Five reasons why the Trump tax bombshell is so potentially devastating

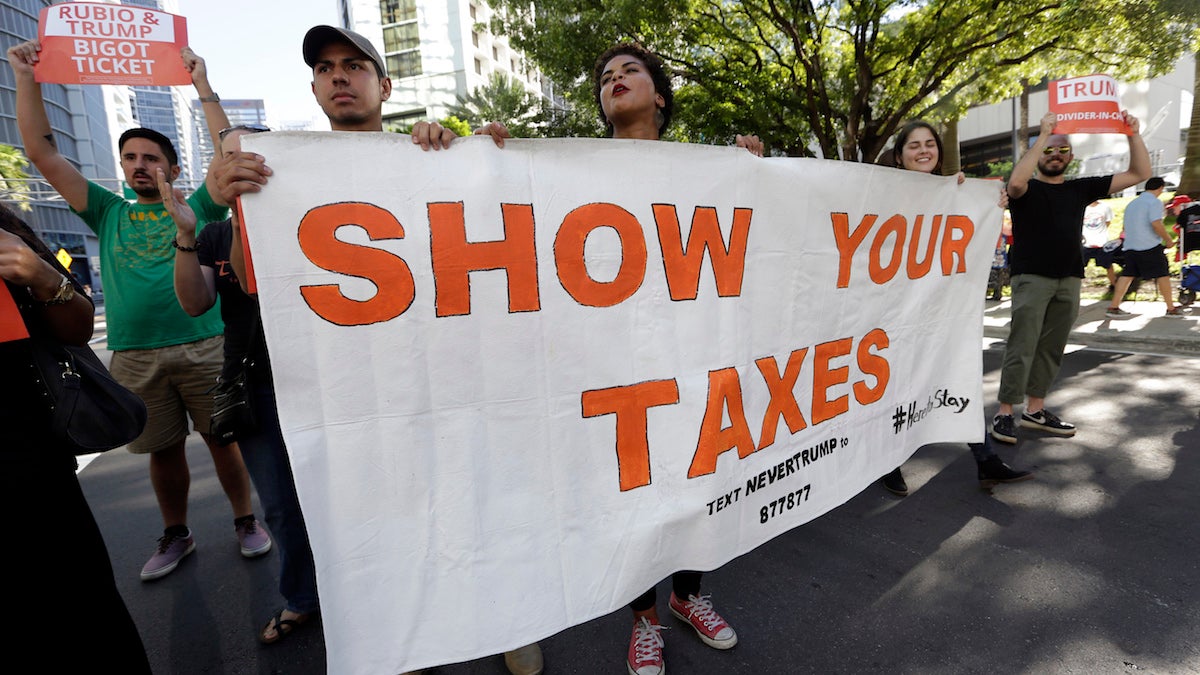

Protestors march in a downtown street holding a sign in support of Republican presidential candidate Donald Trump releasing his tax returns

If Donald Trump loses this race – for the sake of our national security and the future of the American experiment, he had better lose it – it may well be said that the turning point came in the 21st hour of the first of October. That’s when the fulminating fraud was unmasked as never before.

Yes, folks, what we learned over the weekend was that the faker is a taker who leeches off the system at the expense of the benighted average taxpayer. Someone in Trumpworld dimed him out by snail-mailing three key pages of his ’95 tax return to The New York Times, and the big revelation – in one calendar year he lost nearly a billion dollars; citing that business failure, he exploited a tax code provision that allowed him to pay no taxes for 18 years – has detonated at high decibels atop his vanilla head.

This news has the potential to inflict great political damage. Let us count the ways:

There’s one set of rules for guys like Trump, another set of rules for everyone else. He has nothing in common with the little people he aspires to represent. As the Times story points out (with confirmation from the accountant who prepared the document), Trump worked the tax code in ways that the average shmoe can’t even dream of. As veteran Republican strategist Rich Galen said on his blog this morning, “Regular people don’t legally avoid paying federal income taxes for 18 years. This is exactly the kind of thing that has work-a-day Americans so angry.”

The next presidential debate, six days from now, features a “town hall” format. The candidates will be tasked with fielding queries from undecided voters. Hopefully, one will ask: “Mr. Trump, you’ve worked the system to avoid paying taxes for 18 years. You’ve said that makes you ‘smart.’ But I pay my taxes every year. Why do you think I’m stupid?”

Bottom line: When Trump says the system is “rigged,” he’s right. Because he’s a prime beneficiary.

His sole alleged presidential credential – that he’s a great businessman – turns out to be bogus. According to financial experts contacted over the weekend, it’s dumfounding that the guy could lose nearly a billion dollars in one year, especially at a time when the economy was bullish; clearly, the precipitous collapse of a hotel-airline-casino empire was symptomatic of reckless mismanagement. In the words of Alan Cole, an economist at a conservative think tank, “The billion-dollar (loss) is evidence of bad business.”

The Trump surrogates’ responses have been worthless. Rudy Giuliani and Chris Christie insisted on TV yesterday that Trump’s shifting of the tax burden to the average citizen was evidence of his “genius” – or, as Giuliani put it, his “absolute genius.” Christie said that Trump should be “taking a bow.” I swear, I’ve heard better logic from the lunatics who nap in city parks. And if you think I’m taking those remarks out of context, here’s Christie in full: “There’s no one who’s shown more genius in their way to maneuver about the tax code.”

Giuliani also compared Trump to Winston Churchill, but I won’t bother to explain that one. I’ll simply point out that if you or I decided to skip paying taxes next April, I doubt that the IRS would call it genius. And if America’s undocumented immigrant workers (the people Trump hates) decided to skip paying their state and local taxes – by the way, they pay nearly $12 billion a year – I doubt the tax authorities would laud that decision as evidence of genius.

Trump has no plans to kill the tax code rule that he deftly exploited for his personal benefit. He repeated his usual mantra in a tweet yesterday morning: “I know our complex tax laws better than anyone who has ever run for president and am the only one who can fix them.” But his fix-it plan doesn’t touch the rule that allows businesses to deduct operating losses and carry those losses into subsequent years (via the non-payment of taxes). And his fix-it proposals would lower the top income tax rate, a boon to the most affluent taxpayers. (Including him, if or when he ever pays taxes again.)

The weekend revelations have amped the pressure on Trump to release his tax returns – just as every other nominee has done since 1976. If the Times’ story is wrong, if indeed he has paid some taxes during the last 18 years, he can prove it by releasing the returns. If there’s indeed a plausible explanation for how he could lose nearly a billion dollars in one year in the midst of a good economy, he can explain it by releasing the returns.

Let’s see what’s in those returns, so that we can judge for ourselves whether this guy is truly an “absolute genius.” Because unless he can plausibly refute what we learned this weekend, we’re inclined to side with Republican strategist Peter Wehner, who served the last three Republican presidents, and says:

“What we’re seeing is somebody who’s blowing himself apart in real time. It’s a pretty extraordinary thing to see….It’s gnawing on him that he could become what he has contempt for, and that is a loser.”

——-

And welcome to a new week. This is a great way to start it. Love the opening paragraph.

——-

Follow me on Twitter, @dickpolman1, and on Facebook.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.