Capitol recap: No money allocated for state agency handling pension aid to 1,000+ Pa municipalities

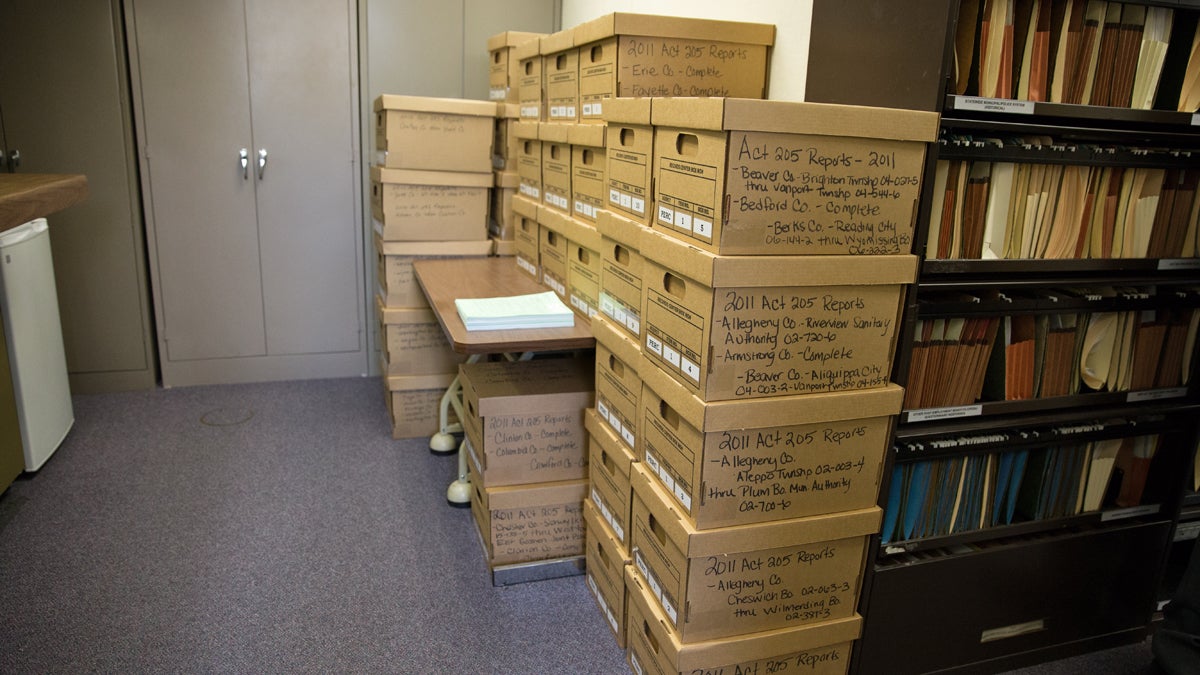

Pennsylvania is home to about a quarter of the nation's municipal pensions and uses a paper-based system to track them. The Public Employee Retirement Commission monitors the Commonwealth's 3,200-plus retirement systems for local police, paid firefighters and other municipal government workers. (Lindsay Lazarski/WHYY)

Local retirement systems in Pennsylvania get about a quarter billion dollars, combined, each year from the Public Employee Retirement Commission (PERC).

Despite that, a good number of them face imminent or immediate funding problems. We know this due, in part (at the very least), to PERC monitoring and analyzing the state’s 3,200-plus municipal pensions.

PERC also analyzes legislation dealing with pensions. Not just the municipal kind, but also statewide systems for public school teachers and employees of the Commonwealth. State law assigns PERC the task so that lawmakers can have independent information when they’re dealing with pension bills.

But Gov. Tom Wolf sees the agency’s role as “redundant.” And its days might be numbered.

Wolf zeroed out PERC’s budget of $942,000

Wolf’s striking PERC’s budget doesn’t dissolve the agency. A 2009 court decision requires the state to cover payroll even in the absence of a budget.

For PERC to be disbanded, state law, including one tasking PERC with legislative analysis, also would have to be changed. And no steps have been taken to do that, says Wolf spokesman Jeffrey Sheridan.

But the veto does limit PERC’s role. It can’t spend any money beyond payroll. That means PERC can pay its five full-timers to handle municipal pensions’ analysis and aid, and expects to be able its functions where that’s concerned. But PERC can’t do legislative analysis because its actuaries are contractors, not on PERC’s payroll. State law permits legislators to move forward without PERC’s numbers after 20 days, but they might not. The situation appears to have stalled, for instance, at least one muni pensions bill, according to Pennsylvania Municipal League Executive Director Rick Schuettler.

“Both pension systems already provide thorough, independent actuarial analysis for all pension legislation considered before the General Assembly. The actuarial analysis provided by PERC is redundant and an unnecessary expense of the commonwealth,” Sheridan said in an email to Keystone Crossroads, echoing his comments to Capitolwire earlier this month.

What about PERC’s role monitoring municipal pensions and handling their state aid? Also redundant, Sheridan says.

The Pennsylvania Municipal Retirement System (PMRS) can do what PERC does, he says.

What’s next?

Sheridan says the governor doesn’t have any details to share about how PMRS would absorb PERC’s functions, though.

PMRS Municipal Services Division Chief Anthony Pinto wondered whether this meant PMRS would expand, or if plan advisers also would handle oversight, in the absence of PERC.

“I’m a little baffled by it,” Pinto says.PMRS isn’t a monitoring organization. It’s the administrator for more than 900 municipal pensions. The other 2,300 plans have other, private admins. PMRS is paid by its client municipalities for its services, as other plan advisers are.

Pinto noted the strict professional standards of actuaries, but conceded the inherent conflict with any subject paying its monitor.

“I don’t think this is what anyone anticipated with the line-item veto,” says state Auditor General Eugene DePasquale. “I don’t think anyone thought about this part of it.”

The state Auditor General’s office relies on PERC for pension plan data and state aid calculations, since PERC’s getting reports from all municipal pension plans every year.

A bit of background

Wonder where this is coming from? Read on.

“If it was retaliatory for anything, and I’m not saying it was, it was because we weren’t able to move with the speed they wanted us to,” PERC Executive Director James McAneny. “Yes, (involving PERC) slows the process down. Like it or not, it’s intended to do that.”

This all came up after PERC was asked to do an actuarial analysis for pension bills before the agency had enough information to do so, according to McAneny.

McAneny has the option of signing off on existing estimates (in this case, from the pension systems) instead of PERC doing its own. He didn’t do that, though. PERC’s actuaries already were working on it, adjusting as the bills changed. When they finished, they found a $630 million mistake in the calculations performed by the pension system actuaries, according to emails provided by McAneny. Sheridan says PERC didn’t catch a mistake. PERC’s contracted actuaries at Milliman declined comment on that, and on how they’ve been affected by the state budget impasse.

This story was updated to add a quote from Jim McAneny.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.