Sheriff sales failing to round up promised bonanza of property tax deadbeats

Two years ago, the City of Philadelphia offered its legions of tax deadbeats a once-in-a-generation chance at amnesty: a 54-day window to settle their accounts without paying a dime in penalties and only half the interest owed the city.

The Nutter administration warned that after the carrot of the amnesty was taken away, a big, heavy, enforcement stick would follow.

Property tax delinquents were singled out. After the amnesty period expired sheriff’s auctions of tax delinquent parcels would soar, from a trickle of about 90 a month, to roughly 600, the city said.

“When Philadelphia Tax Amnesty ends … so does the idea that you can avoid paying your taxes and get away with it,” Mayor Nutter said in a June 2010 press release.

But that long-promised crackdown on property tax delinquents has so far fallen well short of its goals. Since July of last year, when sheriff tax sales resumed after a 13-month moratorium, the Nutter administration has offered up an average of 202 new tax delinquent properties at monthly sheriff sales.

That figure represents more than a doubling of the pre-amnesty sheriff sale rate, but it comes nowhere near the now nearly two-year-old, 600-a-month target. An even smaller number of delinquent properties have actually been sold, an average of 90 a month.

“Are we reaching our goal? No. But more money is coming in the door, and we feel like that’s progress,” said city Revenue Commissioner Keith Richardson.

Is it enough progress, though, given the scale of the delinquency crisis?

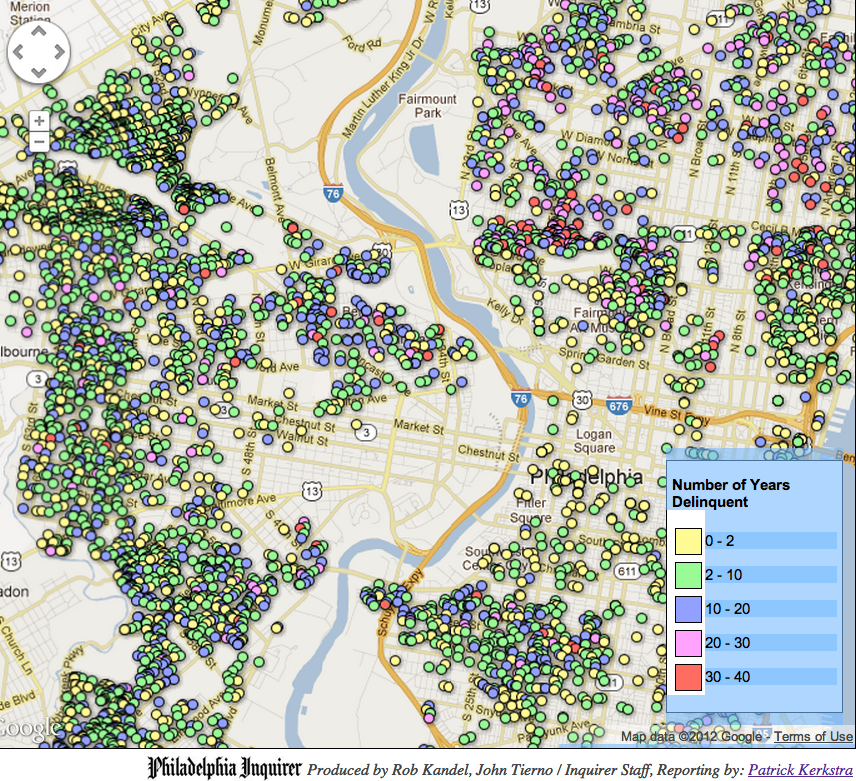

A PlanPhilly/Inquirer investigation last August revealed that nearly one of out every five properties in Philadelphia is tax delinquent, an epidemic of non-payment that is worse than any big city in the country. There are more than 100,000 tax delinquent properties in Philadelphia, and on average those properties are 6.5 years past due.

According to sheriff’s office records, the city doubled the pace of tax delinquent property sales beginning in September, the month after the PlanPhilly/Inquirer report on the delinquency crisis was published. Still, in light of the sheer volume of old delinquencies, the increased pace of sheriff sales seems unlikely on its own to make a meaningful dent on the overall inventory of deadbeats.

If the city continues to offer only 202 new properties a month at sheriff sale, it would take 45 years to bring each tax delinquent parcel to the auction block, and many more years if new delinquents continue to be added to the rolls.

The city’s decades-long failure to collect taxes has crippled the municipal and school district budgets; the total amount of unpaid property taxes, penalties and interest stood at $472 million in as of April, 2011. PlanPhilly intends to update those figures for 2012 once the city closes its books for the month.

But the costs of tax delinquency are not limited to uncollected funds. Tax delinquent parcels are far more likely to be vacant or poorly maintained than other properties. National experts say that delinquent real estate spreads blight, depresses the values of neighboring properties, and in some instances create dangerous physical hazards.

The five-alarm fire at York and Jasper Streets where two Philadelphia firefighters were killed this week is a case in point. That tax delinquent parcel – home to the old Thomas W. Buck Hosiery Building – had been cited by the city’s Department of Licenses and Inspections three times since November for failing to maintain and seal the building.

In February, after the Buck building had been delinquent for three years, the city began foreclosure proceedings by filing suit against the owners in Common Pleas Court. Most other cities would have lowered the foreclosure boom earlier, forcing the owners either to pay their debts, or lose the property to new – and hopefully more responsible – owners at a sheriff sale.

And yet, by Philadelphia’s historically lax enforcement standards, the city’s response to the Buck building delinquency was relatively prompt. With the exception of valuable properties in well-off neighborhoods, the city routinely lets most of its tax delinquents go years or even decades before foreclosure proceedings begin.

For instance, there were 1,577 tax delinquent industrial properties in Philadelphia in 2011, with a total balance of $19.3 million owed in unpaid taxes, penalties and interest, according to city delinquency records obtained by PlanPhilly and The Inquirer. More than 500 of those are five or more years delinquent, and more than 250 are more than a decade past due.

“From a public safety perspective, the more properties we have on the delinquency list the more likely it is that we’ll have owners who are not paying attentions to their properties, and that can lead to tragedies like the fire,” said Councilman Bill Green, who in February introduced an ordinance that would overhaul the city’s property tax delinquency system.

Green’s bill seeks to move large numbers of long-term, low-income tax delinquents into payment plans, while using the threat of imminent sheriff sales to compel property owners with the means to pay up immediately. His bill would require the city to begin foreclosure proceedings against delinquent properties within a year, theoretically putting an end to long-term tax delinquency.

“There needs to be a date certain by which there will be consequences for not paying your taxes,” Green said.

Another related reform was proposed by Councilwoman Maria Quiñones-Sánchez, who hopes to create a city-run land bank that has the authority to seize tax delinquent properties in large numbers before they ever go to sheriff sale. Sánchez contends that land banks, when effectively run, can spur neighborhood redevelopment.

The Nutter administration is willing to consider a land bank, and it has not yet taken a public position on Green’s bill. But Richardson said the administration was making an array of improvements to the city’s property tax collection system on its own.

Richardson said that part of the reason the city is not yet offering 600 new tax delinquent properties per month is because the city has gotten more effective at collecting on delinquent accounts without resorting to a sheriff sale. The number of new delinquents has also dropped dramatically, Richardson said, from 16,000 last year to 9,000 this year, and he anticipates the city this year will post the first overall decline in total delinquencies since Mayor Nutter took office.

It is too early in the year to independently verify the administration’s claims of improved collections.

Richardson credited internal reforms with the progress he said the city has made. Now, instead of splitting enforcement duties between two different city departments, the responsibility for going after property tax deadbeats is wholly Revenue’s responsibility, Richardson said.

“Now we have a better handle on what’s going on, so it’s not about blaming other folks any more,”

Still, he warned that “Jerusalem wasn’t built overnight. We have a lot to clean up here.”

Contact Patrick Kerkstra at pkerkstra@planphilly.com or follow him on Twitter at Twitter.com/pkerkstra

This story is part of a continuing collaboration between PlanPhilly and The Inquirer. Last August that effort produced a two-day series on the tax-delinquency crisis in Philadelphia.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.