New Philly tax valuations leave some furious, others grateful

-

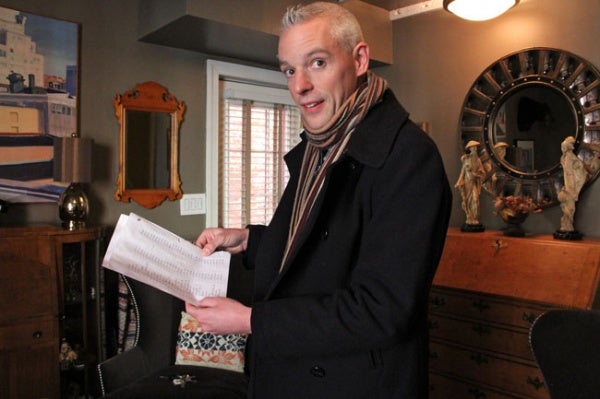

Will Massey, standing in the living room of his Carpenter Street home, holds a list he compiled of 400 properties that have sold in the last year. The city's assessment of their value, he says, are way off. (Emma Lee/for NewsWorks)

-

Will Massey stands in front of his home in the Queen Village neighborhood, a section of the city that will see some of the highest tax increases. (Emma Lee/for NewsWorks)

-

<p>Second Street in Philadelphia's Queen Village neighborhood, where taxes are generally likely to rise. (Emma Lee/for NewsWorks)</p>

-

<p>El Zarape restaurant on Passyunk Avenue, where many property owners could see higher bills under AVI. (Emma Lee/for NewsWorks)</p>

-

<p>Armando Perez, owner of El Zarape restaurant on Passyunk Avenue, says his landlord's property tax bill could almost double. If that cost gets passed on, Perez says he might have to find a new location. (Emma Lee/for NewsWorks)</p>

-

<p>Property taxes are expected to decrease for 1528 Chestnut St., where Modell's Sporting Goods is located. Overall, the property tax burden is expected to shift from businesses to homeowners under AVI. (Emma Lee/for NewsWorks)</p>

-

In the 6200 block of Ellsworth Street in West Philadelphia, where sales associate Arleen Pugh lives, some property taxes could decrease. (Emma Lee/for NewsWorks)</p>

Will Massey is furious about Philadelphia Mayor Michael Nutter’s Actual Value Initiative.

The city started mailing out more than 500,000 new property assessments last week in an effort to fix the error-ridden property tax system.

That’s when Massey learned that the assessment for his Queen Village home jumped from $60,000 for 2013 to $225,500 for 2014.

Massey, who works as a mailman, could see his property taxes go up by more than $940 next year. If the new tax rate is set at 1.25 percent of his assessment, the resulting bill will rise from $1,876 to $2,819.

He said it won’t be easy for him to pay the higher bill, but he will find a way to do so.

“I’m working six days a week,” he said, “sometimes as many as 20 hours overtime in a week.”

Massey said he isn’t convinced that the new assessments are accurate. Over the weekend, he hand-wrote a detailed list of several supposed errors. For instance, he found that a house on nearby Kater Street sold last year for $725,000, but the city assessed it at $476,800 for 2014.

“This was supposed to be fair and equitable,” Massey said. “I want to be treated just like everybody else in the city.”

A mixed impact

Nutter said the new assessments, which took more than two years to complete, will be “fair to every Philadelphian.” Property assessments had become outdated, uneven and, in some cases, politicized.

Nutter said the new figures are based on real market values. If property owners think that their assessment is inequitable, they can appeal.

At the 1.25 percent tax rate, 40 percent of property owners will see their property tax bills go down or stay the same under AVI, according to the city. The program also shifts some of the overall tax burden from commercial property owners to homeowners.

Residents in Queen Village, Northern Liberties, Center City and other trendy neighborhoods are more likely to face much higher property tax bills under AVI. Meanwhile, in parts of West and Southwest Philadelphia, plenty of homeowners could enjoy lower tax bills.

A cheer from W. Philly

Arleen Pugh, a sales associate, could see her property tax bill decrease from $1,613 to $1,097 under a 1.25 percent tax rate. She lives on Ellsworth Street in West Philadelphia.

“It’ll be awesome to get that little bit of breather,” she said. “I need all the money I can get.”

She said it’s been tough to keep up with rising property taxes over the last few years. By September, she’ll have three children in college. She plans to use to the extra money to help pay for their education.

The 1.25 percent tax rate would yield the same property tax revenue in 2014 as in 2013, as Nutter has proposed.

Council has already passed a homestead exemption, set for now at $30,000, which would take part of each house’s assessment out of the tax calculation. That step could bump up the rate to as high as 1.4 percent, to keep revenues the same.

A break for some businesses

Just like homeowners, some businesses owners will have lower property taxes under AVI, while others will have to fork over more money to the city.

Many commercial properties in Center City, for instance, could get lower tax bills.

The tax bill for the Modell’s Sporting Goods building, located on the 1500 block of Chestnut Street, could decrease from $90,675 to $52,764 at a 1.25 property tax rate.

Paul Levy, executive director of the Center City District, said the tax overhaul could impact Center City in several different ways.

“One scenario is that a decrease in real estate taxes could lead to more investment in existing properties,” he said. “But there are also commercial properties whose taxes will go up, so there are lots of scenarios.”

Levy pointed out that City Council still must set a property tax rate for 2014, which could change who the winners and losers are under AVI.

Overall, the property tax burden is expected to shift from businesses to homeowners under AVI. This is because commercial properties were assessed at much closer to their actual market value than homes in the past.

Worry along Passyunk Ave.

But that doesn’t mean every commercial property is getting a break.

Along Passyunk Avenue, a bustling commercial corridor in South Philadelphia, many property owners will likely see higher tax bills.

Armando Perez owns El Zarape, a BYOB restaurant that serves al pastor, azteca soup and other Mexican dishes. His landlord’s property tax bill could almost double — going from $3,127 to $6,096 at a 1.25 percent rate.

If Perez ends up eating the higher cost of property taxes, he said his business could suffer.

“We have to wait and see what happens,” he said. “Maybe we got to move somewhere else.”

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.