Capitol recap: Which Pa. cities are most affected by tax exemption?

Keystone Crossroads crunched the numbers as state lawmakers advance a bill that could ultimately affect tax revenues.

The measure would let voters decide whether to bolster the General Assembly’s authority over which organizations to consider charitable and thus exempt from paying real estate taxes.

These state-level discussions have focused attention on a typically obscure issue.

But some local leaders know it well – and fear the consequences of giving more power to the legislature.

How lawmakers would proceed remains to be seen, so it’s unclear whether approval would mean more or fewer taxable properties.

But many cities couldn’t manage losing more taxed properties, officials say.

The fewer parcels are taxed and the higher their assessed values, the heavier the burden on the rest: for-profit businessees and residents, mainly.

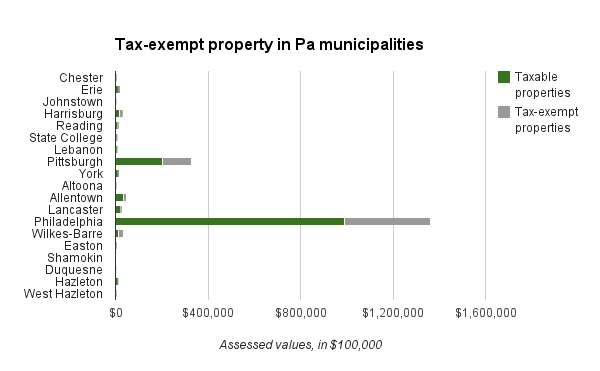

How communities fared

In the city of Chester, 65 percent of the real estate base isn’t taxed – the highest percentage of the Commonwealth’s most populous cities and boroughs. That factors in Chester’s financial problems, which in 1995 drove the city into the state’s Act 47 program for fiscally distressed municipalities.

Of course, towns’ financial fortunes don’t rely solely on tax exemption.

But other Act 47 cities have a similarly high proportion of properties off the tax rolls: About half in Johnstown and Reading; 38 percent in Pittsburgh; a third in Altoona; and about a quarter in Shaomkin, according to Keystone Crossroads’ analysis.

But some municipalities – State College and Erie, for example – have stayed out of Act 47, despite a higher burden on taxable properties than some municipalities under state supervision

And others have been driven into Act 47, despite officials’ ability to tax nearly all property. West Hazleton, for example, spent a few years under state intervention despite a 91 percent taxable base. West Hazleton’s main problem was a lawsuit settlement that proved too expensive for the tiny borough.

Key considerations

Sometimes, policies offset the revenue missed due to exemptions – and must be considered in determining a community’s true burden attributable to untaxed land.

Offsetting mixed tax revenue with fees, which all property owners pay, can help. So, too, can getting exempt entities to voluntarily contribute money or services.

Lancaster hasn’t even flirted with Act 47 during the past decade, as the city’s enjoyed a downtown renaissance – but Lancaster General Hospital’s been kicking in more than what it would pay in local property taxes for far longer ($1.3 million last year for the city, plus another $1million for public schools).

The voluntary contribution is known as a payment in lieu of taxes (PILOT).

Pittsburgh’s “eds & meds”-heavy nonprofit community ponied up after the city’s Act 47 entry, generating as much as $9 million per year in PILOTs since then.

Harrisburg gets $5 million from the state to help offset the cost of the Capitol workforce using the city’s roads, water and sewer systems, and police and firefighters. Pinnacle recently doubled its contribution to $300,000, and added an incentive program for hospital workers to buy their first homes in the capital city.

The use and type of exempt property is critical, too.

One might expect a high exempt/taxable split in Harrisburg and other government centers. At least 25 percent of land is exempt in Pittsburgh, Shamokin, Wilkes-Barre and Reading (all county seats), although it’s higher in Chester and Johnstown than their respect county seats.

About a dozen tiny townships had more than 65 percent exempt tax bases, according to data provided by state Rep. Rob Freeman, D-Easton. One (Clarion) is a county seat. Findlay Township (Allegheny) hosts an airport. Two other communities – Loretto (Cambria) and Canaan Township (Wayne) – host federal prisons.

And a handful of others are heavily forested and sparsely populated (between five and 46 people per square mile). The group includes Pine Township (Clearfield County), which is home to a state park and so gets a $3 per acre subsidy from the state government.

Voters will consider the constitutional amendment this fall if the House passes Senate Bill 4. It cleared the Senate earlier this week.

Editor’s note: This post has been updated to correct a reference to the borough of State College as a city.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.