Jersey Shore trio charged in insurance fraud scheme

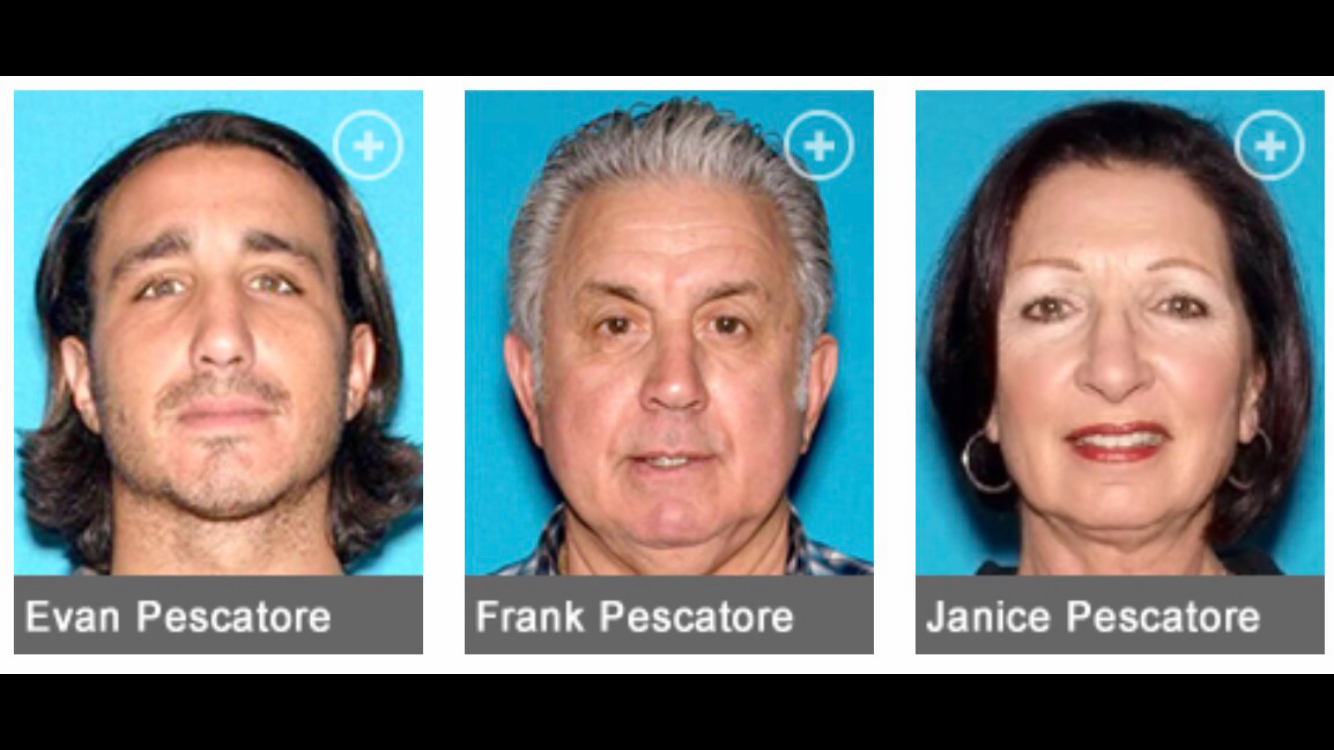

Image courtesy of the New Jersey Office of Attorney General.

A Jersey Shore insurance agent and his parents have been charged with conspiracy and money laundering in an alleged scheme that provided insurance applicants with free life insurance and caused various insurance companies to disburse millions in commissions, Attorney General Christopher S. Porrino announced.

Evan Pescatore, 35, of Highlands, and his parents Frank Pescatore, 70, and Janice Pescatore, 64, both of Asbury Park, were charged with first-degree conspiracy to commit money laundering and two-counts of second-degree money laundering in a state grand jury indictment issued last week, Porrino said in a news release.

Evan Pescatore was also charged with first-degree money laundering. In addition, Evan and his father were also each charged with insurance fraud, theft by deception, conspiracy to commit insurance fraud, and conspiracy to commit theft by deception, all in the second degree, Porrino added.

According to prosecutors, the trio allegedly provided free high-value life insurance policies to applicants in order to obtain commissions from the insurance companies, an action known as “rebating” that is prohibited by both the insurance industry and state law.

More than a dozen insurance policies, totaling $61.5 million, were issued by eight insurance companies that disbursed more than $4 million in commissions, Porrino said.

“This family allegedly conspired in a criminal plot to file more than a dozen fraudulent insurance applications that cost numerous insurance companies millions of dollars in ill-gotten commissions, rebates, and free-short-term insurance,” said Porrino. “Though the alleged scheme was complicated, the defendants carefully shepherded illicit funds through a series of transactions, knowing that they would reap hundreds of thousands of dollars in undeserved commissions along the way.”

Evan Pescatore and his father “approached and recruited” 13 applicants by offering them “free insurance” and the option to sell their policy in the future for profit, Porrino said, adding that Evan Pescatore took out loans from a third-party lender ranging from $15,000 to $582,520 to pay for the premiums.

Then when the insurance companies disbursed more than $3 million in agent commissions to Evan Pescatore, he and his parents transferred or assisted in transferring the commission funds to the lending sources in order to repay the loans for the insurance premiums, the prosecutor said.

Porrino added that the insurance companies paid more than $1 million in commissions to Evan Pescatore’s hierarchy, of which at least $500,000 were allegedly passed to Evan Pescatore.

Acting Insurance Fraud Prosecutor Christopher Iu says the indictment should send a strong message.

“Rebating fraud is a costly problem for insurance companies but the ultimate victim is the consumer. They’re the ones who pay the price in the form of higher premiums,” he said. “These indictments should serve as a warning that we will not allow criminals to get rich by cheating the insurance system and driving up costs for honest policy holders.”

Iu says the public can anonymously report fraud by calling 1-877-55-FRAUD or visting www.njinsurancefraud.org.

spacer spacer spacer spacer spacer spacer For Immediate Release: For Further Information: April 13, 2017 Office of The Attorney General – Christopher S. Porrino, Attorney General Office Insurance Fraud Prosecutor – Christopher Iu, Acting Insurance Fraud Prosecutor Media Inquiries- Lisa Coryell 609-292-4791 spacer Citizen Inquiries- 609-984-5828 spacer spacer spacer spacer spacer Insurance Agent and his Parents Charged with Fraud for Allegedly Providing Free, High-Value Life Insurance Policies in Order to Collect Commissions spacer spacer spacer spacer spacer Click to enlargespacerClick to enlargespacerClick to enlarge spacer spacer spacer spacer spacer TRENTON – Attorney General Christopher S. Porrino and the Office of the Insurance Fraud Prosecutor (“OIFP”) announced that a Monmouth County insurance agent and his parents have been charged with conspiracy and money laundering in an alleged scheme that provided insurance applicants with free life insurance and caused various insurance companies to disburse more than $4 million in commissions. Evan Pescatore, 35, of Highlands, and his parents Frank Pescatore, 70, and Janice Pescatore, 64, of Asbury Park, were charged with first-degree conspiracy to commit money laundering, and two-counts of second-degree money laundering in an indictment handed up by a state grand jury yesterday. Evan Pescatore was also charged with first-degree money laundering; and he and his father were also each charged with insurance fraud, theft by deception, conspiracy to commit insurance fraud, and conspiracy to commit theft by deception, all in the second degree. The trio allegedly engaged in a scheme to provide free high-value, life insurance policies to applicants in order to obtain commissions from the insurance companies. Eighteen policies –with face values totaling $61.5 million – were caused to be issued by eight insurance companies in the alleged scheme. This process of providing applicants/insureds with an inducement to apply for life insurance policies by paying their premiums, known as “rebating,” is prohibited by the insurance industry as well as state law. “This family allegedly conspired in a criminal plot to file more than a dozen fraudulent insurance applications that cost numerous insurance companies millions of dollars in ill-gotten commissions, rebates, and free-short-term insurance,” said Attorney General Porrino. “Though the alleged scheme was complicated, the defendants carefully shepherded illicit funds through a series of transactions, knowing that they would reap hundreds of thousands of dollars in undeserved commissions along the way.” “Rebating fraud is a costly problem for insurance companies but the ultimate victim is the consumer. They’re the ones who pay the price in the form of higher premiums,” said Acting Insurance Fraud Investigator Christopher Iu. “These indictments should serve as a warning that we will not allow criminals to get rich by cheating the insurance system and driving up costs for honest policy holders.”

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.