Companies are telling unvaccinated workers to pay more for health insurance

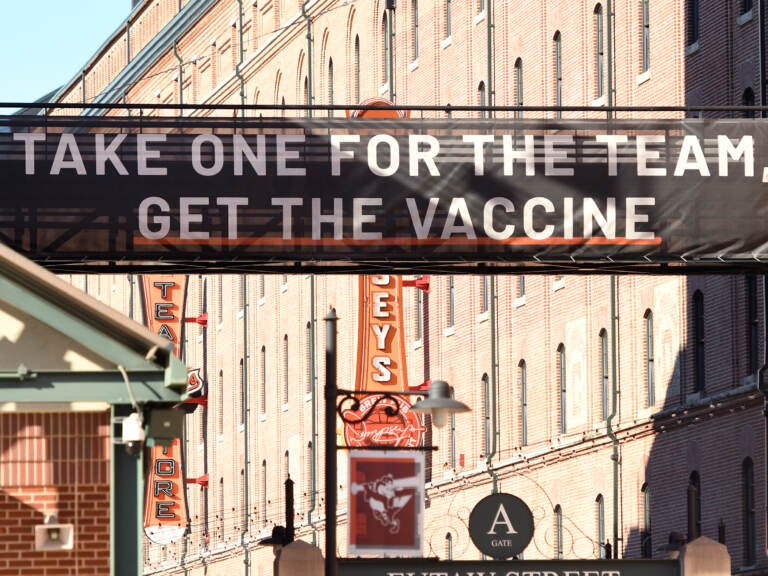

A sign outside Camden Yards in Baltimore, Maryland, encourages people to get a COVID-19 vaccine. Mitchell Layton/Getty Images

As Covid cases surged over the summer, Delta Air Lines CEO Ed Bastian took action: Unvaccinated workers would have to pay an extra $200 a month for their health insurance, starting Nov. 1.

It felt less onerous than the vaccine mandate imposed on workers by rival United Airlines. But still, it was audacious.

Around 75% of Delta’s workforce had already received the Covid shots by that time. But each employee who was hospitalized with Covid had cost Delta $50,000, and Bastian noted in an August memo that none of those hospitalized in the summer surge had been fully vaccinated.

“This surcharge will be necessary to address the financial risk the decision to not vaccinate is creating for our company,” he wrote.

More companies are considering fees and surcharges for unvaccinated

Now, as Covid cases climb once again, more companies are putting aside carrots and turning to sticks in an effort to protect their workers. From Utah grocery chain Harmons to Wall Street banking giant JPMorgan Chase, companies are telling their unvaccinated workers to get the shots or pay more for health insurance.

In a September survey, the Society for Human Resource Management found less than 1% of organizations had raised health insurance premiums for unvaccinated workers and 13% have considered doing so.

It was higher among large companies, where nearly 20% were considering the move.

A new fee at one employer drove up vaccination rates

One employer is trying a different tactic. Mercyhealth, which has more than 7,000 employees at hospitals and clinics in Wisconsin and Illinois, introduced what it called a “risk pool fee,” instead of higher health care premiums. Since mid-October, unvaccinated employees have had $60 deducted from their wages each month to go into this pool.

In a memo to employees, Mercyhealth compared the fee to 16-year-old drivers having to pay more for auto insurance to cover the heightened risks they present as new drivers.

Alen Brcic, Mercyhealth’s vice president of people and culture, says $60 per month is a nominal amount, even symbolic. Mercyhealth still bears most of the costs when someone misses work or is hospitalized because of Covid.

But after the policy was announced in September, the vaccination rate among the health system’s employees rose to 91% from around 70%, according to Brcic.

“We really feel that this approach is working,” Brcic says. “Truly, our goal is to encourage everyone to get vaccinated, but also ensure that people have the choice.”

A “couple of handfuls” of people quit over the policy and roughly 9% of employees are now contributing to the risk pool. Mercyhealth did provide a very small number of medical exemptions, but no religious exemptions.

Brcic is not sure how the federal vaccine mandate for health care workers, set to take effect Jan. 4, will affect the risk pool program.

“We are evaluating all options,” he says.

“Wellness programs” allow companies to raise health care premiums

Other employers, including Delta Air Lines, JPMorgan Chase and Harmons appear to be raising health care premiums for unvaccinated workers under something called a “wellness program.”

According to federal law, companies are allowed to charge employees different amounts for health care as long as they do it through a program designed to promote healthy behaviors and prevent disease.

For example, a company may run a wellness program that encourages employees to accumulate a certain number of steps every day or sets targets for BMI, a measurement of body fat based on height and weight. There are also wellness programs aimed at preventing and curbing tobacco use.

“Your wellness program could simply be: I’m going to encourage all of my employees to get vaccinated, full stop,” says Sabrina Corlette, founder and co-director of the Center on Health Insurance Reforms at Georgetown University.

As part of these programs, companies can offer rewards or penalties for meeting certain targets, such as getting vaccinated. But they must not exceed 30% of the cost of the employee’s health care plan, calculated as the amount paid by the employee and the employer combined. The maximum penalty rises to 50% for wellness programs targeting tobacco use.

“Most employers are doing this to try to have a healthier and more productive workforce… and to spend less on overall health care costs,” says Corlette.

Wellness programs must include waivers

Under federal law, the wellness program must be “reasonably designed,” meaning there’s a reasonable chance the program will improve the health of or prevent disease in the participants.

To ensure that wellness programs do not violate discrimination laws, companies must provide waivers for individuals who have medical reasons for not meeting the stated targets or alternative ways for them to satisfy the requirements.

As part of its policy, the Utah grocer Harmons says its insurance premium surcharge of up to $200 per month applies to “unvaccinated associates who don’t qualify for an exemption or who chose not to complete a vaccine education series.”

“Over 86% of our associates are vaccinated, and we believe this and the other safety measures we have taken have kept our associates safe through the pandemic,” a company statement read.

Delta Air Lines would not say how many of its 73,000 U.S.-based employees are paying the $200 monthly surcharge since it took effect Nov. 1. It did report that its vaccination rate saw a bump after the surcharge was announced and “has steadily climbed to 94%.”

9(MDAzMzI1ODY3MDEyMzkzOTE3NjIxNDg3MQ001))