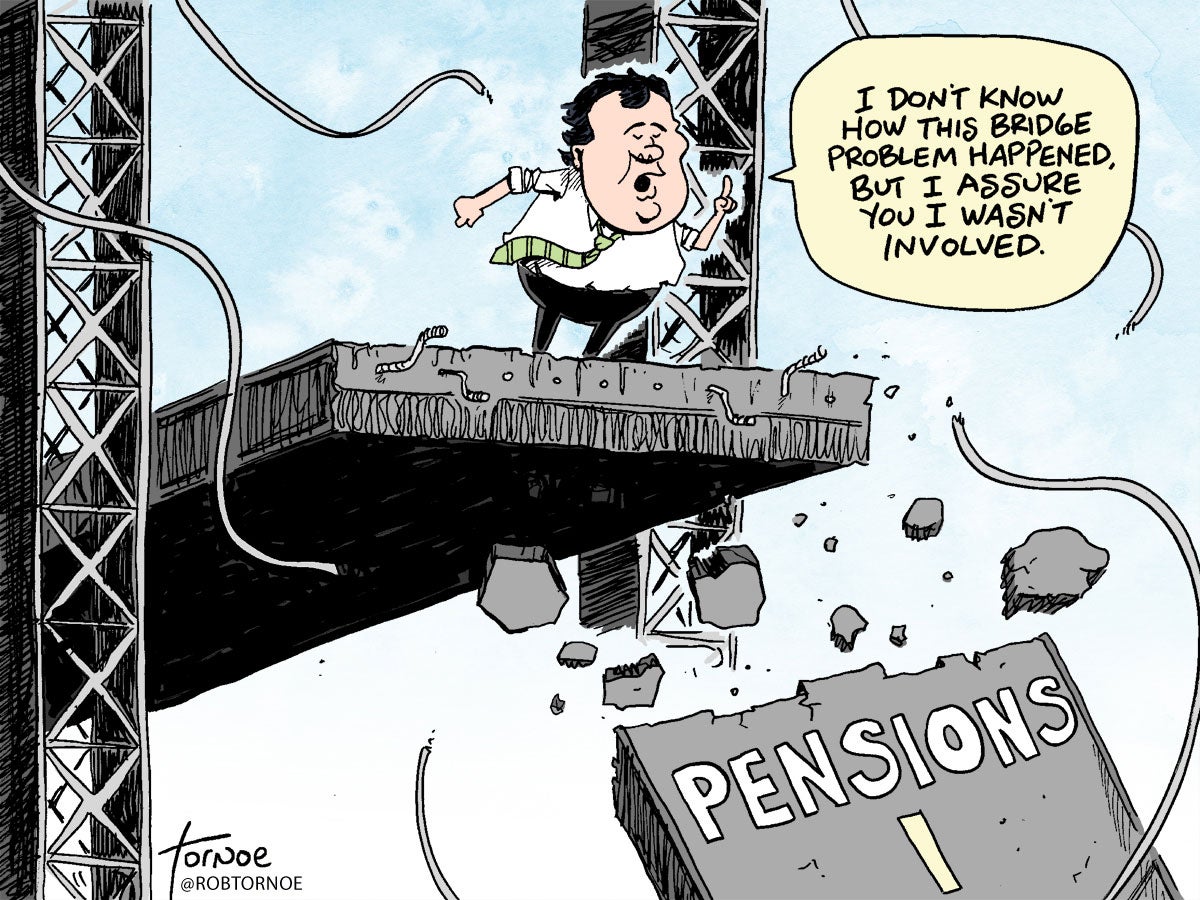

Commentary: Maybe people would care if we called it ‘Pensiongate’

Just in time for Christmas, Chris Christie received the best gift he could hope for – he’s been exonerated from having any role in the “bridgegate” fiasco involving lane closures on the George Washington Bridge.

Well, not exactly. The interim report from the legislative panel investigating “bridge gate” simply revealed that no evidence exists that shows Christie ordered, approved of or knew about the lane closures.

Left unsaid is how “The Governor” could be so out-of-the-loop from the actions of his inner circle he wouldn’t know about what many consider revenge against a political foe. The report also mentions 12 deleted text messages between Christie and a top aide on the day it was revealed the idea the lanes were closed for a traffic study was a total lie, putting Christie’s “I know nothing” claims into doubt.

But never mind all that, Christie didn’t know, so now he can be president. That seems to be the opinion of conservatives across the country, as if this one, singular event was the only blemish on an otherwise spotless political resume.

To them, and anyone else who thinks Christie is now suited to be our commander-in-chief, I have one word: Pensiongate.

Never heard of it? That’s because the ever-growing financial calamity facing residents of New Jersey has never been sexy enough of a problem to have a “gate” attached to it. Unlike a sex scandal (Monicagate), inadvertent photos of genitalia (Weinergate) or inappropriately placed cooling devices (Fangate), the slow boil of the Garden State’s fiduciary obligation to both its workers and taxpayers has never grown to “gate” status.

Despite that, Christie’s handling of New Jersey’s finances and the position it will leave its residents once he starts running for president presents a strong argument why his ascent to the White House might not be in the best interest of the country.

Consider this – new calculations reported on by the Bergen Record show the pension fund most public employees will count on for retirement benefits will go broke in just 10 years. Teachers have 13 years, while judges have less than 10 years before funds are completely gone.

According to a more realistic assessment of the pension system, assets now cover just 32.6 percent of obligations to workers, down from a still-dismal 54.2 percent last year. Most alarming? New Jersey’s unfunded pension liability has risen to $82.7 billion. Yes, that’s billion with a “b.”

Christie’s not the first

I know, I know – Christie didn’t create the problem, he inherited it from terrible governors and horrible legislators in both parties who raided pension funds like kids ransacking a cookie jar. However, Christie ran for governor specifically on fixing New Jersey’s financial woes.

Recall back to 2011, when Christie struck a deal with Democrats that required workers to pay more into the pension system and contribute to their health costs. In return, Christie agreed that the state would send more money into the perennial-underfunded system. It was a deal that helped Christie gain national recognition as a serious Republican.

Unfortunately, earlier this year there was a crash at the intersection of pie-in-the-sky budgeting and economic reality, which Christie decided to remedy by slashing $2.4 billion in pension payments, adding nearly $5 billion in liabilities to the pension fund over the next five years and leading Wall Street to downgrade the state’s debt rating not once, but twice over just the last few months.

Basically, what all this means is not only will taxpayers be on the hook for public retirement benefits once the pension system goes belly-up, the state will have to pay increasing amounts of money to borrow to cover things like construction and highway repair.

And before you say it, I know Christie has made contributions to the pension system in recent years. But so did Corzine, who made the single largest contribution to the pension system back in 2008 and was the first governor in years to cut a deal and scale back benefits.

Don’t forget that in June, lawmakers passed a bill that would have used money raised by tax increases on earnings over $1 million and targeted taxes on corporations to make a full payment into the pension system. Christie vetoed it, not because it didn’t make economic sense (look at California for how targeted tax increases can help rescue the balance sheet), but because you can’t raise taxes while being a Republican.

“There is no fiscal emergency when you yourself are vetoing the funding,” said New Jersey pension trustee Tom Bruno. “He is creating the crisis through his own actions.”

On top of all that, David Sirota over at International Business Times has been relentlessly following the story of how New Jersey has increasingly invested state pension funds in high-risk Wall Street firms under Christie, many with politically favored firms. According to Sirota, the “alternative” investments underperformed by nearly $6 billion, while cronies have cashed on management fees which have tripled since Christie took office, to the tune of nearly $1 billion.

On Wednesday, trustees of the boards overseeing the state’s largest pension fund announced they plan to sue Christie for not making the legally required pension contributions he himself proposed. Maybe a court case is what we need to elevate this crisis to “gate” status. Then maybe, people will start to care about it as much as lanes closing on a bridge.

_________________________________________________

Rob Tornoe is a cartoonist and WHYY contributor. Follow Rob on Twitter @RobTornoe.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.