Pennsylvania takes credit ratings hit amid budget fight

Pennsylvania Gov. Tom Wolf has decided to let the school code bill become law without his signature. (Matt Rourke/AP Photo, file)

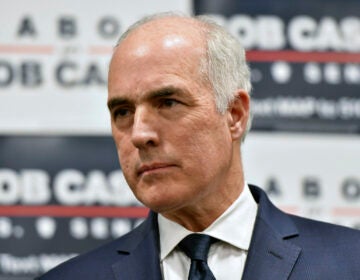

Pennsylvania’s credit rating took its latest hit Wednesday, another black eye in a nearly three-month budget stalemate that has pitted Democratic Gov. Tom Wolf and the Republican-controlled Senate against the Republican-controlled House of Representatives.

The credit rating agency Standard and Poor’s lowered its rating on Pennsylvania’s debt, citing the state’s stubborn post-recession deficit and its history of late budgets, as well as Standard and Poor’s belief that the pattern could continue.

The state’s deficit is manageable, Standard and Poor’s said. But, it said, the state’s reliance on one-time cash infusions has put too much stress on its tax collections to pay its bills on time. The downgrade is the second by Standard and Poor’s in three years — the previous one was under Wolf’s Republican predecessor — as budget makers have struggled to pull Pennsylvania out of a long-running deficit.

The downgrade comes as lawmakers argue over how to resolve a roughly $2 billion deficit, stemming largely from Pennsylvania’s biggest cash shortfall since the recession. The deficit is making itself felt: Wolf has had to delay big payments for lack of cash.

Pennsylvania is now rated even lower among states, sliding to the bottom five rated by Standard and Poor’s.

Finger-pointing and blame-shifting began immediately over a downgrade that had been expected for months without a tax increase or deep spending cuts.

“For months, I have warned that a credit downgrade was looming,” Wolf said in a statement. “I have said repeatedly for three years that we must responsibly fund the budget with recurring revenues.”

Democratic lawmakers accused anti-tax House Republicans for forcing the downgrade, while House Republican leaders blamed Standard and Poor’s and state “fiscal officers” who “refuse to pay bills.”

The downgrade means Pennsylvania will pay more to borrow money, an estimated $10 million more for every billion dollars the state borrows or refinances. That could mean tens of millions of dollars this year, particularly as lawmakers look to borrow $1 billion or more to help bail out the deficit.

Last week, House Republicans defied weeks of urging by Wolf and Senate GOP leaders to agree to a revenue plan that relied on a $550 million tax package. Instead, House GOP leaders muscled through a no-new-taxes plan that relies entirely on one-time cash infusions.

Wolf has spending authority under a nearly $32 billion budget bill lawmakers overwhelmingly passed June 30. That amounted to a 3 percent increase. But, in July, House Republican leaders pulled out of negotiations over a revenue bill, and serious talks have yet to restart.

In the past week, Wolf delayed making more than $1.7 billion in payments, mostly to Medicaid insurers and school districts. It is the first known time that Pennsylvania state government has missed a payment as a result of not having enough cash.

Since the Recession, Pennsylvania state government has reliably bailed out its deficit-ridden finances by borrowing money from the state treasury or a bank during stretches when its main bank account reached got particularly low.

However, Pennsylvania’s two independently elected fiscal officers, Treasurer Joe Torsella and Auditor General Eugene DePasquale, both Democrats, are refusing to authorize a short-term loan during the stalemate.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.