Young, educated Philadelphians struggle to understand health coverage lingo

Young adults are often perplexed by insurance jargon when navigating the HealthCare.gov site. By following study participants in real time as they shopped, researchers (from left) Mike Kaiser, Charlene Wong and Cjloe Vinoya now have recommendations for making the process easier. (Emma Lee/WHYY)

Confused by health insurance terms such as deductible and co-insurance?

Researchers at the University of Pennsylvania have found that even highly educated young adults aren’t familiar with those key concepts—and that could be a problem.

Getting healthy young people to join the ranks of the insured has been a top priority for the Obama administration and key to the success of the Affordable Care Act.

To figure out the challenges facing young adults, Penn pediatrician Dr. Charlene Wong tracked a few dozen Philadelphians, ages 19 to 30, in real time as they tried shopping for insurance on HealthCare.gov last year.

“A big barrier to making that choice was a lack of understanding of basic health insurance terms,” said Wong, who is also a Robert Wood Johnson clinical fellow and lead author of the study, which was published in the Journal of Adolescent Health.

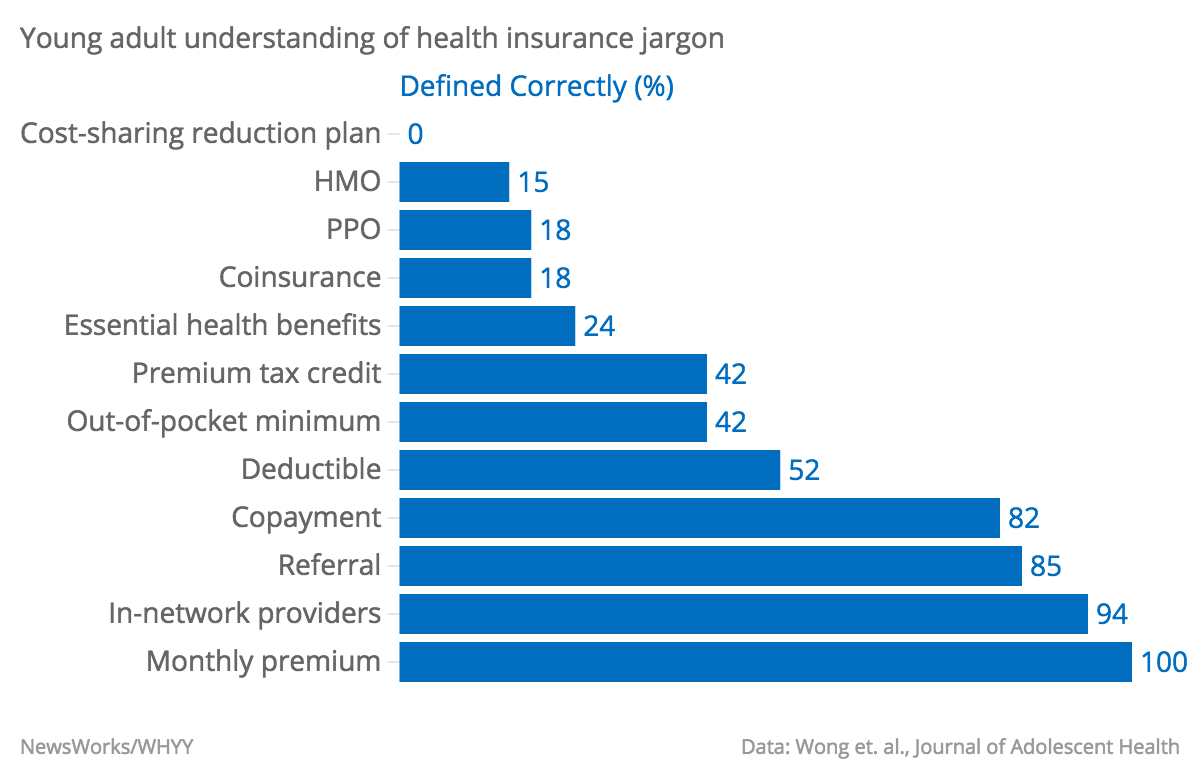

Despite impressive academic training — nearly all the participants had bachelor’s degrees, and many had finished grad school — only about half knew what a deductible was. Fewer than one in five understood co-insurance or PPO. And no one correctly defined a cost-sharing reduction plan.

“I just wasn’t able to comprehend all of the things on HealthCare.gov. I got confused. I’m not a person to give up — not at all — but with the system, I just wanted to quit,” said one participant in a follow-up interview.

Wong said milennials expected the website to offer more guidance, perhaps in the form of pop-up definitions –- a fix that has since been implemented on some exchanges.

In addition to problems with lingo, price was a major concern identified in the study.

“We even had one participant who said, ‘I’ll just pay whatever the tax consequence is, $95 or something, right? Because $200 a month right now is way too much. I don’t know how my friends with student loans do it,'” said Wong.

The group of young Philadelphians said an affordable monthly premium would be under $100. But without tax credits, the cheapest plan in the area is nearly twice that.

In the end, about a quarter of the young adults signed up on HealthCare.gov, most opting for middle-of-the-road silver plans. Fifteen percent decided to remain uninsured.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.