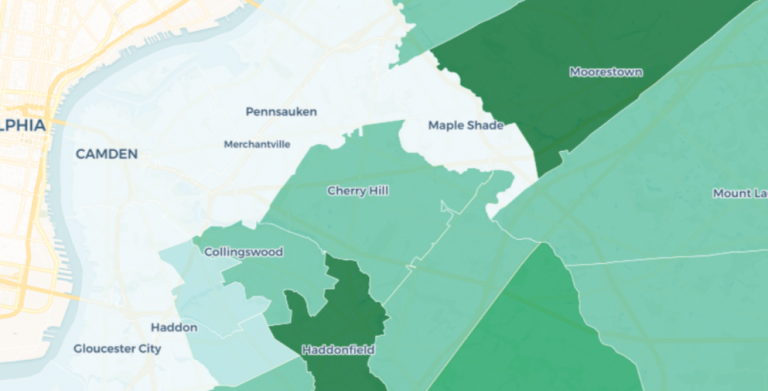

Map of who will be hit hardest in N.J. if local tax deductions are eliminated

Taxpayers can lower their federal taxable income by not counting as income what they pay in state and local taxes. President Trump wants to eliminate this option.

Areas in darker green rely more heavily on the state and local tax deductions. (Image from NJ Spotlight)

The loss of the federal income tax deduction for state and local taxes paid would mean a loss of about $21,500 in write-offs for the average New Jersey taxpayer.

An analysis of the Internal Revenue Service’s 2015 Statistics of Income data, which counts all tax returns filed in 2016, the vast majority of which were for the 2015 tax year, shows that the amount New Jerseyans subtracted for state income and sales taxes and for local property taxes comprised nearly 70 percent of their total itemized deductions of $31,185. Other common deductions include home mortgage interest, medical expenses, and charitable contributions.

But several studies indicate it will do the opposite for a significant proportion of taxpayers in states like New Jersey, where people take large deductions for state and local taxes or SALT, especially the notoriously high property tax.

The map legend shows the lowest and highest SALT deductions. The average write-off is roughly $21,5000.

Studying the numbers

An analysis by the Institute on Taxation and Economic Policy, for instance, found that more than a quarter of New Jerseyans would pay higher taxes — $2,400 annually on average — under the GOP plan, although the wealthiest 1 percent would get an average tax break of $74,000 a year. Most in New Jersey would receive a modest tax cut, the analysis found. Those who would pay more in taxes would be filers with incomes between $78,000 and $329,000.

“Make no mistake: this proposal is not tax ‘reform’ – not by a long shot,” said Sheila Reynertson, a senior policy analyst with New Jersey Policy Perspective, a progressive think tank. “It’s merely a package of huge tax cuts for those who are already doing well in this rigged economy: the very wealthy and large corporations.”

Because tax filings are highly individual, for instance, whether a person itemizes his taxes and takes the SALT deductions or not, and because all the details of the Trump plan are still not available, it is hard to predict how individuals would fare.

It is clear from the IRS data, though, that these deductions are more significant to filers in some parts of the state than in others.

For instance, taxpayers in three zip codes — Short Hills’ 07078, Far Hills’ 07931, and New Vernon’s 07976 — took more than $100,000 in SALT deductions on average in 2015. Short Hills led all, subtracting nearly $155,000 in state and local taxes from their federal returns. The SALT deductions were 95 percent of the total deduction taken and it represented more than a quarter of that area’s average adjusted gross income, which is gross income minus adjustments for such items as health savings account deductions, some contributions to qualified retirement plans, college tuition, and other items, of nearly $580,000.

On the other hand, filers in Trenton’s 08608 zip code took only $1,567 in SALT deductions, with all of that for state income taxes. That was just 7 percent of the adjusted gross income of about $24,000.

In both 07055 in Passaic and 08401 in Atlantic City, the total deduction for state and local taxes represented more than 40 percent of the adjusted gross income in those areas.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.