Philly mounts campaign to help residents claim Earned Income Tax Credit

Listen

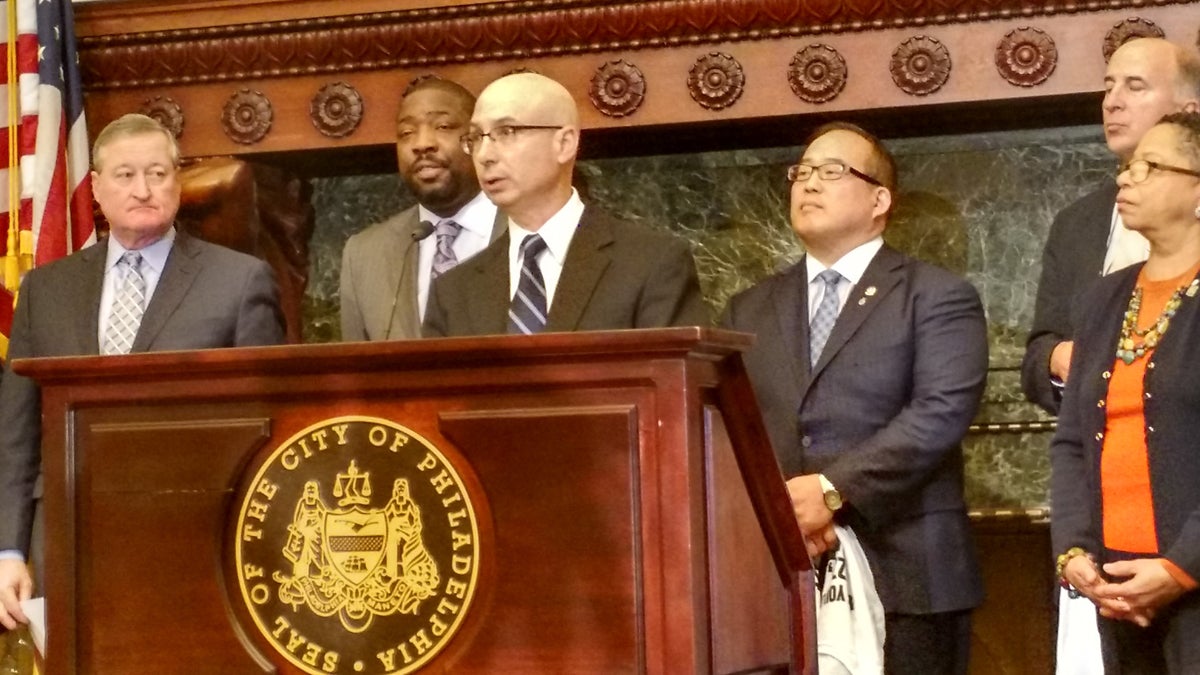

Philadelphia Revenue Commissioner Frank Breslin said low-income residents in the city left $100 million in tax credits on the table last year. (Katie Colaneri/WHYY)

It’s tax time again and officials in Philadelphia say last year many low-income residents left a combined $100 million in tax credits on the table.

On Friday, the city launched a new campaign to keep that from happening this year.

It’s called the “You Earned It” campaign because that’s essentially what the Earned Income Tax Credit or EITC is: a federal tax refund on income earned by low- to middle-income families making less than $53,267 dollars a year. Not everyone qualifies since eligibility changes based on filing status.

It’s designed as a fully-refundable credit, so low-income earners can get back more from the IRS than they paid in income taxes. Those who do qualify can get a check from the IRS for $500 to $6,000. The average refund under the EITC is $2,400.

“The Philadelphians who qualify for this money work hard,” said Mayor Jim Kenney. “Many of them struggle to make ends meet, to keep their families fed, clothed and in quality housing. Whether it’s a few hundred dollars or a couple thousand dollars, this refund can make a huge difference in everyone’s daily life.”

It’s considered one of the country’s most effective anti-poverty programs, but of the 200,000 Philadelphians eligible for the tax credit, about 40,000 or 20 percent of them don’t even apply.

City Revenue Commissioner Frank Breslin said that’s because many people have never heard of the credit or they assume it’s too complicated to apply. Other just cannot afford good tax preparation services.

“It doesn’t have to be this way,” Breslin said. “Our department has invested our top people, top resources and we’ve enlisted the insights of those serving the target communities for this program to strategize how to best overcome these barriers.”

The city is paying two nonprofits, Campaign for Working Families and PathWays PA, $700,000 to provide free tax preparation services at multiple sites across the city, as well as in Delaware in Montgomery Counties.

It’s also spending about $350,000 on a marketing and outreach campaign that will feature online, radio and Pandora ads, posters on SEPTA trains and buses, street teams handing out filers, and a website, YouEarnedItPhilly.com.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.