Pennsylvania may urge state workers to retire early to cut cost

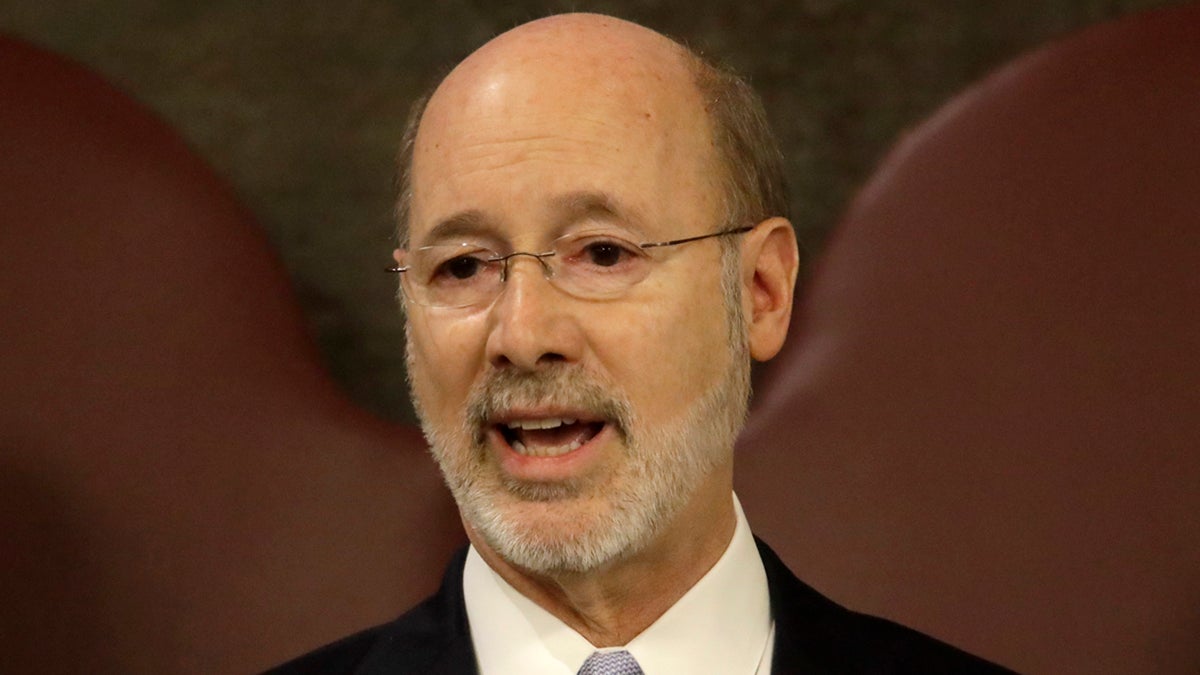

Gov. Tom Wolf delivers his budget address for the 2017-18 fiscal year to a joint session of the Pennsylvania House and Senate in Harrisburg, Pa., Tuesday, Feb. 7, 2017. (Matt Rourke/AP Photo)

Part of Pennsylvania Gov. Tom Wolf’s plan to deal with a multibillion-dollar structural deficit is to shrink the state’s employee workforce by urging early retirement.

But lawmakers — particularly Republicans — have repeatedly brought up concerns that this would just add unnecessary millions to the state’s more than $60 billion in unfunded pension debts.

Wolf’s incentive would allow employees who’ve worked close to 30 years to retire without penalty. That could save between $15 million and $16 million per year, he said.

That’s a rough estimate — the plan would still have to go through the legislature.

The incentive would affect only employees who get their pensions through the State Employees’ Retirement Fund, so it wouldn’t include teachers or police officers.

SERS executive director David Durbin said he’s received few specifics on the plan from the state. But he said previous plans offer some idea of what could happen.

“We know, in the past, the pension system has had an increase in the liability that they’ve had to pay as a result of early retirement incentive programs,” he said in a recent budget hearing before the House.

Pamela Hile, a spokeswoman for SERS, clarified further. Historically, she said, “early retirement incentives save employers money from a payroll perspective, but increase their post-employment costs.”

The last time the state proposed a retirement incentive program was 2003. It didn’t pass, but actuarial analysis SERS did at the time showed it would’ve added between $600 million and $800 million to the unfunded pension liability. That shakes out to somewhere between $97 million and $137 million in annual employer contributions.

A spokesman for the governor said that plan would have been more costly than the current proposal, because it provided an additional bonus for retirees.

He added that Wolf’s plan makes fiscal sense because the state has to pay these employees’ pensions at some point anyway — and this helps reduce the state’s complement at the same time.

“You’re enabling people who have put 30 years of service in to retire, and then — in some cases — it will also enable the commonwealth not to refill that position, which saves money year after year,” Abbott said.

A spokeswoman for Senate Republicans said the caucus takes issue with the governor adding to the pension debt without first looking for a way to reduce it.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.