Commercial developers have concepts drawn but markets prevent groundbreaking

Enjoying the Philadelphia skyline, with the shimmering Comcast tower punctuating the end of the 20th century? Get used to it.

In late November 2008, as world markets were reeling from the unraveling of Wall Street, commercial real estate forecasters were intimating doom for the coming year.

“Values will drop substantially, foreclosures and delinquency rates will increase sharply, and a limping economy likely will crimp property cash flows,” said Stephen Blank, an Urban Land Institute researcher and adviser, at an event at the Union League nearly two years ago.

Blank was right — 2009 saw an overall dearth of development in Philadelphia and across the nation, as builders searched in vain for loans.

So far in 2010?

“If you had asked me this question back in March, I would’ve said, ‘Yeah, we’ll be out of it,’ or ‘we’ll start to be out of it a year from now,’” said Craig Schelter, a longtime economic development and planning official in Philadelphia, and now the representative of the Development Workshop Inc., a mostly private group of local landowners. “Now, I don’t know. … It’s very hard to get a development cranked up when you’re fighting little skirmishes and you’re not sure when your lender is going to come forward, or under what terms.”

There are dozens of questions about development progress from the planning and development community echoed often by the general public. Questions like, ‘what’s happening with Stamper Square?,’ ‘is that American Commerce Center for real?,’ ‘is there a new mixed-use on tap for the 400 block of Race Street?’

The answer for most: ‘on hold.’ But doubters are plenty. After all, we’ve seen concept drawing after concept drawing.

When will the digging start?

It’s not that private developers are necessarily hurting, financially. Some are doing quite well, and Center City sources say that savvy operators like Ron Caplan (Philadelphia Management Inc.) and Tony Goldman (the New York-based developer behind the 13th Street efforts over the past decade) are currently eyeing opportunities to leverage their experience during the condo and apartment boom.

Slowed progress is more a result of the fact that the market for commercial real estate is still terrible. Further, there are major indications it is will get much worse before it gets better. “By the end of this year commercial real estate will have dropped in value between 40 and 50 percent from its peak a few years back,” said Elizabeth Warren, chair of the Congressional Oversight Panel and a candidate to run the newly established Consumer Financial Protection Bureau, in a recent interview on PBS. Warren added that it is usually community banks that supply the industry with loans – not Wall Street. “Commercial real estate drags down the bank’s balance sheet, and that means that banks are less likely to lend to small businesses, which means there are fewer tenants for the commercial real estate.”

The result is more and more empty skyscrapers, or “see-through buildings,” as Warren called them.

Dull is good

On the upside, “certain companies are in a position to make decisions they weren’t a year ago,” said Charles Steelman, assistant director at the Center City office of Studley Inc., a national commercial real estate brokerage. However, “from a landlord’s perspective, things are still deteriorating. Tenants are still downsizing.”

The Center City office availability rate (a variant of the vacancy rate) was 14.7 percent in the second quarter of 2010, according to Studley statistics due for release soon. That’s compared to an 11.2 percent vacancy rate in the third quarter of 2008. But Philadelphia’s numbers are good compared to markets that fully enjoyed the boom years of the past decade, such as Midtown Manhattan (where total effective rents dropped more than 40 percent in 2009 compared to the year before), or San Diego, or Miami.

Still, in the office space sector, “market demand is very low,” Steelman said, with “significant vacancy to prevent new construction” from making any kind of financial sense, at least in Center City. That means development of new office towers is probably years away. In the meantime, it is more of the same – wait and see.

“Unfortunately, that’s somewhat true,” said Peter Kelsen, a land use and zoning attorney who is involved in the Zoning Code Commission and its re-write efforts. “You’re seeing the institutional folks able to go forward, with some of the [Federal] stimulus money.”

Self-funders

While loans are hard to come by, development is moving ahead on some “institutional” projects.

“The Barnes [Museum on the Benjamin Franklin Partway] is going forward,” Kelsen said. “The Mormon church on North Broad. But they can self-fund – they’re not dependent on a lender to help them out.”

Kelsen also notices more retail development of the “one-off” variety – such as chain supermarkets in neighborhoods with demand. Even projects like a new Wawa are seen as sparks of life. “That’s different from last year,” Kelsen said. “I didn’t see the retailers last year doing anything, even on a small scale. And I am seeing more and more residential developers coming in for smaller scale developments, like 15 or 20 [apartment] units, or infill parcels.”

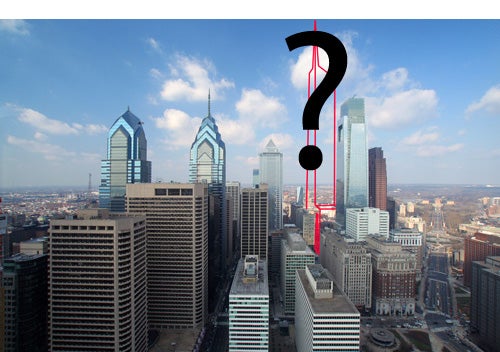

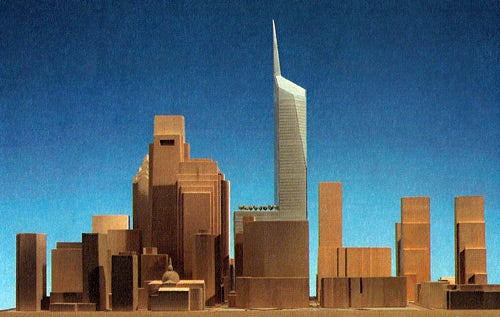

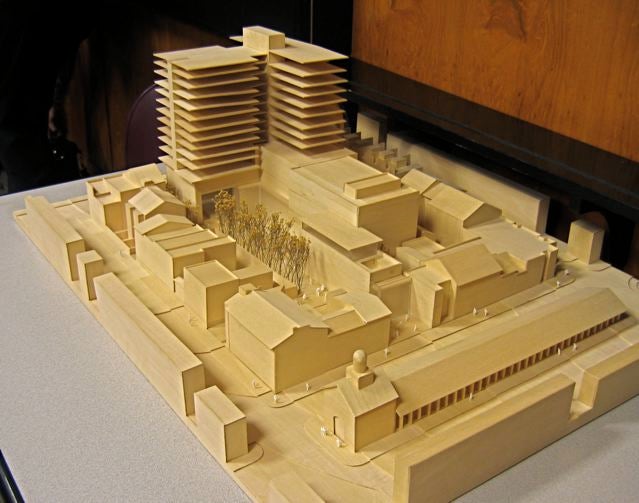

Aside from the ZCC, Kelsen is well known as representing the developers of the would-be American Commerce Center, a $1 billion, 1,500-foot planned tower with 2.2 million square feet of mixed-use development (office, high-end retail and residential, with perhaps a hotel, plenty of public space) with a promised groundbreaking environmental design. Slated to occupy the 1800 block of Arch Street, it would be far and away Philly’s tallest building.

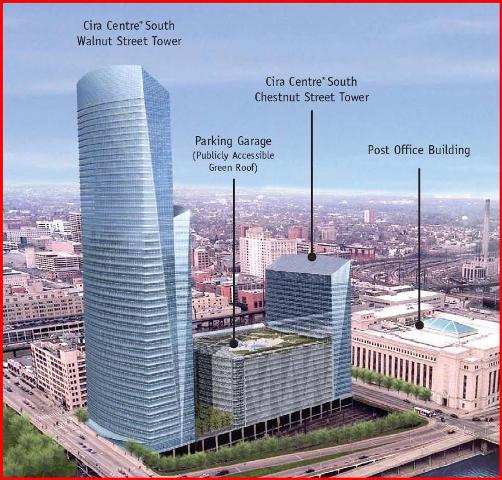

“Relatively speaking, Philadelphia is a stable market,” said Steelman. “They’ve held their own.” But, “there’s more talk about Cira Centre Two than about the American Commerce Center. A lot of that has to do with Cira as a Keystone Opportunity Zone. There are enormous benefits to relocating.”

Steelman was referring to the long-discussed sequel to the successful 29-story Cira Centre, the silver-glass curtain-clad office structure which is sublime art by day and appears to be an ongoing construction site by night.

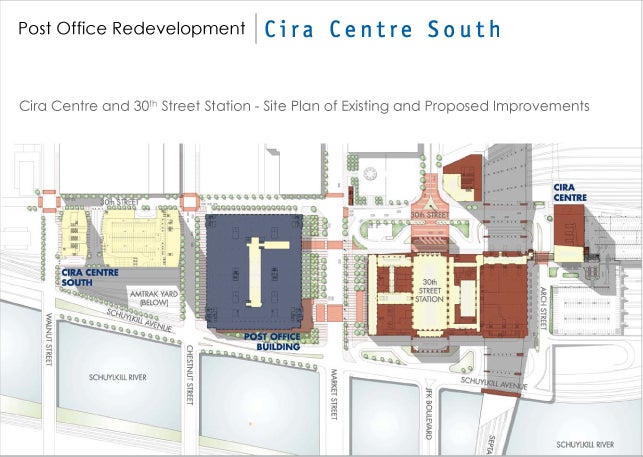

Developed by the publicly traded Brandywine Realty Trust and designed by César Pelli, the Cira Centre enjoys direct access to Amtrak’s 30th Street Station. It sits at the enviable crossroads between Center City and the expanding University City, just across Market Street from one of the area’s most vibrant construction spots – the old U.S. Postal Service building, which is being converted into modern office spaces for thousands.

Nexus

“The level of activity in West Philadelphia in many respects rivals Center City,” said Walt D’Alessio, vice chairman of NorthMarq Capital (a national real estate investment banking firm) and the dean of Philadelphia commercial real estate. D’Alessio has served in multiple public and private roles, including leadership positions at the Philadelphia Industrial Development Corp. and as a board member at Brandywine Realty Trust, the developer of Cira.

“More and more I’m thinking of it as part of Center City, even though you have to cross the river,” he said. “The Cira Center proves you can cross the river. Commerce isn’t just related to all buildings near Penn Center or the Comcast Center. Everything going forward in the world today is going to be about transportation-centered locations.”

Alan Greenberger, deputy mayor of Commerce and Planning, said projects that are “gap-fillers” – such as supermarkets – are getting lower interest loans accompanied by “significant public support” because they contribute to the public interest.

As for more high-profile offices or mixed-use developments, “it’s all a matter of demand for space,” D’Alessio said of any prospects for new buildings in the short term.

“Right now, the economy isn’t producing any demand. If you believe what the economists are saying, we’ve got a couple more years.”

This week in PlanPhilly: Sweet spots for developers, and the developers with a history for sweet timing.

Contact the reporter at TWalsh@PlanPhilly.com.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.