Putting a number on forgone Pa. property taxes

-

A mixed-media sculpture by Paulette Bensignor (Paulette Bensignor/for Great Bay Gallery)

-

'Arches and Lupine (Escape Series)' — 16'' x 20'' oil on canvas (Paulette Bensignor/for Great Bay Gallery)

-

'The Wave' — oil on canvas, by Paulette Bensignor (Paulette Bensignor/for Great Bay Gallery)

-

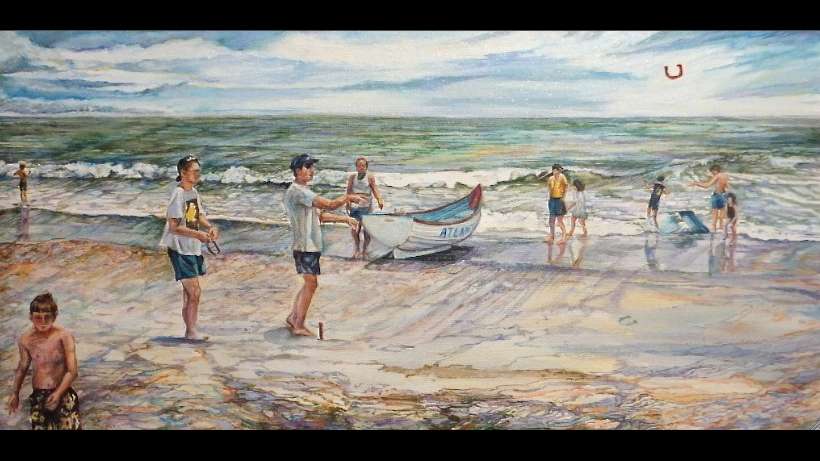

'Game on Beach' by Paulette Bensignor (Paulette Bensignor/for Great Bay Gallery)

-

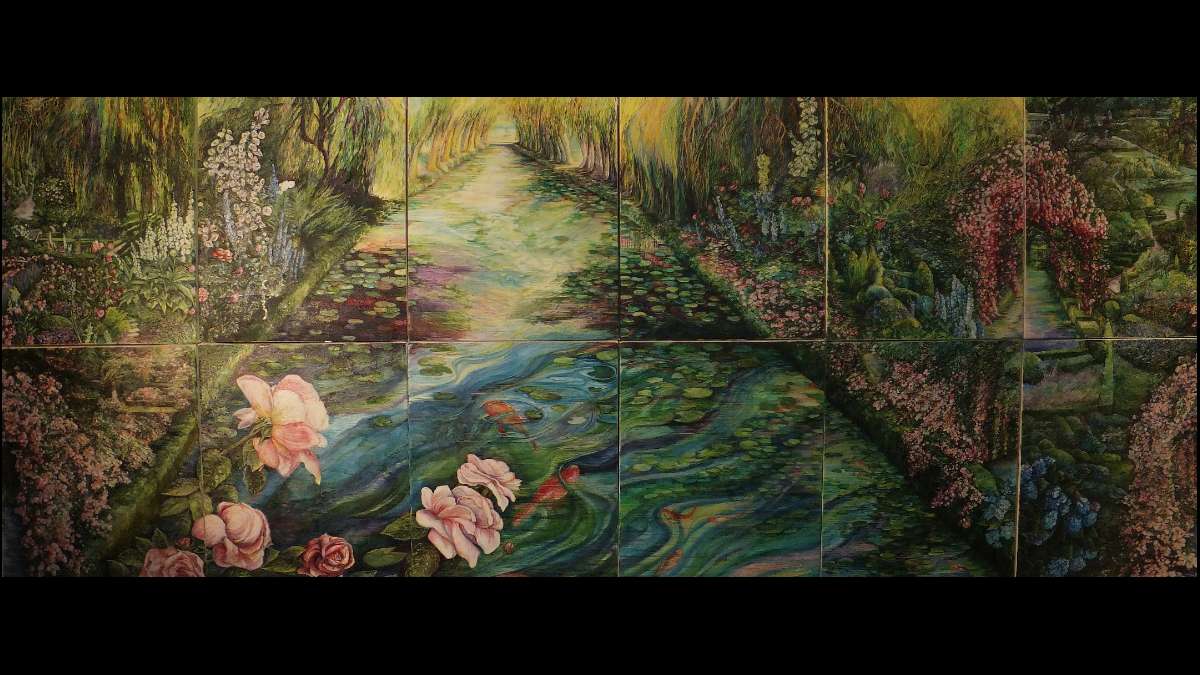

'Illusion,' detail of two panels, by Paulette Bensignor (Paulette Bensignor/for Great Bay Gallery)

-

New work from Paulette Bensignor (Paulette Bensignor/for Great Bay Gallery)

-

'Shark Bait' and detail from 'Wave with White Vortex,' oil on canvas, both by Paulette Bensignor (Paulette Bensignor/for Great Bay Gallery)

-

'Tsunami,' 2008, by Paulette Bensignor (Paulette Bensignor/for Great Bay Gallery)

-

The Nutcracker isperformed at the George Washington High School. (Nathaniel Hamilton/for Newsworks)

-

Ballerinas unwind before the performance, sharing things on their phones. (Nathaniel Hamilton/for Newsworks)

-

Ballarinas wait backstage for their cue to perform. (Nathaniel Hamilton/for Newsworks)

-

Child soldiers watch the battle between the soldiers and rats. (Nathaniel Hamilton/for Newsworks)

-

The roles of Mother Ginger and Mother Ginger’s children are performed by local dancers. (Nathaniel Hamilton/for Newsworks)

-

Ballerinas perform the Waltz of the Snowflakes. (Nathaniel Hamilton/for Newsworks)

-

A ballerina waits for her cue to go on stage.(Nathaniel Hamilton/for Newsworks)

-

Young dancers make many costume changes throughout the performance, acting as Mice, Children’s Guests, Soldiers, and Mother Gingers Children. (Nathaniel Hamilton/for Newsworks)

-

Dancers perform the Danish Marzipan Shepherdess Dance. (Nathaniel Hamilton/for Newsworks)

-

-

-

-

-

-

-

-

-

Students stage a 'Die-In' at the Philadelphia school administration building. (Bas Slabbers/for NewsWorks)

-

-

-

-

Marchers at the Philadelphia school administration building. (Bas Slabbers/for NewsWorks)

-

Before the SRC meeting Thursday night, protesters gathered on the steps of the districts administration building for a 'Die-in'. (Bas Slabbers/for NewsWorks)

A report by Pennsylvania’s auditor general finds that some counties are losing hundreds of millions of dollars from organizations defined as charities and are therefore exempt from property taxes.

A report by Pennsylvania’s auditor general finds that some counties are losing hundreds of millions of dollars from organizations defined as charities and are therefore exempt from property taxes.

The study cherry-picks 10 counties — including Bucks and Montgomery –and tallies up how much money they lost in 2014 because of the nonprofit entities within their borders that don’t pay property taxes. It also discloses what those counties’ hospitals and medical facilities would have to pay in property taxes if not for the exemption.

Auditor General Eugene DePasquale said he knows some of these organizations make voluntary payments to local governments instead of property taxes, but those payments aren’t standardized.

“It was just really hard to get at those precise numbers,” DePasquale said. “Those were really all over the map.”

Schools, churches, and hospitals have been under scrutiny for years because there’s so much money riding on their charity status.

The courts and state Legislature have tussled for decades over who has the power to define a charitable organization. Lawmakers have begun trying to take control over the process. A proposed constitutional amendment passed during the last legislative session. It would need to be approved in the next two years and then clear a voter referendum.

DePasquale suggested the commonwealth could see even more charitable organizations if lawmakers have the power to bestow such a status.

“Whoever has the best lobbyist would then have a better chance of getting their property tax exempt by the Legislature,” DePasquale said.

The report sampled the following counties: Allegheny, Beaver, Bucks, Dauphin, Erie, Lackawanna, Lehigh, Luzerne, Monroe, and Montgomery.

In 2014, the auditor general’s report finds that Allegheny County lost more than $600 million in potential county, municipal, and school property taxes because of charity tax exemptions. In the same year, Montgomery County lost $230 million and Dauphin lost $138 million in potential property taxes.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.