Thousands sign up for Delaware health insurance marketplace despite challenges

Delaware’s health insurance marketplace remains strong after nearly 25,000 people signed up for 2018 coverage in midst of many insurance challenges.

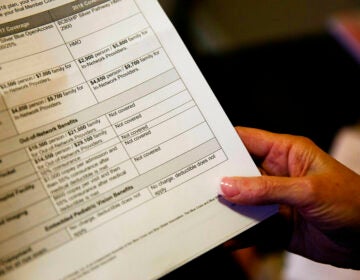

This Sept. 15, 2014, file photo shows part of the HealthCare.gov Website in Washington. (AP Photo/Jon Elswick, File)

Delaware’s Health Insurance Marketplace remains strong after nearly 25,000 people signed up for 2018 coverage in midst of many insurance challenges.

The proof is in numbers released by the Centers for Medicare and Medicaid Services this week. According to CMS, Delaware’s total peaked at 24,860 for the enrollment period that ended on December 15. Although, that number is 10 percent lower than what was recorded last year, state leaders are still impressed.

“I am pleased that so many Delawareans saw the value and the need in having health insurance coverage despite the challenges they faced this year during open enrollment,” Governor John Carney said in a statement. “Health insurance provides that critical connection to quality health care. That connection is the first step toward building a healthier Delaware.”

However, concerns still linger about the state of Delaware’s Health Marketplace since Aetna announced its plans to no longer participate. As a result, people who bought into Aetna’s insurance had to shop plans offered by Highmark Blue Cross Blue Shield of Delaware. It’s now the only insurer on the marketplace with some changes that include a 25 percent insurance rate increase for all Highmark’s 2018 plans.

“Despite the challenge of a much shorter enrollment period and little funding for marketing, Delaware still enrolled thousands of people who may not otherwise have been able to get covered,” said U.S. Senator Tom Carper, D-Delaware. “I will continue my work to strengthen the health insurance marketplace and bring down the cost of healthcare for all Delawareans.”

As for those who cannot afford health coverage or choose not to participate, there are still penalties to pay under the Affordable Care Act. The maximum penalty amount could reach as much as $2,000 per household depending on the family size. That could change due to the tax cut recently passed by Congress. Once signed by President Trump, many of the rules and regulations may be repealed by the 2019 tax year.

It’s reported that nearly 9 million people signed up for coverage nationally, in the 39 states that use HealthCare.gov for the online enrollments.

Meanwhile in 2017, close to 81 percent of the people enrolled in the Marketplace received some sort of financial assistance to help reduce what they pay for premium costs on a monthly basis. Also, people who experience life altering challenges are allowed to sign up for health insurance outside the enrollment period. Some of those challenges include the birth or adoption of a child, marriage, divorce, moving from one state to another, or losing coverage through employment. Also, some residents might be eligible for coverage though Delaware’s expanded Medicaid program, which is open year-round too.

Local organizations with insurance agents and brokers have been offering help to assist residents. Westside Family Healthcare, Chatman LLC, Henrietta Johnson Medical Center in Wilmington and La Red Health Center in Georgetown are some of the places providing one-on-one enrollment assistance.

“I am grateful that we were able to get out the message to Delawareans that health insurance is important to have and that financial assistance was available to help them pay for it,” said Department of Health and Social Services (DHSS) Secretary Dr. Kara Odom Walker, a board-certified family physician. “Our federal navigators, enrollment assisters and insurance agents and brokers did an outstanding job of working with people to help them understand their options, including the availability of federal financial assistance.”

More information, rules and special enrollments are detailed online when you visit Healthcare.gov.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.