2014 Pa. governor’s race: Getting to the truth on taxes

Listen

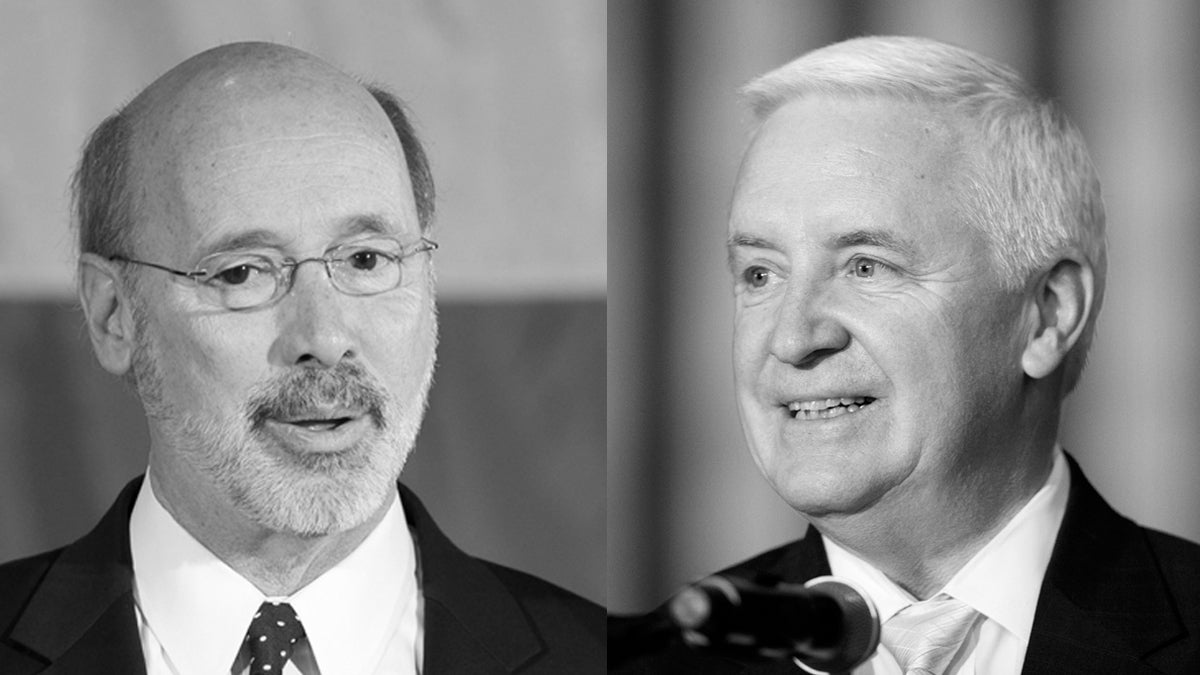

Pennsylvania Democratic gubernatorial candidate Tom Wolf (left) and Pennsylvania Gov. Tom Corbett. (Matt Rourke/AP Photos)

In the Pennsylvania governor’s race, there’s been a whole lot of talk about taxes — and a lot less clarity about how each candidate’s plan would affect most taxpayers.

The airwaves have been flooded this year with advertisements from Republican Gov. Tom Corbett’s campaign painting his Democratic contender, Tom Wolf, as a tax-and-spend liberal.

“Tom Wolf’s going to raise the income tax on middle-class families,” a man in one ad tells the camera, adding sarcastically, “it’s about time somebody does.”

The Wolf camp has tried to strike back with negative ads noting Corbett raised gas taxes — a decision Corbett defends by saying he simply lifted an “artificial” cap on that tax.

“Have you seen Tom Corbett’s ads attacking me?” Wolf says in a TV ad. “Get real. It’s Tom Corbett who’s been sticking it to the middle class on taxes.”

Political analysts believe the campaign ads have made a difference in the race. Terry Madonna, a political science professor at Franklin & Marshall College, said they have helped Corbett, who remains down in the polls.

“One of the reasons the race has narrowed is because Gov. Corbett is winning back Republicans,” he said. “He was not doing well among Republican voters in the spring when he was doing 50, 55 percent. Now he’s up to 65 to 75 percent, and I think the argument about tax-and-spend … has helped him among core Republican, base Republican voters.”

Flat rate vs. progressive rate

Corbett has been able to make that argument by seizing on Wolf’s plan to make income taxes in Pennsylvania progressive — in other words, to have different effective tax rates for different income levels.

Right now, whether you’re a trash collector or a business executive, your income is taxed at a rate of about 3 percent in Pennsylvania. Wolf says he wants to change that, so residents making somewhere between $70,000 and $90,000 annually or less would get a tax break or pay the same amount, and everyone else would pay more.

But Wolf hasn’t said exactly whose taxes would go up or by how much. The Philadelphia Inquirer Editorial Board called the lack of details “troubling.”

Wolf has said he doesn’t have access to state tax records that would allow him to come up with a more detailed plan. He also said he needs to learn more about the nature of the state’s fiscal troubles. Analysts have said the next governor will face a budget shortfall of as much as $2 billion.

“I’ve been as specific as I can,” Wolf told CBS3 news anchor Chris May. “I’ll be specific when I understand what kind of a hole this governor has left the next governor.”

Corbett has also been criticized, for different reasons. Eugene Kiely, director of factcheck.org, said Corbett’s campaign ads about Wolf’s tax plans are misleading.

“For Corbett to say that Wolf is promising to raise middle-class income taxes is inaccurate,” he said, “because those are the very people who would benefit from Wolf’s plan.”

This has left voters in a strange place: They’ve heard a lot about Wolf’s tax plan, but little about whether a progressive income tax or a flat tax would be better for Pennsylvania.

“Taxes are the third rail of Pennsylvania politics,” said Sharon Ward, executive director of the left-leaning Pennsylvania Budget and Policy Center.

Ward said a progressive income tax would level the playing field in Pennsylvania, where the middle class and poor pay a larger percentage of their income in state and local taxes.

“Almost 20 percent of families in Pennsylvania, they earn just over $11,000. And after taxes, they have just $9,600 left,” she said. “For the top 1 percent of families in Pennsylvania, they earn a little bit over $1 million and even paying all of their state and local taxes, they still have more than $1 million.”

Ward also said Wolf’s plan could help the state’s coffers because income growth has been concentrated at the top in recent years, and a progressive income tax would capture that money.

Liz Malm, an economist at the right-leaning Tax Foundation, said Pennsylvania should consider how a progressive income tax would affect the economy. The state’s current income tax rate, she said, is one of the most business-friendly things it has going for it.

“Pennsylvania’s flat rate of 3.07 percent is actually one of the lowest among its neighbors. It’s actually pretty low when you look at it nationally as well,” she said. “You’ve got New Jersey, Delaware, Maryland, even West Virginia, Ohio and New York all have top individual income tax rates that are higher than that.”

Comparatively, Malm said, Pennsylvania has high corporate and sales taxes.

Constitutional questions and GOP reluctance

Amid the fog of numbers, other questions are obscured. For example, the state constitution requires that all taxes be applied uniformly. Wolf said his plan would be constitutional; some tax lawyers disagree.

Even if Wolf’s plan passes constitutional muster, what are the chances the General Assembly would ever pass it? The state Legislature is expected to remain under control of the GOP.

“The Wolf tax plan, I think, is going to have a tough sling in the state Legislature,” said Madonna, the political analyst. “It’s almost inconceivable to me to think that a conservative, Republican-controlled state House would pass it.”

Wolf said he is confident that Pennsylvanians want a progressive income tax, and that Democrats and Republicans alike will listen to their constituents.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.