N.J. solar firm pitches Philly investors as global market shifts

Listen

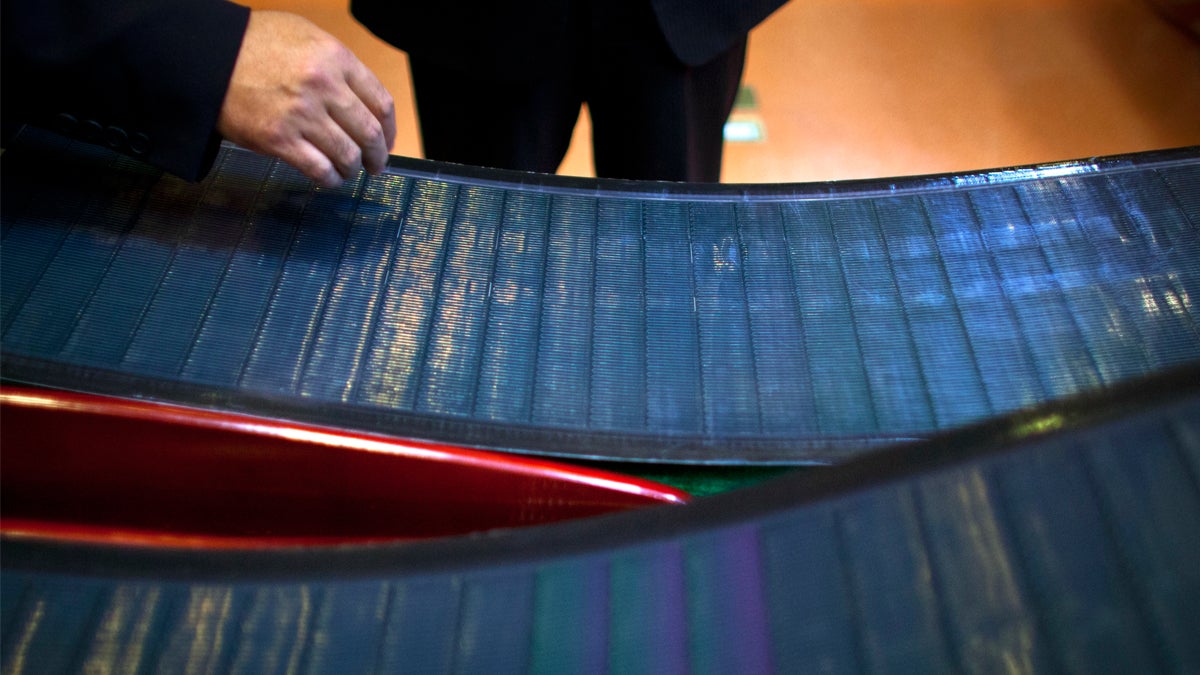

Hanergy Group, the Chinese company that bought MiaSole, a California producer of thin-film solar panels, in January said it can make a success of the emerging technology where others have suffered huge losses. The nation is now rethinking the incentives it pumps into its solar industry. (AP Photo/Alexander F. Yuan)

A solar company from North Jersey wants investors in Philadelphia to think it’s the real deal.

Red Bank, N.J.-based Natcore Technology was in town Thursday laying out the case for why this unique moment in the global solar industry could spell opportunity for American firms.

Natcore CEO Chuck Provini drove down to the swank Racquet Club of Philadelphia in Center City to talk to an association of investors.

He says his solar startup can make traditional panels with higher efficiency and more power output.

The big picture, however, is that China, the world’s leader in solar manufacturing, is rethinking the incentives it pumps into its solar industry.

“Now the question is, who fills that void with technology?” Provini said. “Of course, I’m hoping it’s the United States, but someone is going to fill that void. Because, right now, small incremental changes — 1 percent in efficiency, 2 percent in power output — are going to make huge differences to that industry, because it hasn’t changed in years.”

Experts say change is afoot in the global solar industry.

“There is a big trade fight brewing globally over solar panels,” said Jeffrey Ball, a scholar-in-residence at Stanford University’s Steyer-Taylor Center for Energy Policy and Finance.

In a recent article first published by Stanford’s business school, Ball says China is hungover from a solar glut. As China’s solar boom moves toward solar bust, the country is now dialing back its generous support of local manufacturers.

“What’s going on now in China is an increasing attempt at a rationalization of the solar industry,” Ball said.

Add to that, significant cutbacks in European solar subsidies and an oversupply of Chinese panels, and you get an industry in flux.

Some argue, Ball says, that it could create an opening for firms in the U.S. or elsewhere.

“If there is a disruptive technology in solar — and there are lots of them that people are playing with — then suddenly China’s edge, at least China’s current edge, dissipates,” Ball said.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.