Pa. businesses will face steeper tax penalties without Medicaid expansion

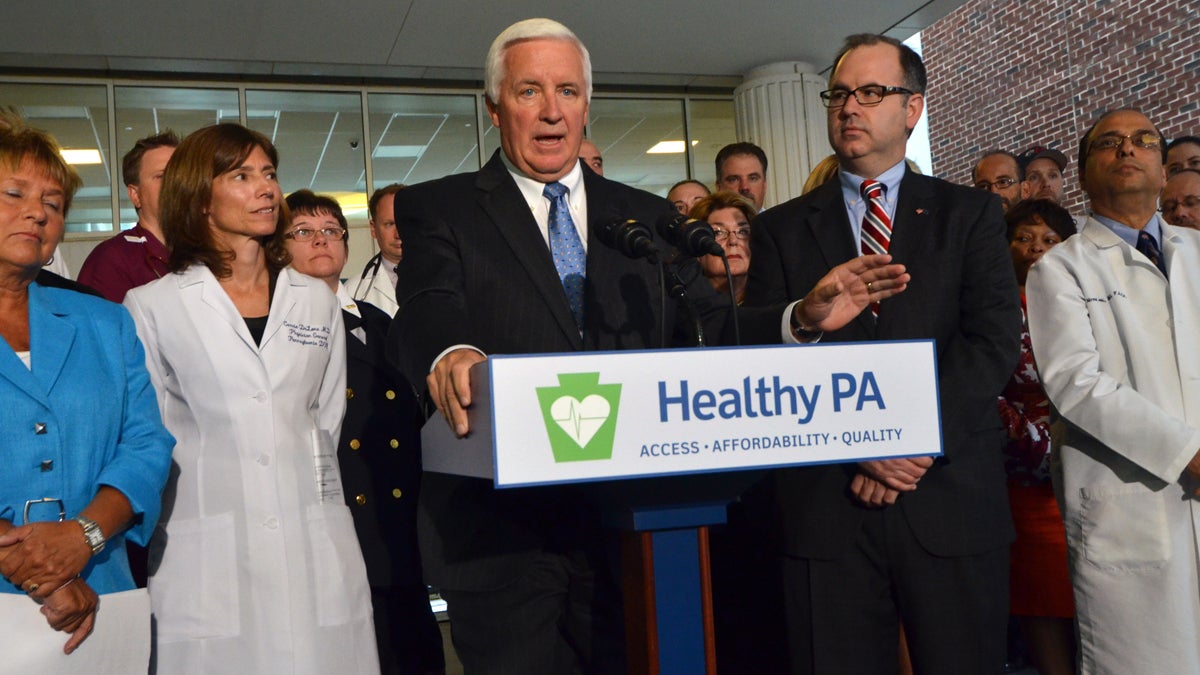

The U.S. government has approved a plan by Gov. Tom Corbett to provide health coverage to an estimated 600,000 Medicaid-eligible Pennsylvanians. Corbett is shown in September introducing his Health PA alternative to Medicaid expansion.(AP file photo)

When originally written, the Affordable Care Act assumed all states would expand Medicaid. But once the U.S. Supreme Court made that optional, 25 states, including Pennsylvania, balked, worried that Washington would not cover enough of the costs down the road. An analysis released on Wednesday by the tax prep company Jackson-Hewitt suggests some businesses will pay higher tax bills as a result.

For workers living in New Jersey making up to 138 percent of the federal poverty level, if their employer doesn’t offer healthcare, it’s not a huge deal. They’re covered by the expanded version of Medicaid, and that coverage helps the employer avoid an IRS penalty.

But next door in Pennsylvania, those same low-income people, at least as it stands now, don’t qualify for Medicaid, leaving their employers open to penalties starting next year.

“It’s too expensive to ignore these kinds of tax penalties,” said Brian Haile, Senior Vice President for Health Policy at Jackson-Hewitt, and one of the authors of the report. “So one of the things we really want businesses to know is that if the state doesn’t expand Medicaid, they may be on the hook for additional tax penalties, and they need to be aware of that so they’re not surprised by a large tax bill.”

At issue is the coverage of low-income, full-time workers employed by companies with at least 50 employees. Penalties range from $2,000 to $3,000 per employee, depending on whether any coverage is offered. Statewide, the costs can add up quickly.

“Very complicated tax consequences are hard to predict,” said Haile. “But in this one, what we did is we took a fair amount of time and a whole bunch of data to generate our estimate that Pennsylvania employers would pay somewhere in the neighborhood of $52 million to $77 million each year in additional federal tax penalties for employees who get these tax credits.”

Businesses will have a bit of time to adjust to the new rules, as the tax penalties have been delayed until 2015.

Governor Tom Corbett has opted out of traditional Medicaid expansion, but is trying to convince the Obama administration to let him use federal dollars to cover the same population using subsidized insurance from private companies.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.